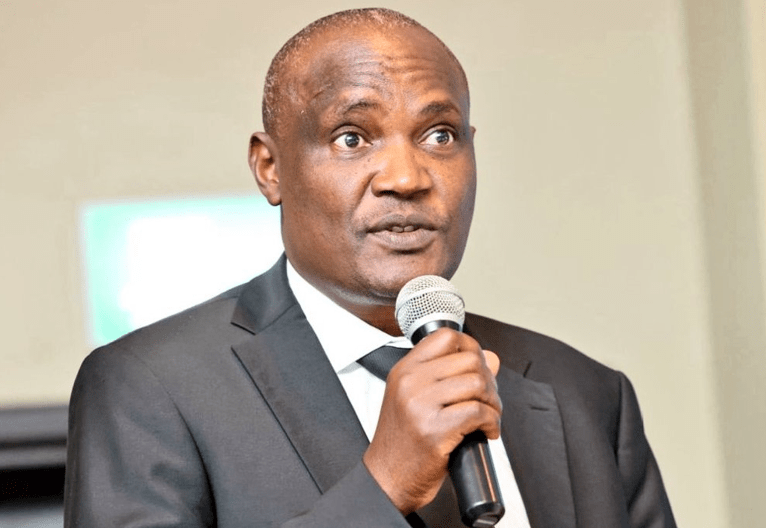

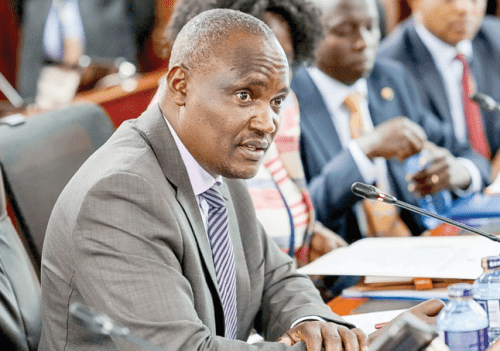

Mbadi: Govt adjusting 2025/26 budget to match bleak revenue reality

Treasury Cabinet Secretary John Mbadi has stated that the government will revise its 2025/26 budget proposal to reflect the country’s underperforming revenue and tighter fiscal space, following a year marked by economic disruption and missed targets.

Speaking during an interview on a local media station on May 23, 2025, Mbadi painted a sobering picture of Kenya’s current economic outlook, citing reduced revenue collection, unmet IMF conditions, and rising expenditure pressures.

These, he said, are among the key constraints affecting the 2025/26 budget-making process.

“You will observe that this financial year, 2024/25, was a very tough one. You remember the events of last year; we lost the Finance Bill, which had a major impact. We also shut down the economy for two to three months, and that has long-term effects,” he said.

Revenue collections

The Treasury CS revealed that by the end of April 2025, the Kenya Revenue Authority had collected Ksh2.12 trillion, adding that as of May 20, 2025, the figure had risen to Ksh2.25 trillion.

Guided by this, the treasury estimates that it will close the fiscal year at around Ksh2.4 trillion — significantly below earlier targets.

“That clearly, if you project, you see we may fall short of earlier projected or revised revenue targets, which we have been revising as we move forward because of uncertainty around the performance of the economy,” he explained.

Mbadi attributed the revenue shortfall to global shocks, including downgraded growth forecasts from the International Monetary Fund (IMF), coupled with Kenya’s own sluggish GDP growth.

“There are other shocks, external shocks like the pronouncement from the world-leading economy. And look, the IMF has revised downwards the world outlook in terms of performance. Our own GDP performance has also been below the earlier projections. Our revenue collections have been short of target, and we have been trying to monitor to see how we are performing. And so, where we are, we have a more realistic and clear view,” he stated.

Fiscal challenges

The CS further disclosed that the government’s fiscal challenges have been compounded by the failure to complete the ninth review with the IMF, resulting in the loss of Ksh99 billion in expected funding.

Despite this, Kenya secured Ksh65 billion from the United Arab Emirates, an amount Mbadi noted was less than anticipated.

However, he says that the remainder is expected to be drawn in the next financial year.

“We agreed with the IMF to cancel the ninth review and get into another program. So, that left us with a gap. Of course, we have managed to get some Ksh65 billion (USD500 million) from the UAE, although we expected to get much more, to draw much more. We’ll draw the rest next financial year,” he explained.

Adding to the fiscal pressures are significant expenditure commitments, including collective bargaining agreements (CBAs) signed with various public sector unions, university staff agreements, health sector commitments, and salary adjustments for disciplined forces.

“All these, and again, the salary adjustment for our discipline forces has put a strain and pressure on some security operations, including in North Rift, the latest security incidents in North Rift, and even our security from external threats like Al-Shabaab; those have put a little bit more pressure on our funding,” Mbadi noted.

Supplementary budget

As for the third supplementary budget expected before the close of the fiscal year (June 30), Mbadi indicated that no major additions will be made.

Instead, unspent allocations from projects that cannot be completed before June will be reallocated to priority areas.

“We’ll just be looking at those areas where absorption may not be practical between now and June and take them off and see how we can use that again to help factor in some of these expenditure pressures,” he remarked.

“So, right now, we have a clear view. With that clear view, we can now revise our budget to fit into the actual revenue,” he added.