Treasury targets indirect taxes to finance next budget

Kenyans are likely to feel a financial pinch as the government pushes to raise Ksh3.3 trillion in domestic revenue to support its Ksh4.2 trillion budget in the upcoming fiscal year.

While the National Treasury has pledged not to introduce new direct taxes, citizens will still pay more for everyday goods and services due to increased reliance on indirect taxation.

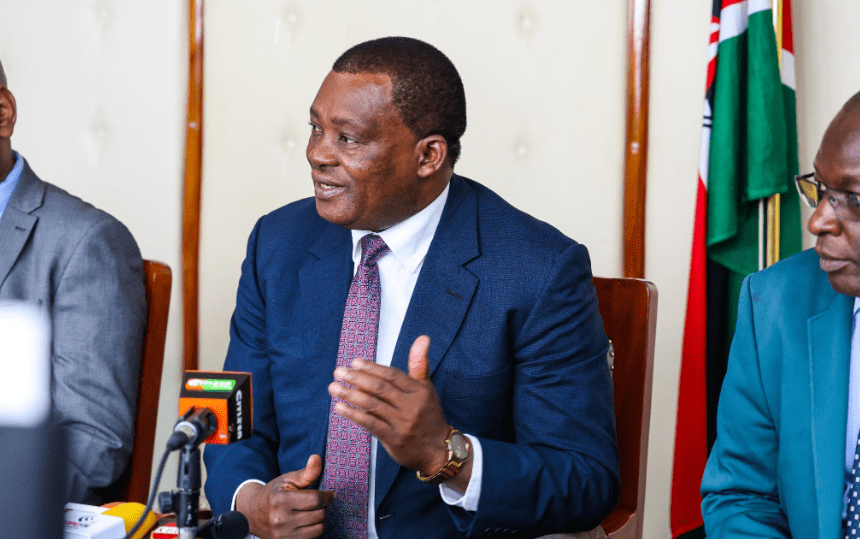

Treasury Cabinet Secretary John Mbadi has maintained that there will be no additional direct taxes, citing tough economic conditions that have already stretched households.

This means employed individuals won’t face new deductions from their salaries, such as higher Pay As You Earn (PAYE), housing levy, or Social Health Insurance Fund (SHIF) contributions.

The move has been welcomed by leaders and economic think tanks who believe protecting take-home pay is key to boosting disposable income.

Significant revenue gap

However, the government still needs to fill a significant revenue gap, and indirect taxes are emerging as the preferred tool.

These are taxes consumers pay when buying goods or using services like airtime, bottled water, mobile money transactions, or Internet access.

They may seem minor at the point of purchase, but collectively, they add up and weigh heavily on lower-income households.

James Mulili, PKF Director for East Africa, raised concerns about the sustainability of this strategy during a media and stakeholder roundtable yesterday.

He said that targeting ordinary revenue sources like consumption taxes could disproportionately affect everyday Kenyans, especially given stagnant incomes.

“So, where is that money going to come from? Already given the extra burden that we face in tax and think about it logically. From a bottle of water that you will buy to quench your thirst, any mobile money or banking transaction you will do to internet that you require for your day-to-day activities, now that is in addition to whatever you are left with at the end of the day after you account for your direct taxes,” he stated.

The government aims to collect Ksh2.8 trillion from ordinary revenue alone—a steep target.

Mbadi admitted to the Senate last week that despite earlier plans to ease the tax burden, particularly by adjusting PAYE and corporate tax, those reforms have been shelved.

The reason, he said, is that the Kenya Revenue Authority (KRA) failed to meet its collection targets, making it risky to cut key revenue streams this financial year.

Meanwhile, digital taxes are becoming a growing part of the government’s strategy.

The Digital Service Tax has been replaced by the Significant Economic Presence tax, and the Finance Act 2023 introduced a new Digital Asset Tax.

These shifts mean that online transactions and digital investments are increasingly being taxed, again affecting everyday users of digital services.

Existing tax policies

Michael Mburugu, PKF’s Regional Tax Partner, believes the deeper problem lies in governance and implementation.

Speaking at the same forum, he blamed the government’s inefficiency and reluctance to enforce existing tax policies like the Medium-Term Revenue Strategy and National Tax Policy.

“Why are we not implementing the national tax policy, yet it has been put in place? We can’t implement it because we are a country that does not observe the basic human rights enshrined in our constitution,” he said.

For investors, the concern is less about the tax rate and more about the predictability and fairness of the system.

“If we don’t deal with corruption, we can have all these nice things, even low taxes and everything, but if we don’t deal with corruption, this economy is not going to be where it is supposed to be,” he cautioned.

“No investor wants to deal with a broken judicial process or uncertainty about how rules are applied,” Mburugu said.

Without proper reforms and better tax management, they will continue to shoulder a heavy tax burden—even as their earnings remain unchanged.