Ndindi Nyoro decries public debt crisis despite assurances from Ruto and Mbadi

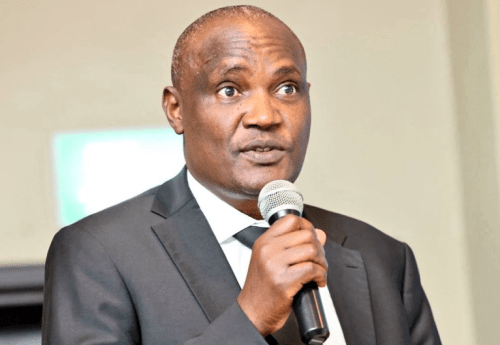

Kiharu Member of Parliament Ndindi Nyoro has taken a swipe at the public assurances by President William Ruto and Treasury Cabinet Secretary John Mbadi that the country is prudently managing its debt crisis.

Speaking during the unveiling of the renovated St Paul’s Gikuu Primary school in Kiharu, the former budget and appropriations committee chairperson indicated that the country’s debt status was worsening by the day.

“The public debt in Kenya is in a level of a crisis. We can go out there and become defensive, but the reality is on the ground. In the budget that will be passed in June 2025, over Ksh1.1 trillion will go towards the payment of interest rates of the loans we have borrowed,” Nyoro observed.

“We are also faced with a situation where we will have to borrow at least Ksh900 billion. We cannot continue digging the hole, yet in our utterances, we appear like we are doing proper debt management.”

Ruto speaks about loans

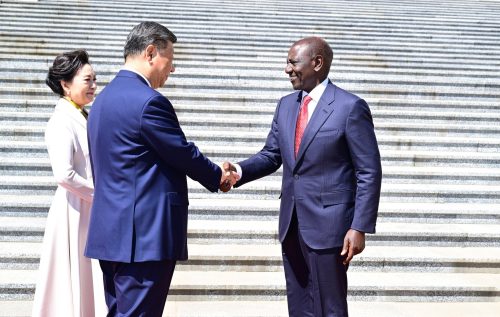

This came just hours after Ruto, during the installation of the Cooperative University of Kenya’s new Vice Chancellor Bernard Chitunga, said that the country was not taking more loans to fund infrastructure projects.

“When I was in China, many people thought that I went to negotiate for more loans. You have heard this young man speak here. He has not said he is going to look for loans. He has not said he is going to look for money from the government; he has said he is coming to me to look for no objection and a letter of support because he wants to transform this place using private-public partnerships,” Ruto said.

“The road you saw listed from Rironi all the way to Malaba through Nakuru is not going to be built using loans to the government of Kenya. It is going to be built using a toll infrastructure; public-private partnership investment.”

He also observed that his government was intent on seeking alternative sources of funding projects without borrowing.

“The railway you saw in the framework, which is going to be built all the way to Uganda, is also not going to be built by loans to the government, but by investments,” Ruto noted.

National savings

“We have developed alternative financing mechanisms that do not take the country down the route of loans, which could endanger the future of our country.”

Ruto also indicated that the country will have at least Ksh1 trillion in savings by the year 2027, following bold decisions that he has made to increase the National Social Security Fund contributions.

“From independence up to 2023, we saved Ksh320 billion in sixty years. But from 2023 to 2025, we have saved Ksh280 billion. By the end of 2023, we will have doubled the money that we have saved from independence and by 2027, we will have saved a trillion shillings because we have made some bold decisions,” Ruto stated.

In previous public statements, Treasury CS Mbadi assured Kenyans that the country would be out of debt distress despite having a total of Ksh11 trillion in debt.

“It is 65.7 per cent in terms of the nominal terms, which is still way above 55 per cent in nominal terms. But remember, we have come down from 72 per cent. So, we are moving towards getting to 55 per cent by the 2028-2029 financial year in nominal terms,” Mbadi said in March 2025.

.