Budget bad for Kenyans, firms

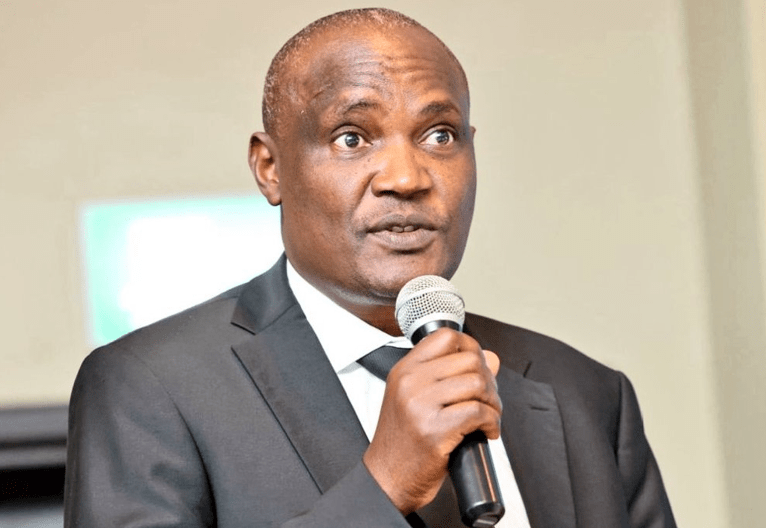

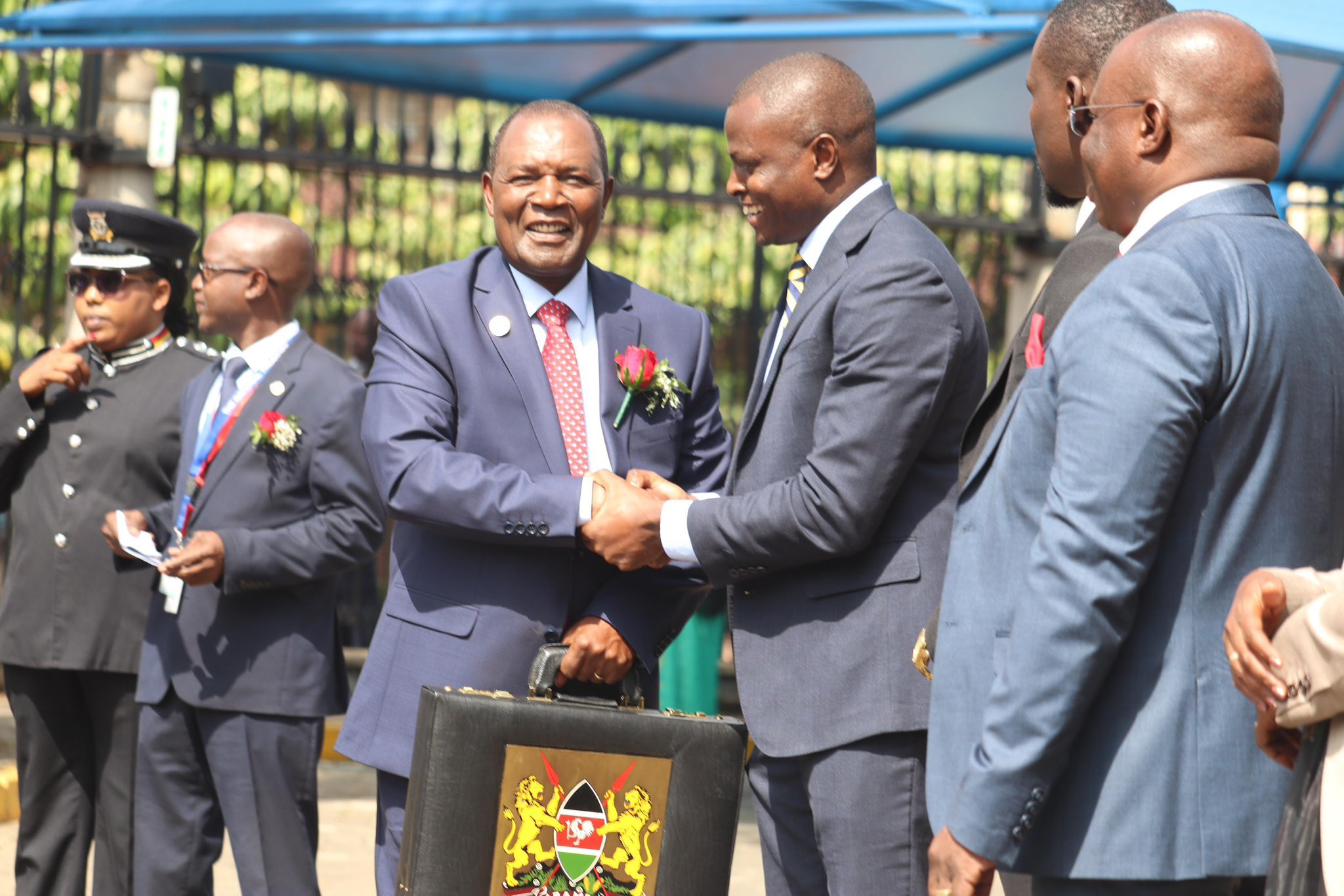

Yesterday’s presentation of the 2024/2025 budget proposals by Treasury Cabinet Secretary Njuguna Ndung’u appeared to be the culmination of President William Ruto’s determined efforts to exterminate the goose that lays the golden egg – that is the private sector.

Just like his first budget last year, which was greeted by protests from citizens, this year’s proposals have stuck to the habit of the Kenya Kwanza administration to raise taxes on employed Kenyans and players in the private sector.

Already, in the nearly two years of this administration, many businesses are either shutting down or relocating to more tax-friendlier countries, layoffs are on the increase and a majority of Kenyans are finding the cost of living more unbearable.

People earning more than Sh500,000 will now have to pay 32.5 percent in taxes, and those making above Sh800,000 will pay 35 percent. Combined with a new housing tax of 1.5 percent and a medical insurance tax of 2.5 percent, the new burden will see some Kenyans part with about 40 percent of their income.

Small businesses are already feeling the pinch, with a tax on their total sales raised from 1 percent to 3 percent last year. A further increase is obviously meant to kill the already struggling small enterprises that have been reporting losses since the Covid-19 pandemic struck.

Though President William Ruto won the 2022 presidential election largely due to his appeal to voters as a fellow “hustler” who rose from a humble background to senior roles in government, his tax policies have cast a contradictory picture of a man that many had seen as a messiah to redeem them from deep abject poverty.

A new Kenya Revenue Authority report indicates that only 6.3 million taxpayers, including corporate entities, filed their 2022 tax returns by June 30 last year.

This implies that in a country of 52 million people, only about 15 per cent contributed to the income tax. As such, the tax burden is not shared fairly as envisaged under Article 201(b)(i) of the Constitution.

The tax proposals are likely to result in a higher cost of living and doing business.

President Ruto needs to prioritise the short and long-term interests of Kenyans and local companies.