Ruto: Kenya Pipeline set for NSE listing in 2025

President William Ruto has confirmed the government is listing the Kenya Pipeline Company (KPC) on the Nairobi Securities Exchange (NSE) through an initial public offering (IPO) in 2025.

According to him, the move will offer investors a unique opportunity to deploy capital in one of Kenya’s most strategic infrastructure enterprises.

The Head of State spoke during the Wednesday, July 2, 2025, London Stock Exchange market opening ceremony in the U.K., where he is on an official trip, Ruto said KPC’s listing is among his government’s plans to widen the local stock market while opening several state corporations to foreign investment.

“As a government, we have equally made a strategic decision to broaden Kenya’s stock market appeal to both local and international investors by earmarking key State assets for privatisation through Initial Public Offerings at the Nairobi Securities Exchange,” Ruto said.

“We are committed to a structured, time-sensitive programme that identifies and prepares a robust pipeline of key government assets to be privatised through the stock exchange or improved through private sector participation.”

The Head of State further maintained that Kenya is committed to the development of its capital markets, particularly through strengthening the NSE.

Ruto highlighted that this commitment is underpinned by strategic reforms and a refreshed, market-focused strategy under the leadership of the new NSE team.

“Supported by fiscal consolidation, effective debt management, and a stronger currency, these reforms helped the Nairobi Securities Exchange emerge as Africa’s top performer in dollar returns in 2024, according to Morgan Stanley Capital International,” he added.

At the same time, the President lauded the United Kingdom for remaining a “steadfast and strategic partner in advancing Africa’s capital markets”.

He noted that programmes such as Mobilist, in partnership with exchanges like the NSE and the Nigerian Stock Exchange, are helping democratise access to investment and promote financial inclusion.

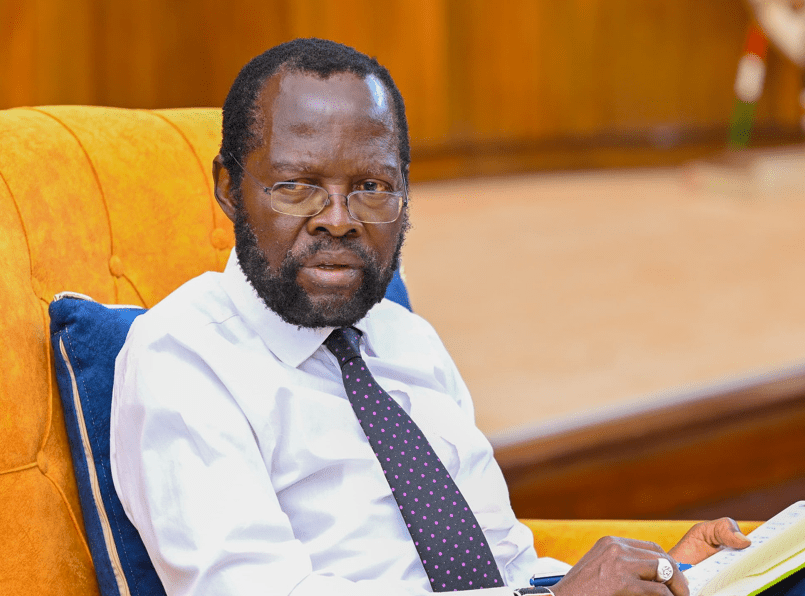

Mbadi on privatisation

Treasury Cabinet Secretary John Mbadi, in February 2025, said the government was mulling the move after receiving the second cheque of the company’s Ksh10.5 billion dividends to the exchequer in 2024.

While announcing the plan in February 2025, Mbadi said KPC has numerous benefits to realise from a listing at the stock exchange, citing Safaricom and KenGen’s performance since being publicly traded.

“Listing will be a good idea, especially as KPC expands into the region, because it will provide much-needed liquidity and capital for expansion and diversification into LPG Kenyans will have a chance to own a piece of KPC,” the finance minister said then.

As part of its expansion and diversification strategy, KPC is exploring the establishment of a petroleum trading hub in Mombasa to facilitate the receipt, trading, and distribution of fuel products across the region—an initiative expected to bolster the regional oil and gas market.

It also seeks to wind down the Kenya Petroleum Refineries Limited (KPRL) and integrate it into KPC’s operations.