Number of students applying for loans in new funding model drops – report

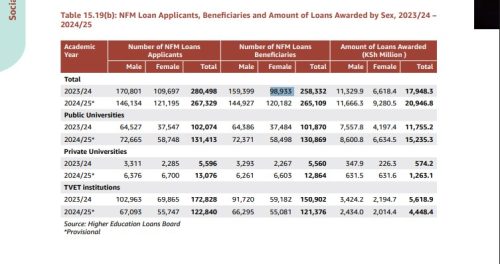

The number of students applying for loans under the new funding model recorded a slight decrease from the 2023/24 to the 2024/25 academic years.

In the 2025 Economic Survey published by the Kenya National Bureau of Statistics (KNBS), the total number of loan applicants decreased by 4.7 per cent from 280,498 in 2023/24 to 267,329 in 2024/25. From the figures, over 13,000 students shunned education loans.

The report also raised concerns regarding the number of male students applying and receiving credit.

KNBS established that the male loan applicants dropped by 14.4 per cent to 146,134 from 170,801, while female loan applicants increased by 10.5 per cent to 121,195 in 2024/25.

President William Ruto introduced the new funding model on May 3, 2023. This student-centred funding model (SCFM) represented a significant shift from the previous block funding approach, the Differentiated Unit Cost (DUC), which primarily allocated funds directly to institutions, a block amount which was shared amongst the enrolled students which led to a lower grant amount per student.

Under the new model, financial support is targeted directly to students based on their level of need, as determined by the Means Testing Instrument (MTI).

Beneficiaries

Despite a slight contraction in the number of students applying for loans under the new funding model, the report indicated that more beneficiaries entered the bracket, making a significant rise of 2.6 per cent from 258,332 in 2023/24 to 265,109 in 2024/25.

“Overall, the total amount of loans awarded increased from Ksh17.9 billion in 2023/24 to Ksh20.9 billion in 2024/25,” the survey established.

However, male beneficiaries recorded a drop in the 2024/25 academic year to 144,927 from 159,399, marking a 9.1 per cent contraction.

On the other hand, female loan beneficiaries rose by 21.5 per cent to 120,182 in 2024/25 from 98,933 in the previous academic year.

Private and Public universities

The total loan applicants from public universities rose by 28.7 per cent to 131,413, while the loan beneficiaries increased by 28.5 per cent to 130,869 in 2024/25.

The total amount of loans awarded increased from Ksh11.8 billion in 2023/24 to Ksh15.2 billion in 2024/25. Male student loan beneficiaries from public universities increased by 12.4 per cent to 72,371, while female student beneficiaries increased by 56.1 per cent to 58,498 in 2024/25.

” The total number of loan applicants from private universities increased from 5,596 in 2023/24 to 13,076 in 2024/25. Similarly, the number of loan beneficiaries from private universities more than doubled to 12,864 in 2024/25,” the KNBS economic survey reported.

“The amount of loans awarded to applicants from private universities grew from Ksh0.6 billion in 2023/24 to Ksh1.3 billion in 2024/25. In the review period, male loan applicants from private universities increased from 3,311 to 6,376 while female loan applicants increased from 2,285 to 6,700.”

The total number of TVET students loan applicants dropped by 28.9 per cent to 122,840 in 2024/25. Similarly, the number of student loan beneficiaries declined by 19.6 per cent to 121,376 in the same period. Loans awarded to students decreased from KSh 5.6 billion in 2023/24 to KSh 4.4 billion in 2024/25. Male loan applicants decreased by 34.8 per cent to 67,093 while female loan applicants dropped by 20.2 per cent to 55,747 in 2024/25.

Challenges

The new funding model has experienced a myriad of challenges since its launch. The state has been forced in several instances to defend the model, which was declared unconstitutional.

However, the government fought back and secured its reprieve. Despite legal challenges, some students had come out to protest the model, arguing that it had placed them in the wrong bands.

Nonetheless, Ruto’s administration has promised to make the new model work and benefit learners.