Senate probes claim Kenyans saddled with demurrage cost

The Senate is investigating the passing on of deliberately incurred demurrage fees to consumers of petroleum products, resulting in higher costs at the pump.

The Energy Committee has taken up the matter at the direction of Speaker Amason Kingi and will report back to the Senate in two weeks.

A demurrage charge is paid to the owner of a chartered ship when an entity fails to load or unload cargo within the time agreed.

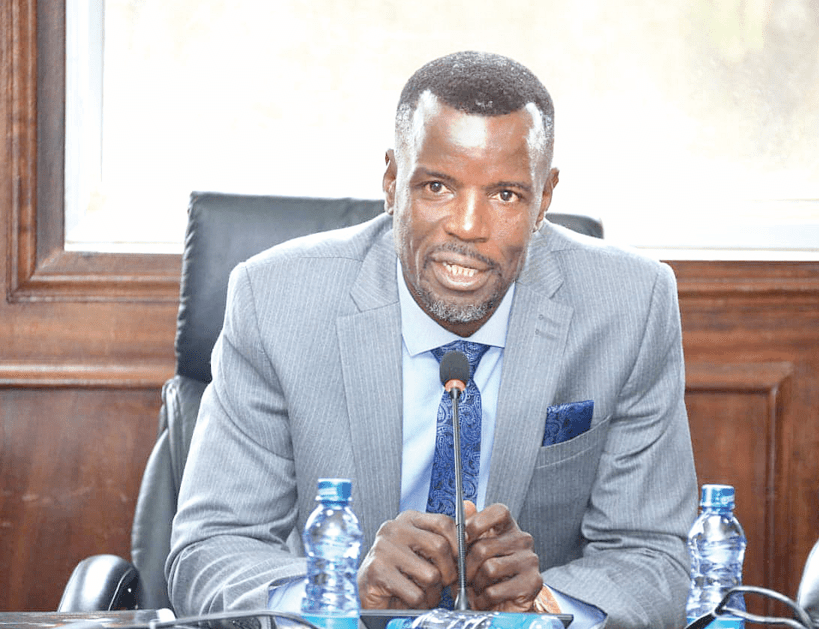

The matter came up after Senator Samson Cherarkey (Nandi) sought a statement on the current daily tariff for demurrage at the port of Mombasa for ships carrying petroleum products.

He wanted to know the maximum fees required based on the port’s current average timelines for offloading and clearing the products.

He also asked the committee to find out the total amount of money that has been paid for demurrage so far in the 2024/2025 financial year because of delays in offloading and clearing the products and explain the reasons for such delays.

The committee is also expected to provide details of the current arrangements for payment of demurrage fees under the government-to-government agreement between Kenya and Gulf states for the supply of fuel.

The senator wanted the committee to establish why Galana Energies is a major beneficiary of the deal.

Cherarkey also wanted the committee to find out why the Energy and Petroleum Regulatory Authority passes down demurrage costs to consumers of petroleum products when some ships are deliberately delayed so that they could claim substantial amounts of demurrage fees.

“The committee should provide a schedule of all vessels that have imported oil under the [government-to-government] arrangement, indicating the total amounts paid as demurrage,” noted Cherarkey.

Forex market

Kenya is seeking to exit the deal with Saudi Arabia, arguing that it is distorting the forex market and has failed to ease pressure on the dollar.

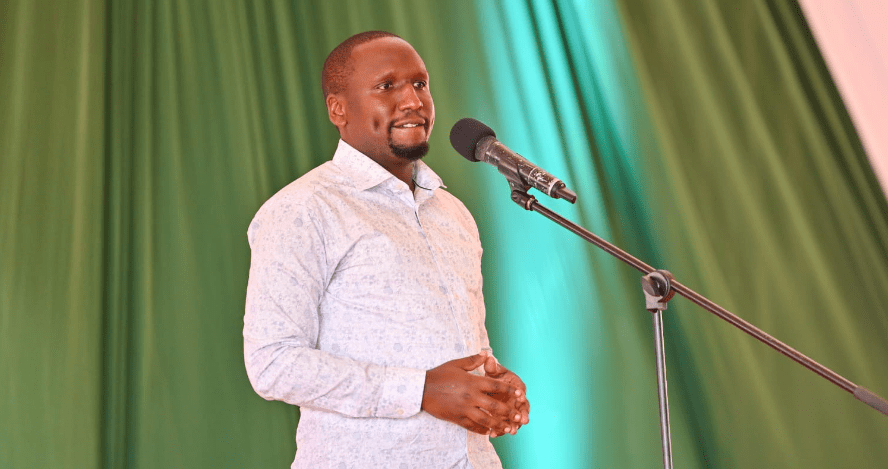

The deal agreed between Kenya and three national oil exporters from the Gulf – and was launched by President William Ruto in April 2023 – was billed as the solution to stabilising the shilling against the dollar. The deal provides for six-month credit for oil imports, backed by letters of credit issued by participating commercial banks.

“The government intends to exit the oil import arrangement, as we are cognizant of the distortions it has created in the FX market, the accompanying increase in rollover risk of the private sector financing facilities supporting it and remain committed to private market solutions in the energy market,” the Treasury was quoted saying in an IMF report published Wednesday.

The government acknowledges that the deal was a short-term measure to help ease foreign exchange pressures.

“As an interim measure to help ease FX pressures, we introduced a new oil import arrangement in April 2023. It replaced the previous open tendering system, under which oil import dues were payable upon five days of delivery, often creating undue FX market pressures,” the government said.

Kenya admits that the deal soured immediately, saying there was low demand that saw import volumes dip.

“In the first six months, the actual average monthly import volumes fell short of the monthly minimums agreed under the arrangement. This was due to lower demand from our domestic market as well as from the regional reexports markets,” the government said.

President Ruto, explaining why he backed the deal with Saudi Arabia, said it would bring down the exchange rate.