Etale lauds Finance Bill 2025 as people friendly

Orange Democratic Movement (ODM) party Director of Communications Philip Etale has lauded the Finance Bill 2025, as people friendly.

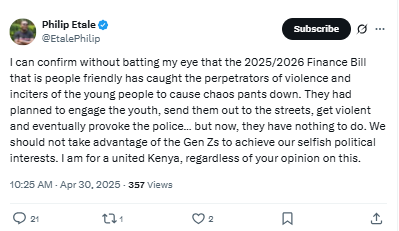

Taking to his official X account on Wednesday, April 30, 2025, Etale claimed that the Bill caught the perpetrators of violence and inciters of the young people to cause chaos pants down.

He further claimed that a section of government critics had planned to engage the youth, send them out to the streets, get violent and eventually provoke the police, but they now have nothing to do.

Taking advantage of youth

Etale went ahead to urge political leaders to stop taking advantage of the youth to achieve their own selfish interests.

“I can confirm without batting my eye that the 2025/2026 Finance Bill that is people-friendly has caught the perpetrators of violence and inciters of the young people to cause chaos pants down. They had planned to engage the youth, send them out to the streets, get violent and eventually provoke the police… but now, they have nothing to do. We should not take advantage of the Gen Zs to achieve our selfish political interests. I am for a united Kenya, regardless of your opinion on this,” Etale stated.

Finance Bill 2025

The Cabinet on Tuesday, April 29, 2025, approved the proposed Finance Bill 2025. This comes almost a year after the defunct Finance Bill 2024 that sought to introduce a raft of tax measures was rejected by Kenyans through widespread protests that turned violent.

In a Cabinet meeting chaired by President William Ruto at State House on Tuesday, April 29, 2025, Cabinet Secretaries approved the bill, which focuses primarily on closing loopholes and enhancing efficiency.

The bill also seeks to address loopholes related to tax expenditures that have historically been exploited to syphon funds from public coffers, such as through inflated tax refund claims.

“In furtherance of these objectives, Cabinet also approved the Finance Bill 2025, which focuses primarily on closing loopholes and enhancing efficiency, including addressing loopholes related to tax expenditures that have historically been exploited to siphon funds from public coffers, such as through inflated tax refund claims,” a dispatch from the Cabinet meeting read in part.

The bill further seeks to minimise tax-raising measures by enhancing tax administration efficiency through a new legislative framework.

It also aims to streamline tax refund processes, seal legal gaps that delay revenue collection, and reduce tax disputes by amending the Income Tax Act, VAT Act, Excise Duty Act, and the Tax Procedures Act.

“Importantly, the bill seeks to minimise tax-raising measures. Instead, it aims to enhance tax administration efficiency through a new legislative framework. Key provisions include streamlining tax refund processes, sealing legal gaps that delay revenue collection, and reducing tax disputes by amending the Income Tax Act, VAT Act, Excise Duty Act, and the Tax Procedures Act,” the communique read.

“Notably, the Bill proposes critical changes to support small businesses, allowing them to fully deduct the cost of everyday tools and equipment in the year of purchase, thereby eliminating unnecessary delays in accessing tax relief.”