Equity Group posts 14 per cent dip in net earnings

Noel Wandera @NoelWandera5

Equity Group has posted a 14 per cent dip in profit after-tax to Sh5.3 billion from Sh6.2 billion in the first quarter of the year amid uncertainties created by Covid-19 pandemic.

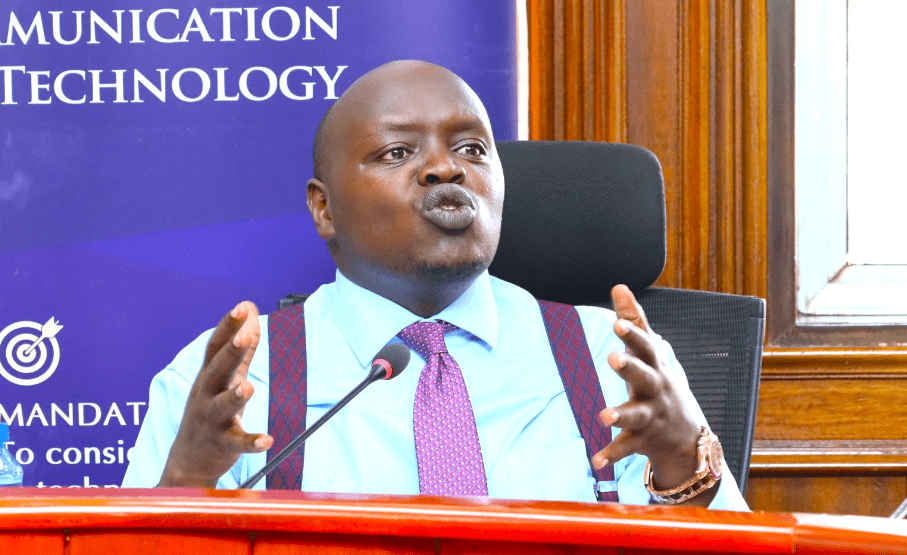

Group managing director and chief executive James Mwangi attributed the decline to a 10-fold increase in the group’s loan loss provision which rose to Sh3 billion from Sh300 million in the first quarter of the previous year.

Profit before provisions was up 10 per cent to Sh10 billion from Sh9.1 billion the previous year.

The global Covid-19 pandemic, Mwangi said, has mutated into a global economic crisis, occasioned by a sudden standstill of economic activity as a result of the global lockdown.

“This has introduced unprecedented uncertainty within the global financial systems prompting us to adopt a conservative approach – fortifying our balance sheet and assuring ample liquidity to support our customers,” he said in a statement.

Total income

In the period under review, according to the financial results, the group’s total income grew by 13 per cent to Sh19.7 billion, up from Sh17.5 billion for the same period last year.

Total assets also rose to Sh693.2 billion driven by a 14 per cent increase in customer deposits, equivalent to Sh499.3 billion.

Net interest income grew to Sh379.2 billion up from Sh305.5 billion, with forex trading generating Sh1.1 billion up from Sh815 million out of which 26.5 per cent of the volume traded was contributed by diaspora flows.

Forex trading income generated Sh1.1 billion up from Sh815 million with 26.5 per cent of the volume traded contributed by diaspora flows, whose remittances commissions grew by 22 per cent to Sh234 million up from Sh192 million the previous year.

The volume of diaspora remittances grew by 31 per cent to reach Sh40.6 billion up from Sh30.9 billion the previous year.

Commission from merchant banking grew by 11 per cent to Sh582 million up from Sh523 million the previous year with merchant banking volume reaching Sh29 billion up from Sh25.6 billion.

Mwangi said the group’s regional and diversification subsidiaries registered impressive results with a return on equity of 18.7 per cent against the Kenyan banking subsidiary return on equity of 21.6 per cent.

The subsidiaries increased their total revenue contribution to the group’s revenue to 30 per cent up from 28 per cent the previous year, while raising their contribution of profit before tax to 26 per cent of the group’s profit up from 17 per cent.

Pandemic

The group, Mwangi said, stands well positioned to confront the challenges of the Covid-19 disruption that is mutating into an economic, financial and humanitarian crisis.

“The group’s business model of high-volume low margins with non-funded income contributing 42 per cent of total income and a low cost of funding of 2.8 per cent, allows the group to ride a compression of margin in interest earning assets,” he added.