Traders say slide fuelled by importer demand for dollar

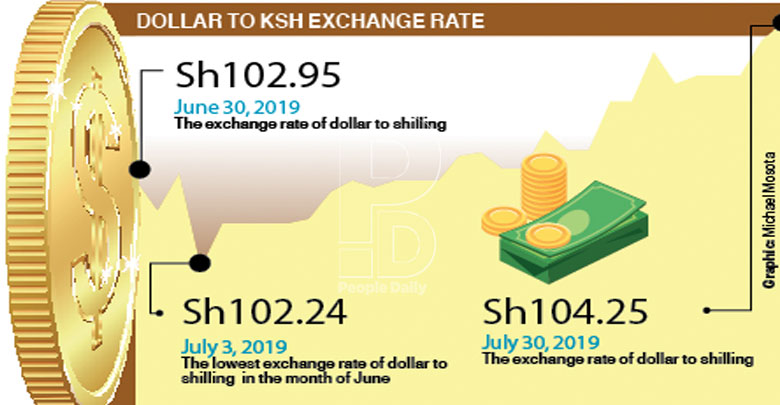

The weakening streak of the shilling continued yesterday and touched a near five-year low against the dollar.

In the short-term, analysts and currency traders said the dip is being fuelled by importer demand for the US currency and excess liquidity in the money markets.

Commercial banks quoted the local unit at 104.25/35 per dollar compared with Monday’s quote of Sh104.05/15.

This dip took the shilling to levels last seen in October 2, 2015, when it traded at Sh104.40/50, having neared Sh106 to the dollar as at September, 2015. Reports indicate that this was not the lowest level shilling has ever touched in recent years, having traded to dollar at Sh107 in October 2011.

Recent pressure

Churchill Ogutu, a macro-economic research analyst at Genghis Capital said the recent pressure is a result of usual end-month dollar demand as firms pay bills.

But, he added, that there is reason to believe there is an excess demand from the micro-level with people seeking refuge in the dollar.

He said the recall of the Sh1,000 notes has brewed lot of anxiety and uncertainty in the market with people trying to play it safe.

“Demonetisation has a four-month transition period whereby at the micro-level, people who do not understand it and trying to seek refuge in the dollar,” he said.

The analyst said there is also sustained demand for dollars by banks amid low supply bringing pressure to the local currency, adding that he also has reason to believe that the Central Bank of Kenya (CBK) has tried to get into the market.

“Demand has outstripped supply of the dollar hence the weakening of the shilling,” he said.

Ogutu said last week’s Forex reserves at CBK went down by $20 billion despite little activity in terms of payments by the Central Bank.

This comes amid a surge in diaspora remittances over the last six months but the inflows were watered-down by dips in proceeds from the agricultural and tourism sector.

Speaking to People Daily, Reginald Kadzutu, chief investment officer at Amana Capital, also weighed in on the sustained weakening of the shilling against the dollar, claiming the shilling could be overvalued.

He said there is more demand for the dollar and an unexplained case on why the shilling keeps maintaining its value despite sustained demand for the greenback.

The growth of money supply over the last six years has risen substantially but core inflation has stagnated on low velocity of money.

With demonetisation in progress, Kidzutu said, proceeds from corruption will be mopped up as they had triggered high circulation of money – more supply of currency without corresponding growth in productivity, and likely to pile inflationary pressure and cause the shilling to devalue.

Purchasing power

Looking at purchasing power parity, he estimates, the shilling has lost close to 50 per cent of its value in the last eight years.

“All these are the fundamentals of why the shilling is under pressure. Will CBK be able to defend it with its reserves? I doubt and that’s why they are trying to have the IMF facility back,” he said.

However, various analysts including Kenya Bankers Association said Kadzutu’s argument that a spike in Consumer Price Index tips currency devaluation is improper, especially with stable diaspora remittances which are soaring month-on-month, and further castigate his theory on purchasing power having a direct impact on the value of the currency.

Last week, CBK Governor Patrick Njoroge dismissed the market’s concerns about the impact of graft charges against the finance minister and attributed the week’s fall in the currency to seasonal demand for dollars and to excess liquidity in the money markets.

Seasonal demand for dollars from companies to pay dividends to their overseas shareholders had also contributed to the pressure on the shilling, Njoroge said.

“We expect those imbalances will sort themselves out, we expect inflows,” he said, referring to hard currency earnings from farm exports and tourism.