Mbadi reveals KRA digital tax tools to enhance compliance and efficiency

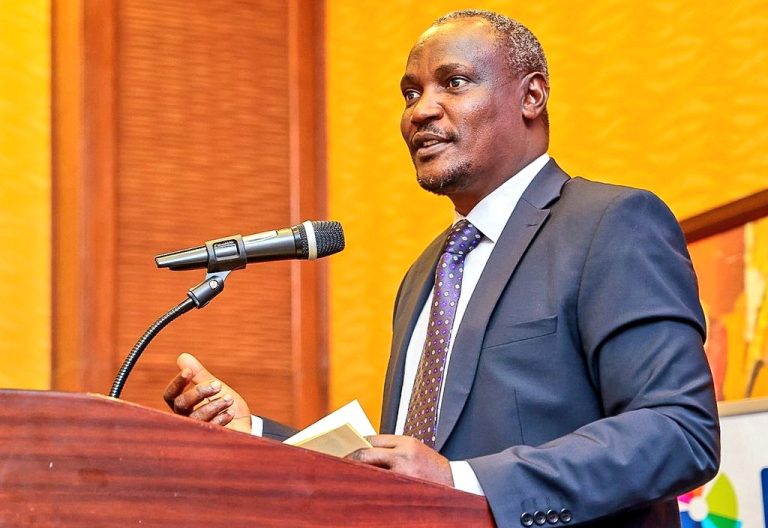

In a bold step toward streamlining Kenya’s tax system, Treasury Cabinet Secretary John Mbadi has unveiled a suite of digital tools developed by the Kenya Revenue Authority (KRA) aimed at improving compliance and enhancing operational efficiency.

The announcement was made during the presentation of the 2025/26 budget in Parliament on June 12, 2025.

Mbadi said the move is part of the government’s broader strategy to modernise revenue collection and ensure a fair, transparent system that works for all Kenyans.

“The Kenya Revenue Authority has also introduced several digital tools to simplify compliance and boost operational efficiency,” he said, noting that embracing technology will be central to fiscal reforms.

One of the key features is the rollout of auto-populated VAT returns, a tool designed to streamline tax filing and reduce errors. “One is what we call auto-populated VAT returns for seamless, accurate tax filing,” Mbadi explained.

KRA has also launched simplified PAYE returns, accessible across multiple platforms including mobile, web, and APIs.

“Two simplified PAYE returns accessible via mobile web and application program interface,” the CS said, in what is expected to significantly widen access and convenience for taxpayers.

The move comes as the country faces mounting pressure to stabilise its economy after a turbulent 2024, which saw widespread protests over high taxes and the cost of living.

Mbadi acknowledged the public’s concerns, describing the demonstrations as a reflection of a citizenry that is “alert and exercising their democratic rights.”

These digital reforms are expected to not only raise compliance rates but also restore public trust in the tax system.

“Kenya Revenue Authority is nurturing a fair and inclusive tax system,” Mbadi said.

The innovations align with global trends championed by bodies such as the IMF, which advocate for digital transformation in revenue administration as a pathway to accountability and improved governance.

“These tools are more than just tech updates; they’re the drivers of economic empowerment and accountability,” Mbadi added, positioning the digital transition as a cornerstone of economic recovery.

As KRA rolls out the new systems, all eyes will be on the implementation process and user feedback, with Kenya hoping to set a benchmark for digital tax systems across Africa.