State eyes digital space to expand revenue base

The government has proposed a raft of new tax measures to tap revenue from the digital space.

In the new measures published in the Kenya Gazette Supplement of April 28th, 2023, the National Treasury has proposed a three per cent tax on Bitcoins and other Non-Fungible Tokens (NFTs) beginning September 2023.

Other taxes set to affect the online marketing platform include a 15 per cent withholding tax on digital content monetization and a further 10 per cent excise tax on imported mobile phones.

NFTs are digital files. They can be a digital photo of a piece of art, real estate or a video.

Turning the files into NFTs usually helps secure them through blockchain to make buying, selling and trading efficient, reducing fraud considerably.

Bitcoins are virtual currencies that can be used to buy, sell and exchange goods or services without an intermediary like a bank.

Should the proposals now before Parliament pass, they will dent the pockets of Kenyan artists including photographers, musicians, sculptors and painters, who are turning to NFTs to directly sell their work to consumers by eliminating middlemen.

Kipchoge auction

In an interview conducted last year, Njaramba Wanjau, a data science and digital media executive at Safaricom was quoted saying NFTs offer an opportunity to monetise creative and artistic work by putting it in a simple, creative art form, leveraging new technology.

“Since NFTs are founded on smart contracts, they can be sold on digital platforms, while protecting copyrights. Their worth depends on what is being sold and the interest it generates,” explained Wanjau.

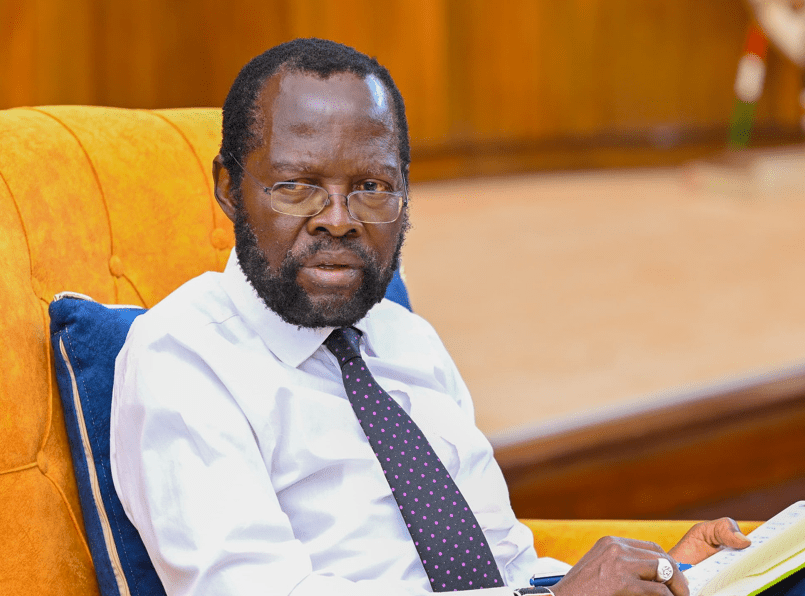

Kenyan’s were in awe when Eliud Kipchoge (pictured), Kenya’s all-time great long-distance runner and marathoner, auctioned two videos capturing his career’s highlights as NFTs for Sh4 million while renowned rapper Octopizzo earned $2,000 (Sh272 million).