Mixed reactions as Kenyans poke holes into Finance Bill during public hearing

Kenyans have received the contentious Finance Bill 2024 with mixed reactions which came up when the National Assembly’s Finance Committee held its last public hearings which started on May 15.

The Bill, which aims to generate Sh302 billion in tax revenue in the 2024/2025 financial year targets Sh3.35 trillion in revenue, with Sh2.91 trillion being regular revenue.

Some of the proposals that were contested include the Income Tax Act (Cap.470), Value Added Tax Act (Cap. 476), Excise Duty Act (Cap.472), Miscellaneous Fees and Levies Act (Cap. 469C) and Tax Procedures Act (Cap. 469B), Data Protection Act (Cap.411C), Public) among others.

Implementing a 16 per cent tax on bread, expected to lead to an approximate price increase of Sh10 for a 400-gramme loaf, raising the average cost from approximately Sh60 to around Sh75 was fiercely opposed by a majority of Kenyans.

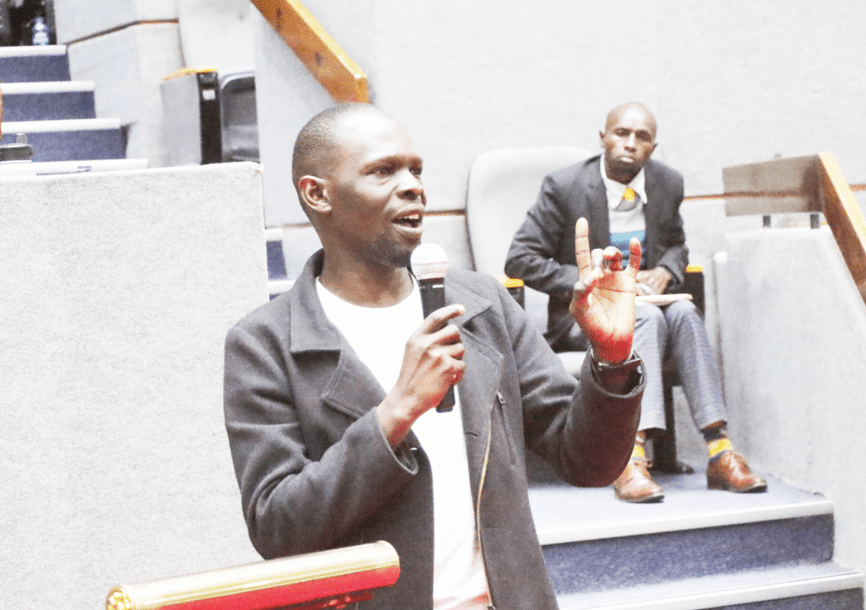

Education activist Pamphil Omondi expressed his concerns, stating, “The proposal to impose VAT on bread will adversely affect schools. If VAT is imposed, the price of a loaf of bread will increase with about Sh10-12, which translates to about Sh3,000 per month.” Mary Wanjiru from Activista Kenya, who argued that the price hike would make bread unaffordable for the common man, echoed his sentiments.

The motor vehicle tax which proposes to introduce tax at a rate of 2.5 per cent of the value of the motor vehicle was opposed by the General Secretary, the National Council of Churches (NCC), Chris Kinyanjui terming it oppressive and double taxation. “This proposal it’s a double taxation as it is paid at the import and on fuel levy and doesn’t generate income to the car owners either.” Stephen Kihara, a resident of Nakuru county cited the digital marketplace tax which proposes to expand the coverage of digital content monetization works for income tax purposes as injurious to the youth who mainly rely on content creation due to unemployment.

“The youth who have turned to content creation due to lack of employment will be most hurt by this bill if these platforms are taxed.”, said Kihara.

Benson Amburi representing Retirees and Claims Association of Kenya, while making his submissions on the FinanceBill2024, asked the Committee to focus on expanding the tax base to capture Kenyans who currently are not in the tax bracket.