Kenyan businesses can now use Indian rupees to settle payments, industry PS says

Kenyans trading with Indian firms can now use Rupees to transact their business to help the country cut its huge dollar demand.

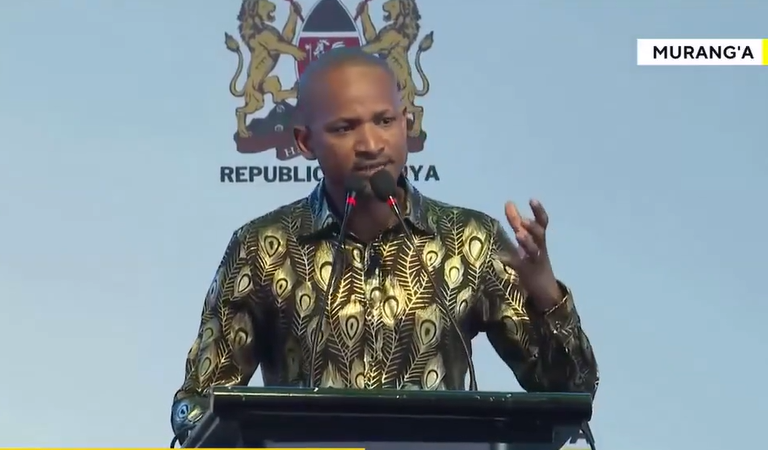

Industrialisation Principal Secretary Juma Mukhwana while revealing the development said it will encourage Indian investors to pitch industries in Kenya, taking advantage of reduced exchange rate risks, ease of trade and increased trade.

“Kenya will trade in Rupees. This will cut the cost of production, given that the Kenya shilling is currently devalued against the US dollar,” he said. Shri Rohit Vadhwana India’s deputy high commissioner to Kenya welcomed the move remarking: “Now we can trade in Rupee’s and Shillings.”

The two were speaking at the Kenyatta International Convention Centre (KICC) during the opening session of the International Textile and Machinery Exhibitions (ITME) Africa and the Middle East 2023.

It is the second to be held in Africa after the inaugural exhibition in Addis Ababa, Ethiopia, in 2019. A total of 23 countries are exhibiting their products and services.

The exhibition will showcase the latest advancements in textile machinery and technology, promote business networking, and encourage industry collaborations.

It is estimated that over 60 major Indian companies that have invested in various sectors in Kenya, including manufacturing, real estate, pharmaceuticals, telecom, information technology, banking, and agro-based industries. The use of the Indian Rupee could further encourage these and other companies to expand their operations in Kenya.

Mukhwana said it is time that Indian partners consider setting up factories and warehouses in Kenya as opposed to having more and more of the exhibitions.

“The government has already established a favourable environment for foreign investors to establish factories and warehouses in the country through supportive policies. It is duty-free to set up these factories and warehouses and the government is open to investments,” he added.

The use of the Indian Rupee in Kenya could simplify trade transactions between the two countries, reducing the need for currency conversion and associated costs.

In addition, Indian investors’ would face less exchange rate risk, as their investments would be denominated in their home currency.

Use of the Indian currency could also potentially increase trade between the two countries, taking advantage of the Reserve Bank of India’s mechanism for the international settlement of trade in Indian rupee by both Indian citizens and non-citizens, who can freely use it in foreign markets, including for international trade and as a reserve currency. It could also allow the central bank leeway to conserve its forex reserves and deploy it to keep the Rupee stable. –Noel Wandera