Rwandan lender taps KBC Group

KCB Group yesterday received regulatory consent by the National Bank of Rwanda (BNR) to merge its newly acquired lender Banque Populaire du Rwanda (BPR) and KCB Bank Rwanda.

The nod means the two lenders will start operating as a single entity dubbed BPR Bank Rwanda effective April 1, whereby KCB Group will assume majority shareholding stake, making the entity Rwanda’s second largest bank.

The acquisition comes three months after similar overtures were cancelled after the lender moved to acquire a Tanzanian lender from London-listed Atlas Mara Limited, citing regulatory hurdles.

Regional expansion

With a 62.06 per cent stake in Banque Populaire du Rwanda Plc. (BPR), the deal gives KCB Group a stronger edge in deepening it’s ongoing group strategy, to scale up its regional presence.

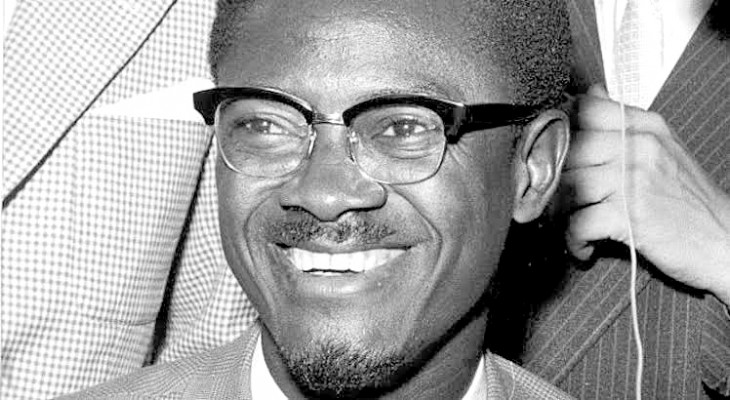

“BPR as we know it today has a lot of potential. The success of this business will build on our era of undisputed leadership in the market and contribute towards Rwanda’s economic success journey. I am confident that we can re-write Rwanda’s next chapter of development and economic growth,” said KCB Group Chief executive Joshua Oigara.

KCB Group added 1,013 employees to its payroll last year, raising its workforce to 8,538 in the year ended December 2021, making it the largest employer among Kenyan lenders by staff count. The year before, KCB’s staff count stood at 7,525.

Subsequently, the BPR Bank Rwanda board approved on Thursday a new organization structure for the integrated entity, effective immediately, and subject to governance approvals obtained from BNR.

In the new changes, George Odhiambo becomes managing director BPR Bank Rwanda Plc., having previously served at the same position at KCB Bank Rwanda outlet.

“The structure has considered the necessity of smooth post-integration transition with minimal business and human capital disruption whilst retaining key talent resources as well as alignment to the KCB Group Structure for support and governance,” said Oigara.

Bank mergers typically result in the review and rationalisation of branch networks and head office operations, and normally credit availability, productivity, loan losses, deposit service charges, and interest-rate risk ordinarily tend to rise as a result.

KCB is also eyeing the Democratic Republic of Congo market after ending its pursuit of BancABC Tanzania, which is owned by Atlas Mara, as parties called off the deal citing unspecified regulatory hurdles.

Industry data

DRC, which was inaugurated this week as a member of the EAC bloc, is also a key market for Equity Group. Equity Banque Commercial du Congo (Equity BCDC) in February last year launched its new identity following the successful merger of Equity Bank Congo (EBC) and Banque Commerciale du Congo (BCDC), to form Equity BCDC.

Industry data shows that Equity Bank has now overtaken KCB Group as Kenya’s most profitable lender in terms of net earnings and dividend payout.

Equity Bank’s net income of Sh40 billion in the year ended December 2021 is a record for the bank and the industry, outpacing Sh34.1 billion posted by KCB Group – which was previously the biggest bank by earnings and assets.