Coronavirus wipes off Sh170b from bourse

Investors at the Nairobi Securities Exchange (NSE) have lost Sh170 billion in paper wealth between January 1 and March 31, a quarterly bulletin report by the Capital Market Authority (CMA) has disclosed.

According to CMA quarterly bulletin, market capitalisation dropped by 25.9 per cent from Sh2.2 trillion on December 31, 2019 to Sh2.02 trillion in March 31, mainly on account of the pandemic.

According to quarter one 2020 statistical bulletin released this week, CMA has said the NSE-20 Share Index dropped by 20.7 per cent for the first three months of 2020.

Panic selling

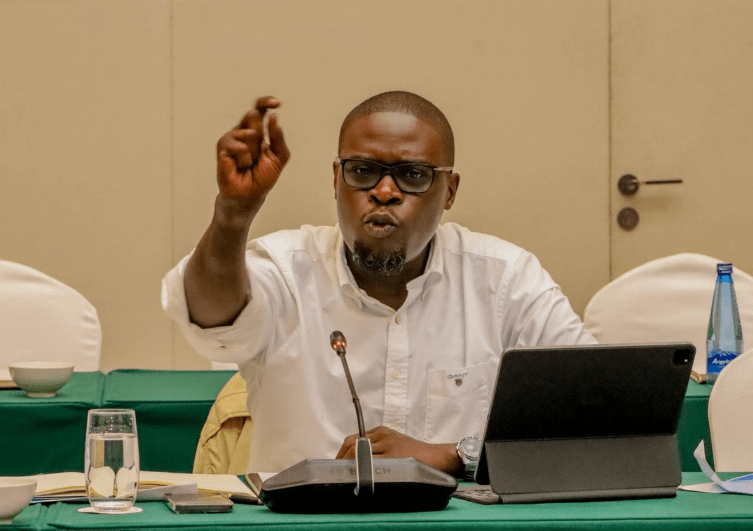

Regulatory Policy and Strategy director Luke Ombara said during the period, NASI, prompted a market halt, sparked-off by panic selling in an already bearish market.

Ombara said the drop in the NSE 20 share index witnessed in the quarter mirrored the corresponding declines in MSCI World, Emerging Markets and Frontier Market Indices of 21.4 per cent, 23.9 per cent and 27.7 per cent, albeit at a lower rate.

He said despite the drop timely fiscal and monetary policy interventions by the government and financial sector regulators, in consultation with stakeholders would lead to immediate return to stability at the NSE.

“The government, the Central Bank of Kenya and the CMA have continued to provide short-term guidance which has had a positive impact on important ‘macro-economic indicators,” said Ombara.

He said the period under review witnessed a decline in the secondary equities market performance in comparison with the preceding quarter across various indicators, with a notable decline in prices of listed shares in the tourism, transport, manufacturing and agricultural sectors.

Equity turnover, Ombara said, also declined slightly to Sh43.7 billion compared to Sh45.01 billion registered in quarter four of 2019, even as the volume of shares traded rose by 5.5 per cent to 1.36 billion.

Ombara said the recent upgrades to market infrastructure at the NSE and the Central Depository Settlement Corporation as well as enhanced trading accessibility through technology played a major role in sustaining high trading volumes in the NSE, even in the adverse Covid-19 environment.