Treasury pondering $2.75b external debt to manage fiscal deficit

Kenya has projected to borrow Sh355 billion (about $2.75 billion) from external sources in the financial year 2024/25, the National Treasury said on Monday.

The money would be borrowed to cater for part of the $5.96 billion (Sh768.84 billion) fiscal deficit in the aforementioned financial year, according to Treasury’s annual borrowing plan for the 2024/25 fiscal year released in Nairobi.

Treasury further said it would borrow $3.21 billion (Sh414 billion) locally to cater for the deficit, which is 5.6 per cent of the country’s gross domestic product (GDP).

Kenya’s total public debt stands at $81.8 billion (Sh10.6 trillion), with external debt accounting for 48.8 per cent of the total.

To manage external debt, Treasury said the Kenyan government will engage in debt swaps, debt buybacks and debt refinancing strategies.

Debt swaps

The institution said Kenya had engaged in debt swaps with Italy and Germany before, with Italy converting €44 million (about $48 million) of debt into funding for development projects.

Similarly, Germany converted €60 million for similar development purposes.

Kenya in February completed a successful Eurobond issuance and buyback transaction to refinance its $1.5 billion Eurobond.

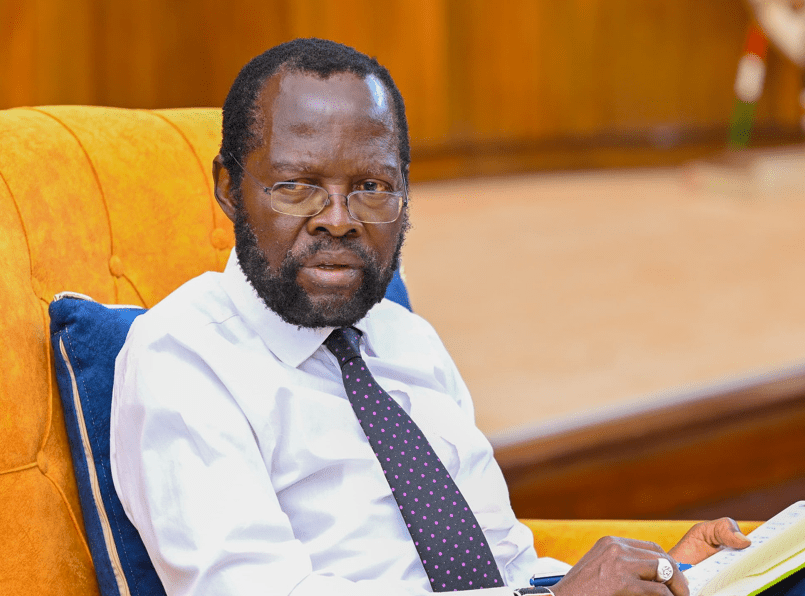

“The government aims to reduce the fiscal deficit from the current 5.6 percent of the GDP to 4.3 per cent in the financial year 2024/25,” said John Mbadi, Cabinet secretary in the National Treasury and Economic Planning Ministry.

“The fiscal consolidation is expected to reduce debt vulnerabilities in the medium term and improve the debt-to-GDP ratio toward a more sustainable level.”

When Mbadi met with IMF Representative in Kenya, Selim Cakir, for the first time, he emphasized IMF’s ongoing critical support for Kenya’s economic stability and development.