Puzzle of insurance CEO demise ahead of date with sleuths

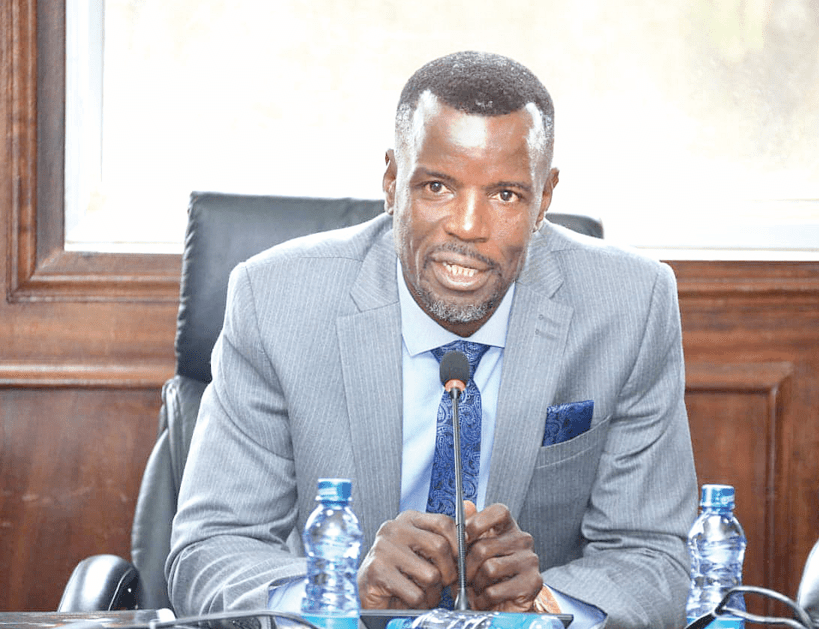

The Chief Executive Officer of Sedgwick Insurance Brokers, Sammy Methu Kiragu, who died by suicide on Tuesday afternoon, was expected to appear before Directorate of Criminal Investigations (DCI) detectives yesterday for grilling.

Kiragu is said to have jumped from the seventh floor of his office at the 4th Avenue Towers on Fourth Ngong Avenue in Nairobi.

Though their offices are on the 14th floor, witnesses said he took a lift to the seventh floor where he leapt to the ground floor in an apparent suicide. He died on the spot.

Sedgwick Insurance Brokers (SIB) together with UAP Old Mutual General Insurance Ltd were being investigated over the tender for the provision of Insurance brokerage services to Kenya Pipeline Company Ltd, for the period July 1, 2023, to June 30, 2025.

Sources said Kiragu was frustrated and had sought the assistance of other people to stop the probe against him and the company over the tender, No. KPC/UOT-298/FIN/NBI/22-23.

The former head of the Insurance Fraud Investigation Unit (IFIU) Daniel Kandie had on February 18, 2025, written to the Managing Director of UAP Old Mutual General Insurance Ltd to nominate a person conversant with the matter to appear before him on February 21 for an interview and statement recording.

Kandie, in a letter referenced DCI/IB/IFIU/SEC/4/4/1/VOL. XVI/369 dated February 18, indicated that IFIU was investigating a case of conspiracy and contravention of the Insurance Act involving the two firms.

“Our preliminary investigations have pointed out that Sedgwick Insurance Brokers and UAP Old Mutual Insurance Company Limited had prior undertakings on how premiums could be adjusted to make a sum total of $1,911,755.66 to suit the market price,” Kandie wrote.

He added: “In view of the above, we kindly but urgently request that UAP Old Mutual Insurance Company Limited to nominate a person conversant with the matter to appear before the Head of Insurance Fraud Investigations Unit on Friday, February 21 at 10.00 hrs at our office for interview and statement recording.”

Lowest bidder

Investigators’ report indicates that Sedgwick Insurance Brokers and UAP Old Mutual Insurance Company Limited participated in the tendering process and Sedgwick Insurance Brokers Limited were evaluated as the lowest bidder hence winning the tender.

However, it was later established that they had colluded with UAP.

The detectives had launched investigations, DCI-Inquiry file number 185/2024, and already senior officials from the UAP had been grilled and their statements recorded.

The IFIU detectives had also summoned officials from Sedgwick to appear before them yesterday.

The Managing Director, Kenya Pipeline Company Limited on March 28, 2023, advertised the tender for the provision of insurance brokerage services in the local dailies.

At the end of the preliminary evaluation, Four M Insurance Brokers Limited and Sedgwick Kenya Insurance Brokers Limited’s bids along with 29 others were found to be responsive.

The two, together with 15 others were also found responsive to the technical evaluation criteria and were eligible to proceed to the financial evaluation stage.

Sedgwick’s bid was evaluated as the lowest at this stage and they were on June 7, 2023, notified of being the successful tenderer.

By a letter dated 21st June 2023, the MD informed Sedgwick that it had been awarded three (3) insurance policies. Sedgwick accepted by a letter dated June 26, 2023.

Subsequently, by a letter dated 7th September 2023 and sent to MD KPC, the applicant forwarded Old Mutual General Insurance Kenya Limited’s confirmation of cover for the subject tender as the underwriter.

KPC instead awarded the tender to Four M Insurance Brokers Limited on September 7, 2023, and entered into a contract for the risks industrial insurance cover with them on October 2, 2023.

Sedgwick then filed a request for Review before the PPARB. PPARB made its ruling on November 2, 2023, and inter alia ordered that the letter of award to Four M be nullified and set aside.

Four M thereafter instituted judicial review proceedings before the High Court at Nairobi on November 6, 2023, being Judicial Review Application No. E121 of 2023.

The High Court held, inter alia, that the Request for Review by Sedgwick offended Section 167(1) of the Act and Regulation 203(2)(c)(iii) of the Public Procurement and Asset Disposal Regulations.

Lacked capacity

It also ruled that Sedgwick lacked the requisite capacity to provide cover to KPC at the price they set in their bid document, and it sought to adjust/vary the price and qualifications that had been set out in the bid document after the event, which was an act of illegality for want of approval in accordance with Section 139(1)(a) of the Act.

The High Court consequently granted an order of certiorari quashing the appellant’s decision and directed KPC to proceed with the implementation and performance of the contract dated October 2, 2023, entered into with Four M.

It was said that Sedgwick’s bid was tainted with illegality contrary to section 20 of the Insurance Act. This is because their underwriter’s lead insurer is an international re-insurer not registered under the provisions of the Insurance Act.

Sedgwick’s underwriter, Swiss Reinsurance, informed KPC that it would only place cover on behalf of Sedgwick at $2,237,039 FY 2023/24 and $2,535,583 – FY 2024/2025, and that this was a clear expression on the part of Sedgwick that it lacked requisite capacity to provide cover to KPC, at the price set out in its bid document, and thus unable to enter into a contract as per its bid document.

The court also ruled that Sedgwick lacked the requisite capacity to provide cover to KPC at the price set out in its bid document and it was seeking to adjust the price and qualifications that had been set out in the bid document after the event.

Sedgwick has in the past 40 years been providing insurance services to clients in the public and private sectors. These include clients from airlines, air charter companies, power and energy providers, tour operators, airport authorities, construction companies, media houses, financial institutions, NGOs, hotels and golf clubs.