Two banks miss deadline to submit Sh10b capital plan

Two banks have missed the Central Bank (CBK)’s deadline to submit plans for raising their core capital to Sh10 billion, instead requesting more time to comply.

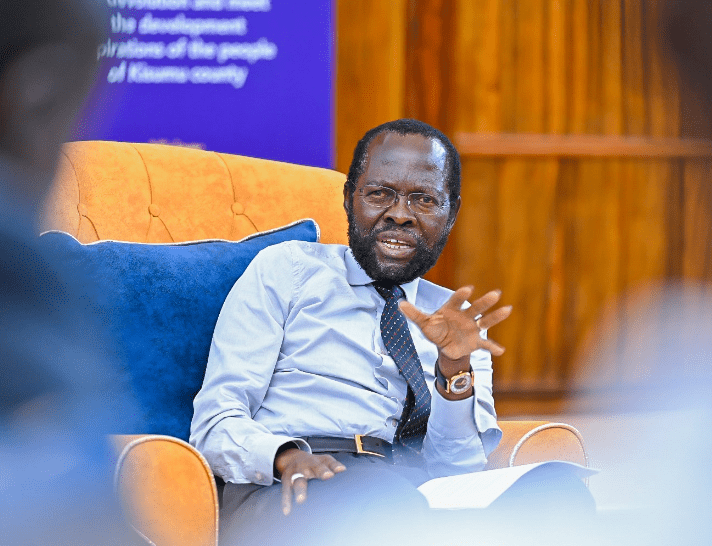

Governor Kamau Thugge made the disclosure during a post-Monetary Policy Committee press briefing on April 9, 2025, noting that the two lenders in question are subsidiaries of foreign banks.

“So far, 22 banks have submitted their capital raise plans. The remaining two have requested an extension, and since they are foreign-owned subsidiaries, we expect they’ll be able to secure the required capital,” he said.

Under the Business Laws (Amendment) Act, passed by Parliament in December last year, all banks are required to meet the Sh10 billion capital threshold by 2029. However, by the end of 2024, lenders must have increased their capital by at least Sh3 billion as part of a phased approach.

Thugge added that the CBK will begin engaging the 22 compliant banks to assess their submitted plans and outline the next steps in the capital restructuring process.

The apex bank through the legislative arm of government revised the core capital from the previous Sh1 billion that had been implemented in 2008 to help maintain a stable and efficient banking and financial system.

Bolstering economic growth

It is also aimed at making the financial institutions to better withstand and adjust to the various economic shocks that are sometimes influenced by global factors and enable them to finance larger projects that are vital for bolstering economic growth. The new requirement is also geared to help local banks meet the regional standards further enabling the status of the local banks.

Additionally, through the higher core capital threshold, smaller banks may be able to merge further creating a sounder financial system in the country reducing the number of “weaker banks in the country in a bid to enhance the system.

As per the guidelines, banks which fail to meet the requirements might be forced to downgrade their license category from commercial banks to lower tier one banks category thereby limiting their operations, while also shutting down some of their branches across. Last November during a public engagement forum at Kenyatta International Convention Centre (KICC) just when the law was being introduced, Kenya Bankers Association (KBA) through its representatives made an attempt to have the deadlines for the capital requirement extended to 2032.

It proposed to have banks do this in three phases to achieve the target whereby in each phase, the core capital would be increased by Sh3 billion a, process that was projected to allow the 24 banks avert the challenge of coursing disruptions, allow the extension of affordable loans to the private sector while also boost revenue generation.

“We are talking about 24 banks that currently fall below the Sh10 billion co-capital and for them, to move up to the Sh10 billion mark they will require a total of Sh150 billion,” the lobby stated. “These 24 banks employ approximately 7,000 Kenyans and that is 20 per cent of the total working force within the banking industry. They again occupy 727 premises country wide in branches.”

Core capital factor started gaining momentum in 2008 when the apex bank implemented the requirement for all banks to raise their core capital to Sh1 billion by the end of 2012 from Sh250 million.

The argument then was that the increment apart from financial stability would lead to risk mitigation on other economic factors that may affect the lending rates.

However, KBA through a report noted that other market players argued that the move would lead to more market concentration despite already being in the state.

CBK last month asked 13 commercial banks to submit detailed plans on how they intend to increase their core capital to Sh3 billion by the end of this year and Sh10 billion by 2032.

Comprehensive strategy

“We have written to 13 commercial banks with core capital below Sh3 billion, requesting them to outline how they will meet this year’s requirement and provide a comprehensive strategy for reaching Sh10 billion in the long run,” Thugge stated.

Since 2012, commercial banks have maintained a minimum core capital of Sh1 billion. However, a previous attempt to raise it to Sh5 billion in 2015 was unsuccessful.

Latest banking supervision report shows 11 banks have yet to meet the Sh3 billion core capital threshold required by the end of this financial year.