Banks signal slow growth of credit to private sector

Commercial banks have signalled depressed lending to the private sector for the better part of 2024 as they implement heightened interest rates previously directed by the Central Bank of Kenya (CBK).

The projection dashes the hopes of most individuals and businesses of getting affordable loans to survive the tough times, something that could further dent the country’s economic growth while leaving the government with unmet revenue collection targets.

Businesses require working capital for expansion plans, sustain operations, and eventually create more job opportunities as well as paying taxes. All these might now be cut should businesses fail to secure the much-needed credit from banks.

Due to interest rate hikes, banks prefer lending to the risk-free government instead of the private sector players such as manufacturers and agriculture, where the chances of loan defaults are high.

Risk-based pricing

“Since majority of the banks are at full implementation of their risk-based pricing models, access to credit by the SME and MSME segments might prove challenging. This will eventually lead to further shrinking of the real-economy in 2024,” says KCB Investment Bank in its global economic outlook 2024.

As such, lenders foresee more reliance on local domestic debt as an easier way for the government to meet its fiscal deficit.

This is even as the private sector credit growth recorded mixed performance in 2023, taking a dip around May to July before growing marginally at 12.5 per cent in October as credit conditions worsened.

To match the tightened monetary policy decision by the CBK, banks are now charging interest rates of about 20 per cent per annum from the previous 15 per cent rate applicable a year back.

CBK had in December raised the key lending rate by 200 basis points to a historic high of 12.5 per cent to wrap 2023 in a decision aimed at rescuing the shrinking shilling against the dollar.

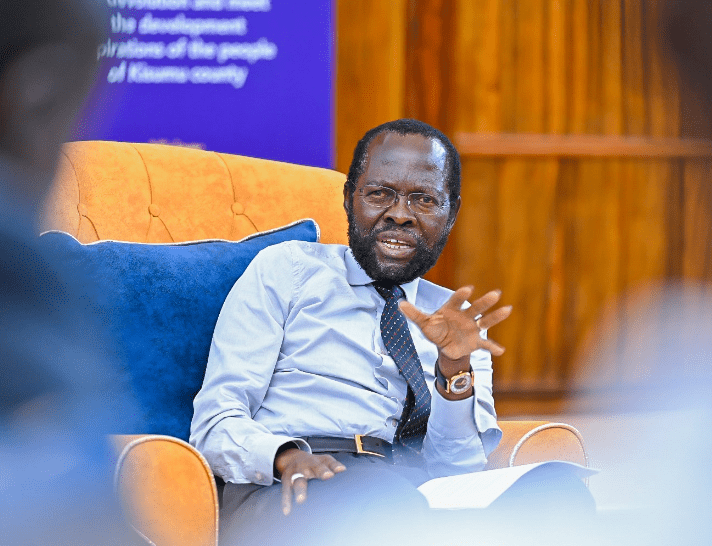

However, the rise in interest rates has equally set up borrowers to costly credit amid huge demand and rising loan defaults, which totalled Sh612.5 billion by the end of 2023. “The number of loan applications and approvals remained strong, reflecting sustained demand, particularly for working capital requirements,” CBK Governor Kamau Thugge stated in the last Monetary Policy Committee statement.

Low credit access coupled with high taxation and rising operating costs due to costly fuel will likely lead to a contractionary effect on the economy and shy away from investing. A majority of businesses have already indicated plans to slash workforce and production capacity this year.

It will be a continuation of 2023, when 70,000 employees in the private sector were laid off by the end of October, according to Federation of Kenya Employers (FKE).

President William Ruto, however, dismissed FKE revelation, arguing his administration had already absorbed part of the laid-off workers, with the majority being teachers hired on a temporary basis.

The lobby group further warned that 40 per cent of its members were gearing a further trim of the workforce by the end of 2023 to survive the tough economy and remain profitable.

Economic environment

“While we laud the government’s efforts to widen the tax base to meet expenditure, we are cognizant that in the current economic environment, KRA may fail to realize the collection targets on a slowdown in business operations hence reduced profitability,” says KCB.

Despite the global uncertainties, Kenya’s economy grew 5.9 per cent year-on-year in the third quarter of 2023, buoyed by favourable weather conditions, according to official data.