Policy flaws to slow down the quest for cheap houses

Noel Wandera @NoelWandera5

The government’s affordable housing programme (AHP) is in jeorpardy unless certain flaws in policy are addressed.

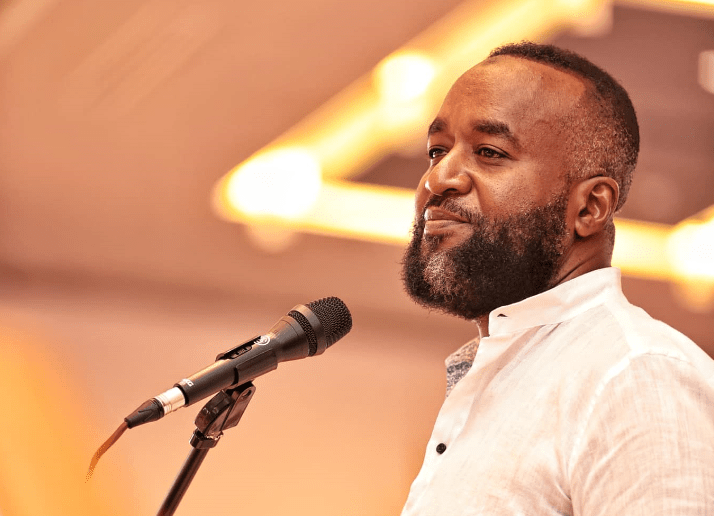

A research analyst at Cytonn Real Estate, Beatrice Mwangi warned that the government’s intent to borrow money from the markets and lend to Kenyans yearning to own homes at a nine per cent interest rate on mortgage is not sustainable.

Authorities hope to fundraise from the markets using the Kenya Mortgage Refinance Company (KMRC) for onward lending to prospective homeowners under its affordable housing plan (AHP) project.

However, Mwangi questioned the government’s rationale of sourcing mortgage funds from the markets at high interest rates to lend to prospective home owners at lower mortgage rates, saying such a re-financing package is not sustainable.

“If the government gets the funds from investors at say 12.5 per cent and is looking to give people mortgages at nine per cent, is it sustainable?” she asked.

Mortgage lenders

KMRC was formed in May 2019 to provide low cost mortgages and increase their availability by providing long term funding to primary mortgage lenders in the country.

Kenyans who earn a monthly income of less than Sh150,000 will qualify for the affordable housing loans funded by the institution.

Construction of 500,000 low cost units is one of the pillars of President Uhuru Kenyatta’s Big Four agenda and which must be completed before the end of his tenure in 2022.

So far, only 228 units in Nairobi’s Ngara Estate are complete and ready for occupation. When fully completed, the Ngara project will have 1,370 housing units.

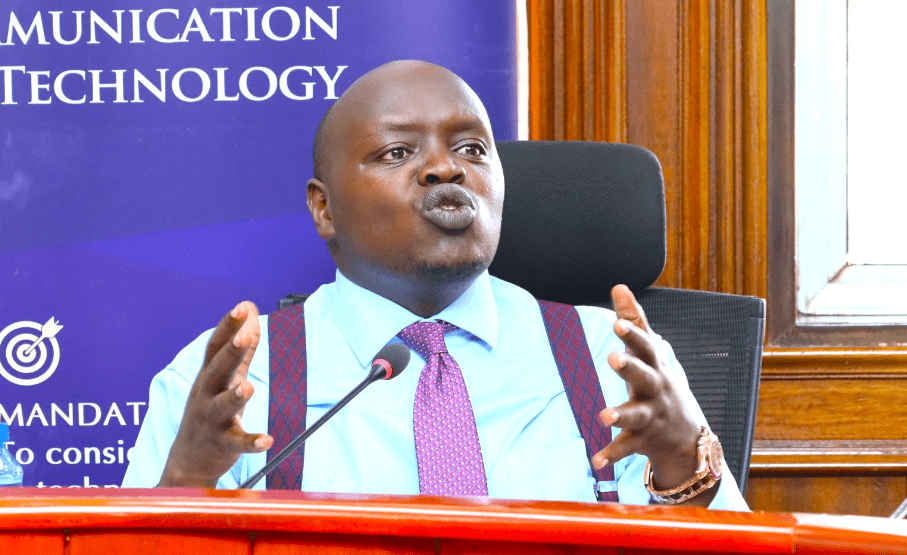

While launching the Ngara project last week, Housing and Urban Development Permanent secretary Hinga Mwaura said the actual financing and construction would be carried out by project partners, while the government facilitates. He said securing an affordable financing deal was one of the hurdles the government was managing.

But speaking on Tuesday during the launch of Cytonn Investment’s Affordable Housing Investment Plan, Mwangi said though the government was creating the necessary incentives for the private sector and complementing AHP, relevant sector regulators were too slow to actualise the reforms.

She spoke in reference to the Finance Bill 2019 enacted in November, which expanded the scope of approved institutions that can hold savings towards the Home Ownership Savings Plan (HOSP) to include fund managers and investments banks registered under the Capital Markets Act, effective January 1, this year, a development that placed the Capital Markets Authority (CMA) at the centre of policy guidance.

However, Mwangi said guidelines from CMA have not been forthcoming, forcing fund managers and investment banks to hold back on crucial investment decisions.