Kenya Airways (KQ) posted a surprising Sh513 million profit in the first half of the 2024 financial year, marking its first since 2013.

However, this unexpected turnaround has sparked mixed reactions, with some experts and pundits questioning the source of the airline’s newfound profit.

The last time KQ posted a profit was in 2013 when it recorded Sh384 million. In 2018, the airline was declared insolvent due to aggressive expansion plans that resulted in significant debts. This latest profit marks the end of an 11-year loss streak, including a staggering Sh21.7 billion loss in the first half of 2023.

KQ credits the profit to its strategic turnaround plan, Project Kifaru, which focuses on customer obsession, operational excellence, financial discipline, innovation, and sustainability.

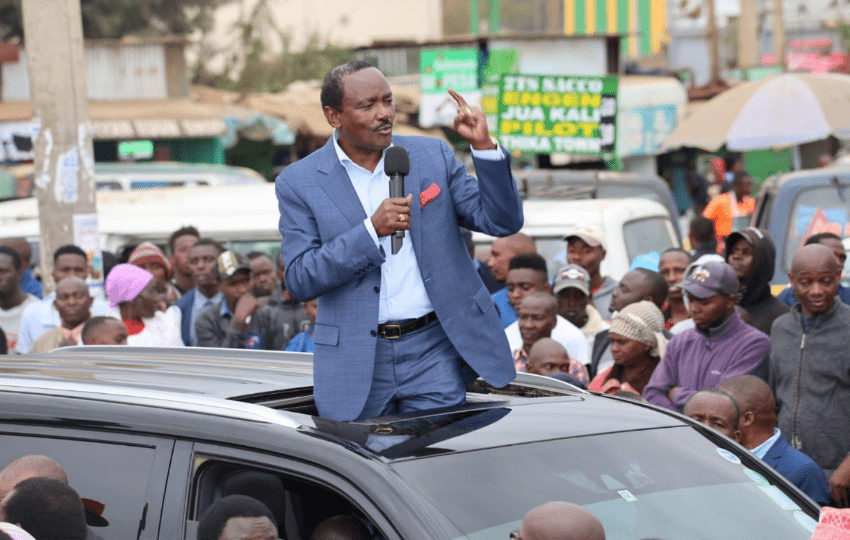

While chief executive Allan Kilavuka is confident that the project will break even before the year ends, he is also concerned about external factors such as oil prices which could easily affect the airline’s performance. “We are a very low-margin business, and any escalation in costs, particularly related to fleet operations, could easily tilt us into a loss position. The difficulty in acquiring larger aircraft to replace the Embraer fleet adds to these cost pressures, making it crucial for us to carefully manage our expenditures,” he said.

Heavy financial burden

Several financial concerns have been raised about the airline’s cash flow in several forums including social media, given that KQ carried a heavy financial burden into 2024, with Sh148 billion in debt as of the end of 2023.

In 2024, KQ’s operational cash flow dropped to Sh11.784 billion from Sh14.45 billion in 2023, with interest received also falling significantly. The airline has yet to provide a detailed explanation for this Sh3 billion drop in cash flow, raising concerns about its ability to sustain its reported profit.

How KQ reconciled its increased total income is also a concern with the decrease in operational cash flow. Normally, higher income should correlate with improved cash flow, but KQ’s case shows the opposite. This discrepancy casts doubt on the sustainability of the airline’s reported profit.

With the airline still having billions in debt, and with borrowing repayments decreasing slightly, experts are speculating whether KQ deferred debt repayments, which could increase future liabilities and lead to more financial difficulties.

There is also concern over the airline’s handling of a Sh600 billion government bailout, which was intended to aid its turnaround. Former Transport CS Davis Chirchir noted that KQ has not yet provided a detailed breakdown of how these funds were utilised.

Further, experts in the sector are questioning whether KQ factored in its outstanding debt to the Kenya Airports Authority (KAA) and unutilised passenger tickets worth Sh4.6 billion.

According to KQ’s Chief Finance Officer, Hellen Mathuka, one of the airline’s strategies to manage its debt involved converting major debts into Kenyan shilling loans to reduce exposure to currency fluctuations. However, with the Kenyan shilling’s volatility against major currencies, analysts are sceptical about the airline’s reliance on foreign exchange gains to boost profits.

Concerns also extend to KQ’s negative shareholder equity, which has dropped to Sh123,587 compared to Sh136,107 last year. Negative equity is typically a warning sign to investors, suggesting that the company might be in financial distress.

The airline’s fleet management strategy has also come under scrutiny. Despite reporting profits, KQ still relies on its ageing Embraer fleet, which may not be sufficient to meet growing passenger demands.

This has raised doubts about the sustainability of the profits, especially as external factors like oil prices could easily impact the airline’s financial performance. Experts argue that KQ should have addressed these challenges before claiming to have a sustainable profit.

These issues, coupled with the airline’s heavy reliance on external factors, paint a picture of a much weaker financial position than the profit figures suggest.

While some financial experts expressed sceptical some industry specialists believe that KQ’s strategies are yielding positive results. Githae Mwaniki, a senior consultant with Aviation Information Consultants, predicts that the airline’s profits could reach Sh1 billion by the end of the year, but emphasizes the need for better debt management strategies.

Strategic plan

He supports the conversion of debts into Kenyan shillings, saying it positions the airline favourably by reducing exposure to currency fluctuations.

Mwaniki also notes that while the airline is on the right track, its strategic plan should not be rushed.

“So, the fact that the debt is the debt that was retired using a shareholder loan which is government of Kenya, that is the only way that could have survived, “ he said, adding that the strategic plan doesn’t need to be rushed as the airline is headed in the right direction.

The mixed reactions to KQ’s profit underscore the challenges the airline faces in maintaining financial stability.

The reported profit is a positive sign, but the airline’s future depends on how it addresses its significant debts and other operational challenges.