MPs: Candid talk with Ruto led to tax plan changes

Members of Parliament reportedly told President William Ruto about the pressure they were under from Kenyans who demanded that contentious clauses in the 2024 Finance Bill be removed.

Before the Kenya Kwanza Parliamentary Group meeting, lawmakers affiliated with the ruling coalition had candid discussions with the President on what they thought about the tax proposals.

“The President was attentive and willing to accommodate what we told him. He knew that the changes had been made even before the meeting,” said a Kenya Kwanza MP.

The Finance and Planning Committee yielded to pressure and made a raft of changes, pared down the controversial bill to just a few tax proposals.

Speaker Moses Wetang’ula directed that voting on the bill take place on Tuesday next week after members elected to have a morning session.

Wetang’ula also told MPs to file amendments by tomorrow. The lawmakers will spend today’s two sessions debating the bill. “You have the whole of tomorrow (Wednesday), to read the report, and those who have amendments make sure they reach the table before Thursday morning,” Wetang’ula said.

Key changes

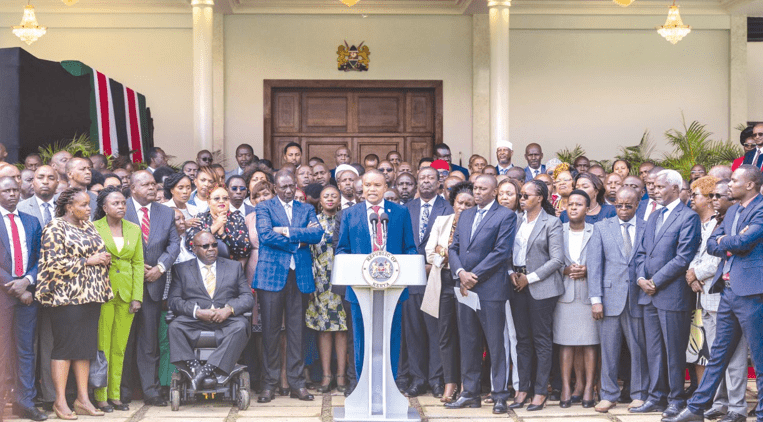

The committee had in the morning briefed the Kenya Kwanza Joint Parliamentary Group, chaired by President Ruto, on the report on the bill.

The committee, chaired by Molo MP Kimani Kuria, has made key changes to the bill on Value Added Tax (VAT), which would have seen the prices of vital commodities go up.

Among the changes is the removal of a proposed 16 percent VAT on bread and the transportation of sugar.

Regarding the VAT proposal, Kuria said, the committee, among other concerns, wanted to zero-rate only the most critical consumption items in most households, and to exempt agricultural inputs and inputs for the manufacturing of medical commodities.

“The committee proposes to zero-rate ordinary bread, unleavened bread, gluten bread, inputs and raw materials supplied to manufacturers of agricultural and pest control products, agricultural pest control products, transportation of sugarcane from farms to milling factories, supply of locally assembled and manufacture of mobile phones, among others,” Kuria said.

The committee also proposed exempting several products from VAT, including the issuing of credit and debit cards, foreign exchange transactions, sanitary towels and diapers, and the services of local film agents.

Risk to economy

During three weeks of public hearings, stakeholders and the citizens raised concerns about the implications of the tax proposals, warning that they would harm the economy.

Other changes are that no tax increase will be made on mobile money transfers.

The contentious 2.5 per cent motor vehicle tax was also removed, providing a sigh of relief for millions of owners who would have been burdened with an extra levy, after the roads levy.

“About the motor vehicles tax, the committee notes that section 3(2) of the Income Tax Act defines what constitutes an income upon which tax is chargeable under the Act, whereas the proposed Motor Vehicle Tax is levied on an asset and not income within the definition,” Kuria said.

But the controversial proposal to amend the Data Protection Act to give the Kenya Revenue Authority (KRA) unrestrained access to taxpayers’ personal data remains and will be among the clauses that MPs will vote on.

Excise duty on vegetable oil was also removed, providing relief for manufacturers and consumers.

Manufacturers had warned that if excise duty had been imposed, the price of the commodity would have gone up by 80 percent.

Eco levy

Contributions to the Housing Fund and Social Health Insurance will become income tax-deductible.

“It is crucial to point out that Eco Levy is being levied on imported finished products. Locally manufactured products will, therefore, not attract the Eco levy. Local assembly and manufacturing will help boost Kenya’s manufacturing capacity, create jobs, and save foreign exchange,” Kuria said.

Consequently, locally manufactured products, including sanitary towels, diapers, phones, computers, tyres, and motorcycles will not attract the Eco Levy.

The threshold for VAT registration, Kuria said, will increase from Sh5 million to Sh8 million. This means that many small businesses will no longer need to register for VAT.