Ruto government borrows Sh104 billion in four months

The Kenya Kwanza government secured loans amounting to Sh103.7 billion between February 1 and April 30, this year.

A report by the Treasury tabled in the National Assembly yesterday indicated that nine new loans were contracted between the government and, multilateral and commercial creditors. Seven of them were secured from the multilateral lenders while two are from a commercial lender.

This was the third tranche of loans by the Kenya Kwanza administration after the last one was secured in January when it received a syndicated loan of Sh227.5 billion from a consortium of international lenders.

Last year the government received a disbursement of Sh141 billion from the World Bank and another syndicated loan of Sh70.55 billion the same year.

“The total value of the nine new loans signed is equivalent to Sh103, 705, 148,433.44. four of the loans had been disbursed by the time of submitting the report,” reads the report.

Sustainable access

According to the report, the country received Sh3.5 billion to strengthen county performance in the financing, management, coordination, and accountability for resources.

A loan of Sh26.5 billion from the International Development Association (IDA) was meant to increase sustainable access to improved water and sanitation services, eliminate open defecation, and improve the financial performance of water service providers in selected counties, including those hosting counties.

In October last year, the government secured a loan with the OPEC Fund for International Development for the improvement of urban roads in five counties.

A Sh3.5 billion loan has been secured to fund the construction of the Ngong Road/Naivasha Road (Junction Mall) Junction Flyover. The loan was signed on March, 8 this year between the government and Instituto De Credito as the lender.

Pumping station

Another loan of Sh3.42 billion was secured to finance the commissioning of Kenya Railways Corporation (KRC) rolling stock maintenance workshop equipment and capacity building in Nairobi, Mombasa, and Nakuru. The Instituto De Credito of Italy is the lender.

The Kabonyo Fisheries and Aquaculture Service and Training Centre of Excellence (KFASTCE) Phase 1 in Kisumu County received a loan of Sh 1.34 billion from the Exim Bank of Hungary.

Another Sh 656.5 million was secured from the same Hungary banking institution to fund the rehabilitation and upgrading of the pumping station in the Ahero Irrigation Scheme in Kisumu County.

The Kenya Second Devolution Support Program has received Sh19.8 billion from IDA whose purpose is to strengthen the county’s performance in the financing, management, coordination, and accountability for resources.

Immediately after assuming power, the Kenya Kwanza administration contracted eight loans worth Sh43.4 billion in the four months between September 1 to December 31, 2022.

According to the Treasury the new loans signed between the government, and commercial bilateral and multilateral creditors will be repaid between 2030 to 2047. President Ruto’s government is counting on concessional loans to retire the short-term expensive loans that have worsened Kenya’s cost of servicing debt.

The hunger for loans comes as concerns grow over the sustainability of the country’s public debt which stands at Sh11.4 trillion amid depressed revenue streams as well as the harsh forex regime against the Kenyan shilling.

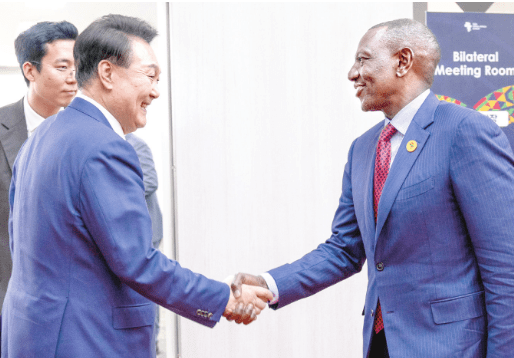

President William Ruto has since declared plans to borrow loans from Kenyans’ savings a move he says is meant to put an end to expensive external borrowing.

While stressing that Kenya should emulate other countries that accumulate savings, the Head of state argues that operating with steady savings would help the government borrow money from Kenyans without having to resort to foreigners.