Mbadi sounds alarm on 2032 debt pile

Treasury Cabinet Secretary John Mbadi has warned that Kenya faces a significant fiscal challenge as a substantial portion of its public debt is set to mature by 2032, potentially placing the economy under severe strain.

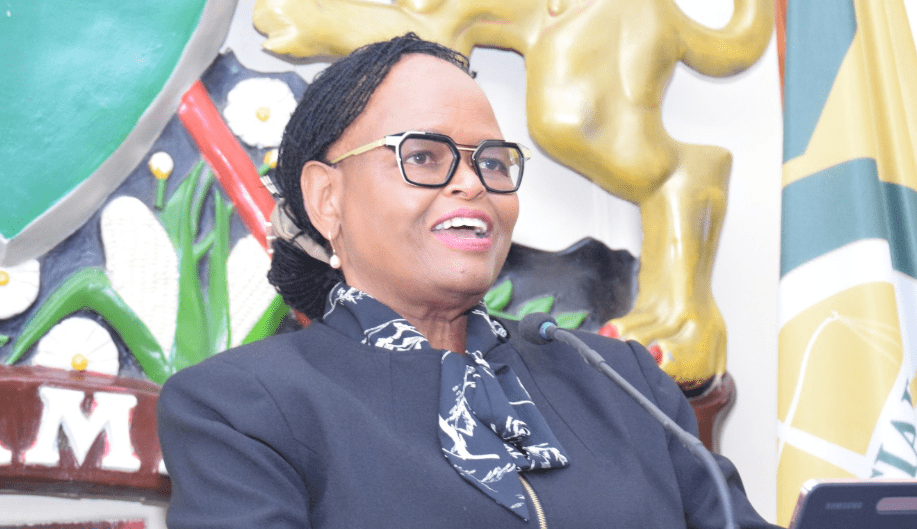

Speaking when he attended a town hall meeting focused on the Finance Bill 2025, on Friday, May 16, 2025, Mbadi provided a detailed assessment of the country’s debt trajectory and fiscal outlook.

He observed that the coming decade will mark a critical period when Kenya must meet sizeable debt repayments, a situation that demands prudent management.

“From now until 2032, we are approaching a juncture where many of our debts are maturing and will require settlement. This situation is concerning; however, it does not unduly alarm me as the government has formulated a clear strategy to manage this responsibly,” Mbadi stated.

However, he pointed out that he is not overly concerned that the country might soon face pressure or teeter on the edge of serious consequences for failing to meet its debt obligations because the government has put in place robust strategies they trust will ensure debt sustainability.

A core pillar of this strategy, he said, involves systematically reducing the national budget deficit, a fundamental step towards securing debt sustainability.

Mbadi noted the progress achieved since 2020, highlighting that the budget deficit has declined from 8.3 percent of GDP to an estimated 5.2 percent, despite acknowledging that further improvements were possible had all proposed revenue measures been fully realised.

“One key approach is reducing our budget deficits, which is one of the most effective ways to maintain debt sustainability. We began this process back in the 2020-2021 financial year when our budget deficit was 8.3 percent of GDP. The following year, it decreased, and now it stands at around 5.2 percent, although I recognise that we could have done better if all tax revenue measures had been fully implemented,” Mbadi stated.

More borrowing

While acknowledging these fiscal gains, Mbadi cautioned that Kenya is not yet in a position where debt sustainability is guaranteed.

He explained that this is one of the key reasons the country will continue borrowing, as it still needs to provide essential infrastructure and services to its citizens, adding that people should not be too quick to criticise when the government chooses to raise funds through borrowing.

“Debt servicing concerns persist because we have not fully secured sustainability. Nevertheless, borrowing remains an essential instrument for any economy, including advanced economies, which continue to leverage debt to finance development,” he explained.

According to him, even the world’s leading economies continue to borrow to this day, and it is neither unusual nor harmful that Kenya will persist in borrowing.

However, he emphasised that the borrowing will be conducted responsibly and strictly within the established fiscal frameworks, assuring that despite accumulating additional debt, the country will not be overwhelmed by debt maturities in 2032.

“Every economy borrows; there is no country that operates without borrowing; even the world’s leading economies continue to do so. Kenya will continue to borrow because we need to invest in vital social infrastructure, healthcare, and development projects. Nevertheless, we must borrow responsibly and always within our fiscal frameworks to avoid jeopardising our economic future,” Mbadi said.