Woman in Amazon scam is revered US counsellor

Nyaboga Kiage @NyabogaKiage

A suspect, who was nabbed at the Jomo Kenyatta International Airport in Nairobi, has been working as a full-time counsellor dealing with mental health in Houston, US, People Daily can now reveal.

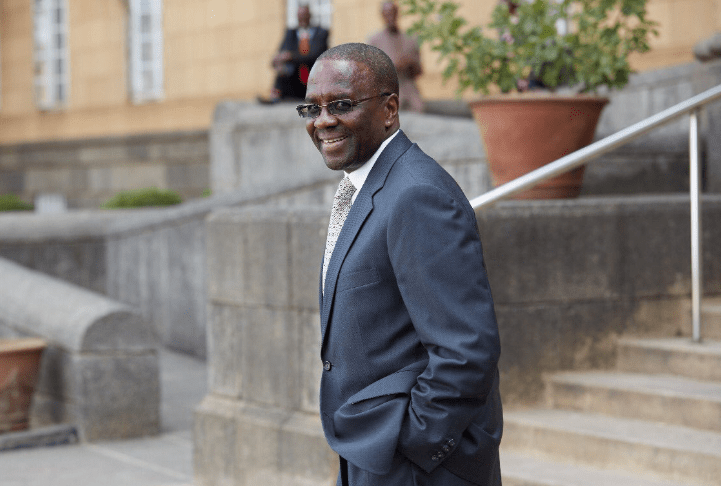

Stacey Marie Parker Blake, 50, the Director Behavioural Health Services, Amerigroup Texas, was nabbed on Friday immediately she alighted from a plane from the US and is expected to be arraigned in court today to answer to fraud charges linked to a scheme known as Amazon Web Worker.

Amazon Web Worker is an online application where people were tricked into investing millions with a promise that they would get huge returns.

In the US, Blake, who according to Kenyan detectives was found in possession of Sh50 million in her account, is a celebrated counsellor, who sees patients with Gender identity, marriage counseling, spirituality and religion.

According to CareDash, Blake has been an active counsellor, who specialises on guilt and shame and such conditions.

On CareDash, patients can search for doctors by name, specialty or location. They can also view doctors’ ratings and reviews from other patients.

“For new and existing patients, please see recommendations on how to schedule an appointment with Stacey Parker-Blake online.

As a counsellor, she may specialise in Mental Illness and Guilt and Shame, in addition to other conditions,” a statement on her CareDash reads.

Sources from the US that spoke to People Daily said the mother of two, and who is married to Everard Jimmy Blake, leads a lavish lifestyle.

Her travel records show she has visited many countries in the last three years including France, South Africa and Kenya.

“She also loves watching hockey and rarely misses matches, especially those that take place within Texas City,” said our source.

On August 25, 2018- Blake, a graduate of Prairie View A&M University, who also holds a masters of Arts in Counseling and a bachelor’s of Science in Psychology was featured in top 30 women, a magazine that features influential women in Houston.

In the article, she says she is dedicated in her professional life to helping and supporting those who cannot do for themselves.

Huge profits

“Working with people with mental illness is what Blake had always dreamed of doing, and she can undoubtedly say, she has never regretted the decision to follow her dream.

Looking back on her career from time to time, she acknowledges how blessed she is to be able to work in her field of study,” she is described in the article.

According to the article, Blake said she had a passion for helping others and that her career goals have always been to work in positions that allow her to empower everyone she serves so that they may build a better life for themselves.

“She believes everyone can overcome their obstacles, and she has spent numerous years teaching individuals how to be resilient,” it further reads.

Yesterday, Blake, who spent the night at Muthaiga Police Station was grilled by detectives drawn from the Special Crime wing on her involvement in the scheme that saw Kenyans lose hundreds of millions.

It all started when she came up with the idea to invest online where investors were tricked that they would earn huge profits of up to 38 per cent for deposits that lasted only for seven days.

“Many Kenyans were tricked into investing in the application and lost hundreds of millions after it went down with their investments” a detective privy to the ongoing investigations said.

The detective who sought anonymity said Blake will be charged for the offences of obtaining money under false pretenses, computer fraud and money laundering.

According to DCI boss George Kinoti, all those interested in the deal were to register their personal details such as full names, M-Pesa account details and phone numbers.

Kinoti said unsuspecting Kenyans downloaded the application in their hundreds, registered and made their deposits. Some even referred their family members and friends.

At the end of the scheme, the application went down with deposits worth hundreds of millions of shillings from gullible investors, who had hopes of hitting the jackpot.