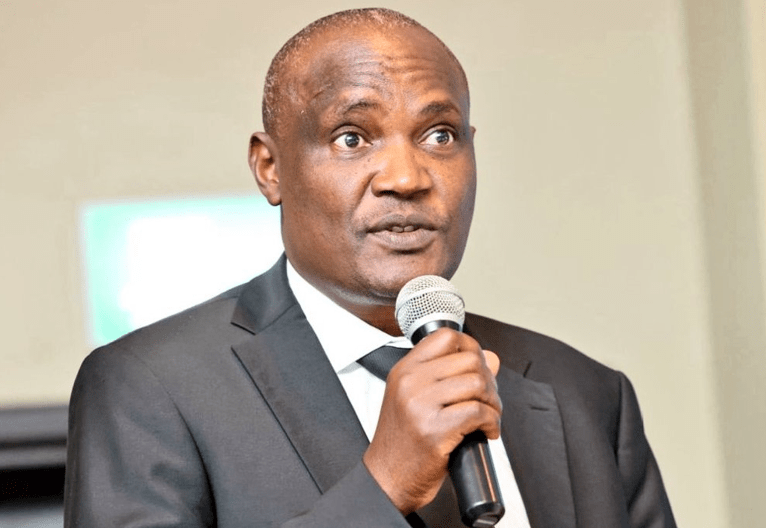

Mbadi admits graft as senators probe pension fraud

The government is now planning to automate the pension system to reduce fraud in the disbursement of pension benefits, especially to the retirees who exit civil service, National Treasury Cabinet Secretary John Mbadi has disclosed.

This, even as he emphasised that the National Treasury has enhanced public awareness and sensitisation programmes targeting civil servants on retirement documentation to minimise errors and delays in pension application.

Appearing before the Senate plenary to answer various questions touching on his docket, Mbadi further disclosed that the Cabinet has approved a Retirement Benefits Policy, which aims to harmonise retirement benefits, improve governance and enhance sector growth.

According to Mbadi, the National Treasury is upgrading the pension management information system (PMIS) to reduce manual interventions, improve efficiency and enhance data security.

“The Treasury has onboarded a contractor to develop an enterprise resource planning (ERP) solution, which will fully digitise pension administration. The automated system will allow for online claim submission to eliminate paperwork delays, create a self-portal for pensioners to track their claims and reduce the time for processing claims,” Mbadi said.

The system, which will be rolled out from July 1, 2025, will eliminate the manual system, which he said has been prone to abuse.

The government’s intervention in setting up the automated system comes amidst reports of a fraud syndicate targeting retirees who receive lump-sum pension payouts from the government.

Reports have emerged of how the suspected swindlers are mysteriously accessing the bank details of retirees and siphoning off their pension funds.

Last week, Senator Eddy Oketch (Migori) tabled a statement stating that fears are growing about how the criminals are accessing sensitive personal banking details not only of retirees but also of other Kenyans.

“We are witnessing a disturbing trend where fraudsters are increasingly targeting retirees and defrauding them of their pension benefits,” the senator said, revealing that the criminals are able to obtain sensitive banking information, allowing them to monitor transactions and swiftly defraud beneficiaries once pension payouts are deposited into their accounts.

He cited the recent case of a retired teacher who lost her entire lump-sum pension of Ksh2.4 million, which had been deposited into an Absa Bank Kenya PLC account.

However, while responding to the concerns of the senators, Mbadi acknowledged the existence of fraud involving rogue pension officers and banking staff.

The National Treasury boss, however, denied claims that the government has been diverting pension funds for other uses.

“I am not aware of any instance where pension allocations have been re-allocated. In fact, pension funds are among the most securely ring-fenced allocations,” he affirmed.