US Securities and Exchange Commission issues summons for Gautam Adani and nephew on bribery allegations

The U.S. Securities and Exchange Commission has issued a summons to Indian billionaire Gautam Adani,indicted on U.S. bribery allegations related to a bombshell federal indictment against him, a court filing showed.

The SEC is suing the head of the Adani Group and his nephew Sagar Adani, alleging they engaged in hundreds of millions of dollars in bribes to help an Adani company while “falsely touting the company’s compliance with antibribery principles and laws in connection with a $750 million bond offering.”

The summons requires an answer within 21 days, according to the filing dated Wednesday in federal court in the Eastern District of New York. The SEC suit seeks unspecified monetary penalties and restrictions on the Adanis from serving as officers of listed companies.

Adani Group representatives did not immediately respond to a Reuters request for comment on Sunday.

The group has denied the criminal charges as ‘baseless’. The group CFO said the indictment is linked to one contract of Adani Green Energy that makes up some 10% of its business, and that no other firms in the conglomerate were accused of wrongdoing.

Federal prosecutors issued arrest warrants for Gautam and Sagar Adani, alleging they participated in a $265 million scheme to bribe Indian officials to secure power-supply deals.

Authorities said Adani and seven other defendants, including his nephew Sagar, agreed to bribe Indian government officials to obtain contracts expected to yield $2 billion of profit over 20 years, and develop India’s largest solar power plant project.

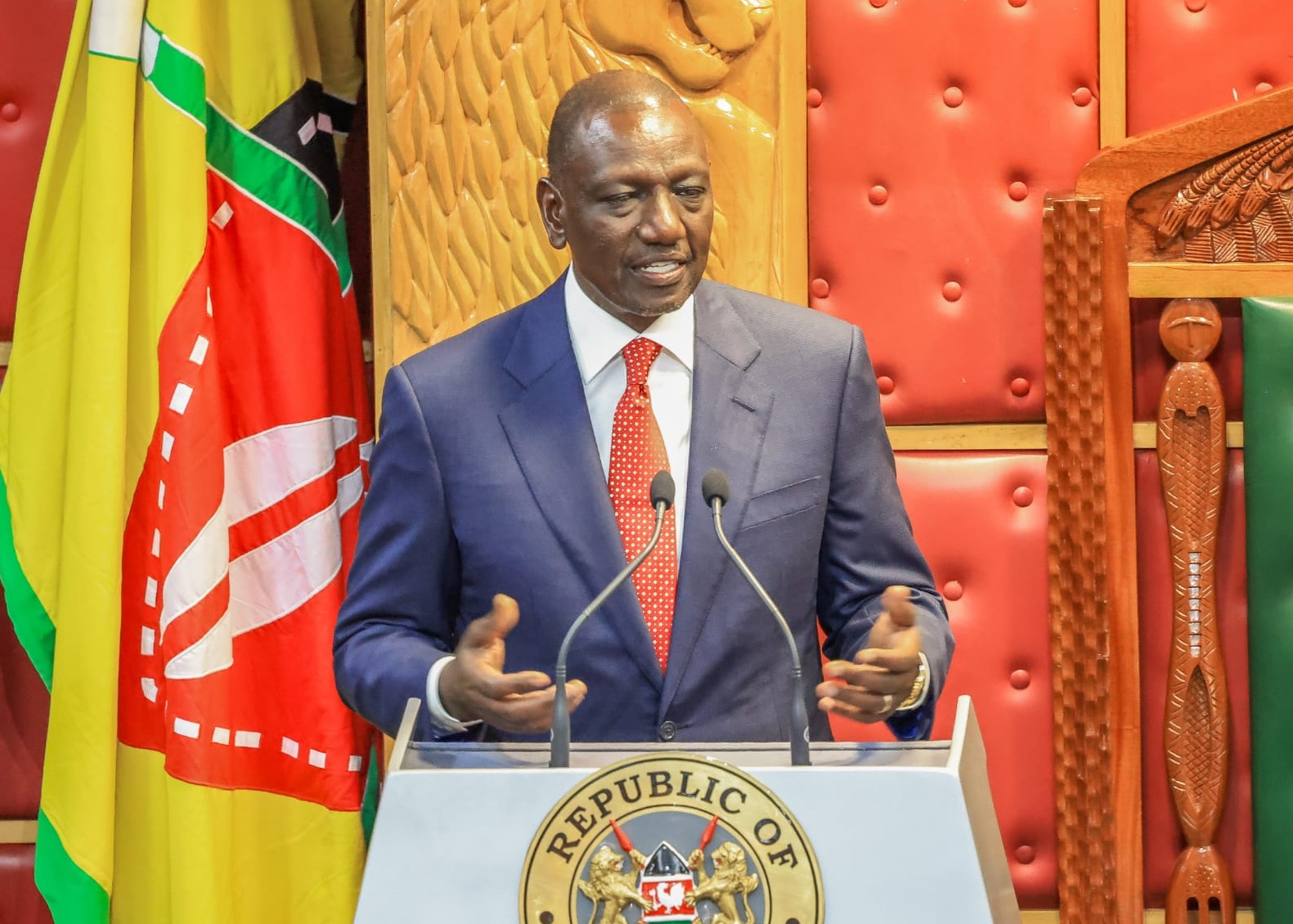

The crisis is the second in two years to hit the ports-to-power conglomerate founded by Adani, 62, one of the world’s richest people. The fallout was felt immediately, as billions of dollars were wiped off the market value of Adani Group companies and Kenya’s president canceled a massive airport project with the group.