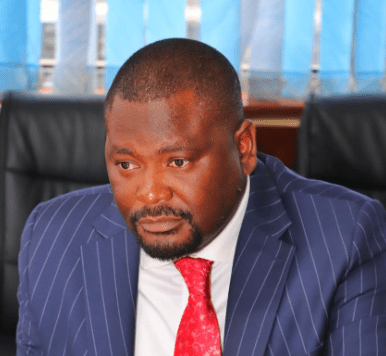

Mbeere North Member of Parliament Geoffrey Ruku has asked Treasury Cabinet Secretary John Mbadi not to overburden Kenyans with new tax policies.

Speaking on Wednesday, November 6, 2024, Ruku, a member of the United Democratic Alliance (UDA), stated that CS Mbadi needs to come up with creative ways of expanding the tax base instead of overtaxing those already in the tax bracket.

The vocal legislator made it clear that other UDA members would be ready to support new policies that would help President William Ruto’s administration raise more revenue.

While pushing for the expansion of the tax base, Geoffrey Ruku challenged Mbadi to formulate revenue-raising policies that would not spark another wave of protests in the country.

“ODM through CS Mbadi is in government and has a responsibility to ensure we expand our tax base without Kenyans making noise. How we are going to do that, I don’t know but we are there to support any innovative policy which will expand our tax base so that we do more development projects.

“We use this money without going to corruption and without Kenyans going to the streets. If those ideas come from CS in charge of the Treasury, we will be ready to support them,” Ruku stated.

Virtual Assets Bill

While pledging his support for well-thought tax proposals, Ruku revealed that he is at an advanced stage of introducing the Virtual Assets Bill to the National Assembly.

The Mbeere North MP explained that the Bill would help the government to develop a framework for taxing virtual assets.

Geoffrey Ruku noted that the country is missing millions of revenue which could be collected from the virtual assets sector which he insisted is thriving.

Virtual assets are digital representations of value that can be used for payment, investment, or transferred digitally. They can include cryptocurrencies, non-fungible tokens (NFTs), gaming tokens, and governance tokens.

“There are no number of areas which are not taxed. I have come up with virtual assets Bill so that we can be able to tax money from virtual asset trade.

“I have developed a virtual asset Bill to ensure that space is regulated and that money can be used in development projects,” Ruku stated.

Proposed taxes

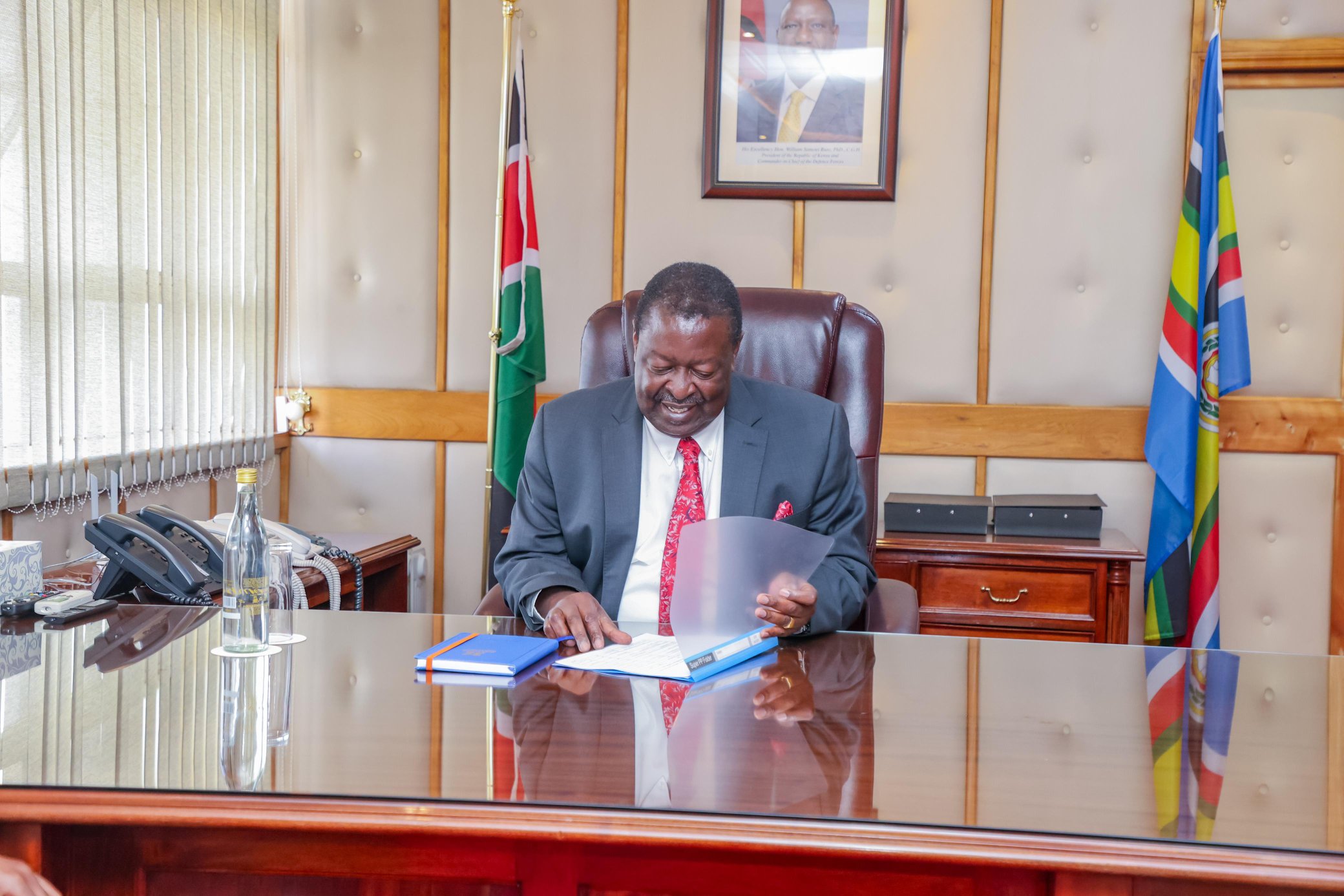

In a statement on Saturday, November 2, 2024, the National Treasury indicated that it had proposed amendments to the Tax Laws (Amendment) Bill 2024, Tax Procedures (Amendment) Bill 2024, and the Public Finance Management (Amendment) Bill 2024.

Treasury detailed that the Business Laws Amendment Bill 2024 aims to create a more enabling and competitive environment to drive private investment.

On the other hand, the exchequer stated that the Tax Laws (Amendment) Bill, 2024, Tax Procedures (Amendment) Bill, 2024, and Public Finance (Amendment) Bills are designed to streamline tax policies and improve public finance management, ensuring fiscal responsibility and transparency.

While defending the proposals, the National Treasury indicated that the said amendments were born out of extensive consultations with various stakeholders and that they are aimed at helping grow the country’s economy.

“These proposed amendments, shaped by extensive consultations with diverse stakeholders, are intended to provide a conducive environment for sustainable growth, innovation, and long-term economic resilience,” the statement read in part.