Yatani to read budget for 2022 in a fortnight

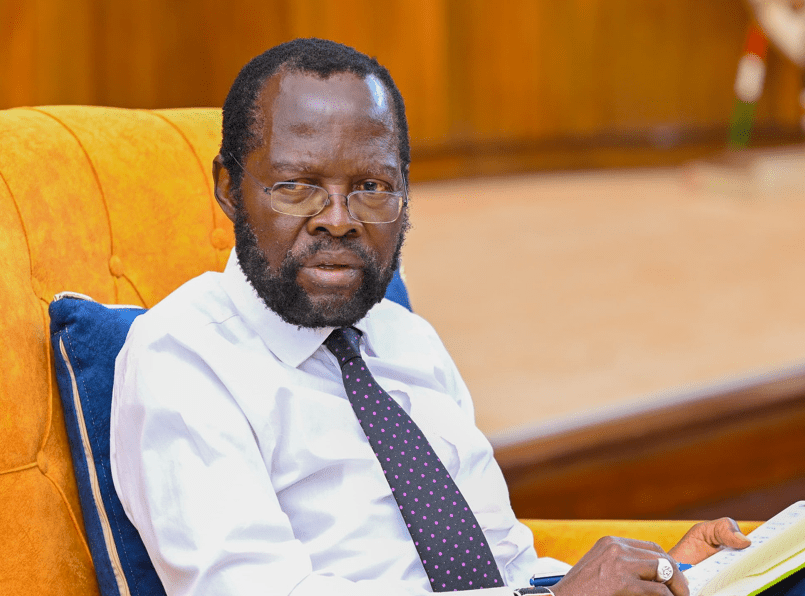

National Treasury and Planning Cabinet Secretary Ukur Yatani yesterday announced that the 2022/2023 financial year budget statement will be released on April 7, 2022, in what is expected to be the last under the current administration.

That is a shift from what has been a traditional June fete, due to the forthcoming general elections slated for August this year and the budget estimate for the 2022/23 financial year is expected to be more than Sh3 trillion compared to Sh3 trillion posted in 2021/22.

A statement issued by the National Treasury said that Kenyans have until close of business today to share their proposals on policy and tax measures for the Budget Statement for the financial year 2022/2023.

While Kenyans will be keen to see how the soaring debt and inflation will be tamed, concerns abound that they will continue to bear the brunt of the high cost of government if the steady rise in recurrent expenditure over the last five years is not checked.

Recurrent expenditure

Data from the Controller of Budget shows that the recurrent expenditure this financial year is 68 per cent of the total budget up from 64 per cent the previous financial year. Five years ago Kenyans were paying 55 per cent of the budget to sustain the government.

“This financial year, recurrent expenditure comprised of recurrent ministerial expenditure of Sh598.03 billion compared to Sh550.17 billion recorded in a similar period of 2020/21 and consolidated funds at Sh462.85 billion, compared to Sh394.45 billion recorded in a similar period of 2020/21,” said the Controller of Budget.

According to the Kenya Institute of Public Policy Research (Kippra), recurrent expenditure is 92 per cent of tax revenue, meaning that the government must borrow to implement development projects.

“Recurrent expenditure constituted 92.5 per cent of total revenue, implying that development spending must rely heavily on external borrowing,” Kippra said. The cost of government hit a record high this financial year has risen steadily for the last five years with experts warning that the tax burden could keep many Kenyans in poverty.

Analysts say that the high cost of government is increasing the tax burden on Kenyans hence reducing the ability of Kenyans to rise from poverty through self-determination.

Tax burden

Institute of Economic Affairs (IEA) said though the world economic freedoms are getting better, Kenya’s economic freedoms continue to decline due to high tax burden, corruption and debt. “The ranking of Kenya’s indicator of fiscal health is an indictment of fiscal indiscipline of the last decade,” said Leon Kemboi, programme officer at (IEA). Recurrent expenditure includes salaries, debt repayment, operations, bills and maintenance and others.