Central banks seek to ease Covid-19 impact on economy

Seth Onyango @SethManex

Central banks across Africa are mulling a string of stimulus packages to cushion the region’s economies from a probable recession in the wake of coronavirus and ongoing locust invasion which could cripple economies.

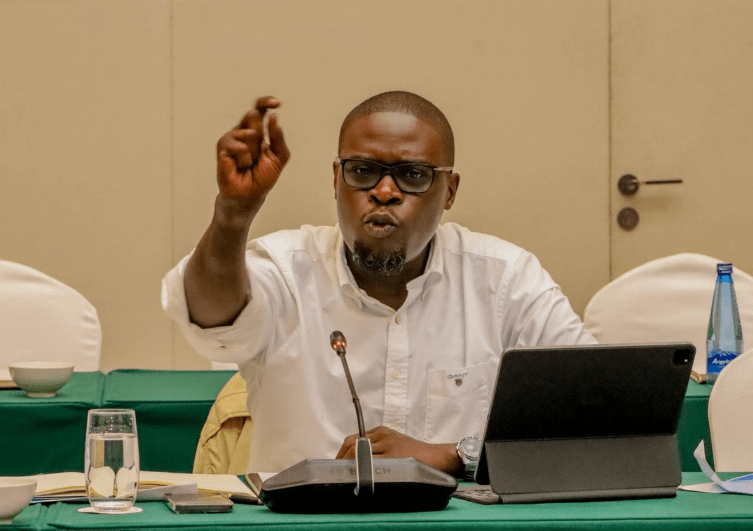

National Treasury PS Julius Muia told Business Hub the governors, including Kenya’s Patrick Njoroge, are discussing measures to insulate regional economies from recession.

“Treasury has been engaging finance ministers and Central Bank governors from Africa to share knowledge on safeguarding the regional economy,” he said.

Globally, more than $5 trillion (Sh500 trillion) has been wiped off share markets in the wake of the Covid-19, with US stocks plunging to their lowest since 1987.

Muia disclosed to Business Hub that the ministry will soon announce a stimulus package to ease the impact of the virus on the local economy.

Top on the list according to him is helping prop up businesses at risk of collapse and prevent the loss of jobs as the nation slides into a complete lockdown on the back of food shortage concerns after a locust invasion which is heading towards Kenya’s bread basket.

Already, the coronavirus code-named Covid-19, which began in China at the end of 2019, has spread worldwide, infecting four people in Kenya by yesterday, and triggering closure of schools.

More than 6,500 people have now died from coronavirus with some 127,000 confirmed cases globally, according to data from Johns Hopkins University.

Kenya could borrow a leaf from global economies such as the US and Japan which have rolled out stimulus packages to cushion their economies from the effects of the outbreak.

The US on Monday cut Fed rates (the equivalent of Central Bank Rates (CBR) in Kenya) to a target range of zero per cent to 0.25 per cent.

Following the outbreak, the Central Bank of Kenya (CBK) Monetary Policy Committee (MPC) is likely to meet this month to determine whether it will cut the CBR rate, a move that would reduce the cost of loans for the common mwananchi.

The Bank of Japan eased its monetary policy by promising to buy risky securities, including bonds at double the current pace and announced a new loan programme to extend one-year, zero-rate loans to financial institutions.

Emergency funding

Locally, it is not clear how much cash the government is looking to plug into the economy as the policy makers have not settled on a figure. Time is, however, running out.

Covid-19 Financing Facility will avail $50 million (Sh5.15 billion) and the Contingency Emergency Response Component of Transforming Health Systems for Universal Care Project will give the additional $10 million (Sh1.03 billion).

The World Bank also announced that it has activated the disbursement of $14 million (Sh1.4 billion) to enhance control of desert locust invasion in Kenya from the Contingency Emergency Response Component of Kenya Climate Smart Agriculture Project

Muia revealed that Treasury has met over the past two weeks to discuss pre-emptive funding to protect the economy.

“We are having consultations to agree on a budget needed to shield the economy from the spread of the virus…we are looking at every sphere of the economy,” he assured.

He said officials will continue to meet in the coming weeks to ponder on what can be done to protect jobs, stabilise supply chains and mobilise emergency funding to counter the virus.

First, the ministry is looking to tap into Sh5 trillion aid package set aside by the International Monetary Fund and the World Bank to help fight the virus.

“We have been doing teleconferencing with officials from IMF and the World Bank and we want to leverage on any source of funding,” he said, adding that already the two multinational lenders are seized of Kenya’s situation.

But the country will need more than an economy rescue to survive the coronavirus pandemic real test will come when curfew is imposed on Kenyans to stay home.

According to experts, the stimulus package should include ensuring people have enough food supplies.

Muia assured Kenyans that the government will inject funds into the agricultural sector to ensure food supply is not disrupted.

And a lockdown has begun after President Uhuru Kenyatta ordered closure of all schools and urged businesses to scale down operations to contain the virus.

Work from home

“Where possible, government offices, businesses and companies are encouraged to allow employees to work from home, with the exception of employees working in critical or essential services,” Uhuru ordered.

He encouraged the use of cashless transactions such as mobile money and credit cards as part of social distancing move to limit the spread of the killer virus.

Meanwhile, the Tourism Ministry announced it has set aside Sh500 million to help the tourism sector recover from the effects of the coronavirus outbreak.

Cabinet Secretary Najib Balala said some of the funds will be used to restore destination confidence to ensure that Kenya remains a preferred tourism hub.