Kenya faces stiff penalty if it terminates SGR contract

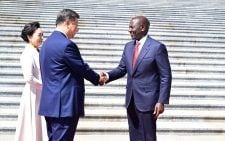

Despite criticising the Standard Gauge Railway (SGR) loan contract during political campaigns, the administration of President William Ruto is unlikely to challenge its validity as this would have serious financial consequences on the country.

Analysts said terminating the contract would see Kenya forced to pay close to Sh500 billion immediately to Chinese lenders, a burden the economy cannot bear at the moment.

Churchill Ogutu, a senior research analyst at IC Group noted that while the new administration was unlikely to challenge the validity of the entire contract, it could try to renegotiate some non-financial terms of the contract deemed punitive.

“For instance, the government could renegotiate the requirement to have operations at the Nairobi Inland Container Depot as part of a credit enhancement agreement for the SGR contracts,” he said.

Sweeping power

In September, KPA reverted port operations back to Mombasa from Nairobi in line with a directive made by President Ruto. The Mombasa-Naivasha SGR has cost taxpayers close to Sh500 billion with Mombasa-Nairobi stretch costing Sh327 billion while the Nairobi-Naivasha stretch cost Sh150 billion.

The contract signed in 2014 gives sweeping powers to China including requiring that arbitration of any dispute is held in Beijing and that Kenya establishes an Inland container Depot in Nairobi.However, the contract has remained unavailable for public scrutiny for the last eight years. According to the contract documents released by Transport Cabinet Secretary, Kipchumba Murkomen, the borrower challenging the validity of the contract constitutes an event of default and would make all amounts disbursed so far, including interest, immediately payable. “Upon the occurrence of an event of default, and at any time or times thereafter, unless such event has been waived by or remedied to the satisfaction of the lender, the lender may… declare the principal of, and accrued interest on the loan and all other sums payable immediately due,” reads the contract in part.

The sums, it adds, would be payable without further demand and notice or other legal formality of any kind and declare the facility terminated whereupon the obligation of the lender to make further disbursement shall immediately cease.

According to the agreement titled; Preferential Buyer Credit Loan on Kenya Mombasa-Nairobi Standard Gauge Railway Project, the priority of the loan service shall be treated as all the unsecured loans the government has with other lenders.

The loan repayment period is 20 years at an interest rate of 2 per cent making it a concessionary loan. There was also a management fee of 0.25 per cent and a commitment fee of 0.25 per cent.

“The maturity period for the facility shall be 240 months among which the grace period shall be 84 months and the repayment period shall be 156 months,” reads the loan agreement.

Loan period

Of the total loan, Sh100 billion was paid to the government and Sh200 to the contractor, China Road and Bridge Corporation. Murkomen, however, said the loan period shall be renegotiated, adding that it will not be possible to repay it in 20 years. The conditions also state that at least 42 per cent of the SGR revenues shall be used to service the loan.