Why investors set eye on KPLC’s revamped stock at NSE

Kenya Power and Lighting Company (KPLC) has witnessed a dramatic financial turnaround, reporting a net profit of Sh9.97 billion, a huge jump from the Sh319 million profit the previous year. Pre-tax profit reached Sh14.1 billion, up from Sh538 million.

This positive performance has boosted investor confidence, driving KPLC’s share price from Sh1.38 in December 2023 to Sh7.00 in February 2025, a more than 400 per cent increase.

This surge has greatly benefited investors, including Kiharu MP Ndindi Nyoro, who has a substantial investment at the Nairobi Securities Exchange (NSE) listed utility firm.

Several factors contributed to this resurgence, including improved operational efficiency, debt restructuring, and favourable economic conditions.

Fluctuations in exchange rates previously impacted KPLC significantly, as a large portion of its debt was in foreign currency.

At the end of the 2023 financial year, the dollar’s value of Sh140 inflated the company’s debt.

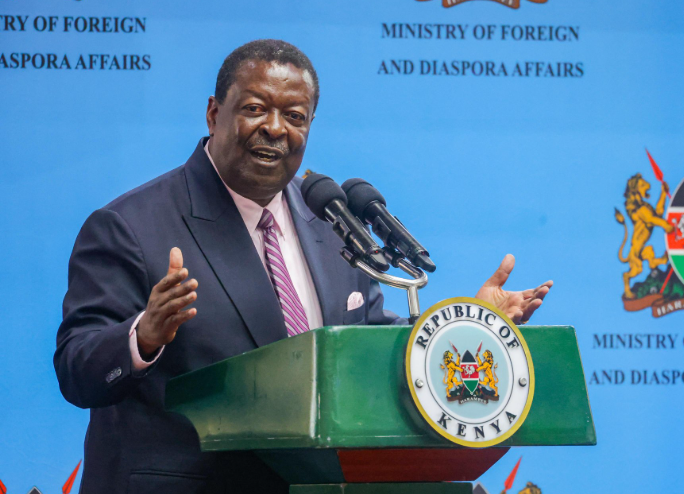

KPLC Managing Director Korir Singoei explained that while they had an operating profit of Sh19 billion, exchange rate losses nearly wiped it out, pushing them towards a negative position.

He noted that the subsequent drop in the dollar to around Sh128 significantly reduced their financial costs.

The stabilization of the Kenyan shilling has been crucial, reducing forex-related expenses by Sh24.84 billion.

Electricity sales also increased by 21 per cent to Sh231 billion, thanks to 447,251 new customers and increased consumption in the industrial and manufacturing sectors.

With a substantial portion of its liabilities denominated in foreign currency, fluctuations in the exchange rate meant that even stable financial performance on an operational level was not enough to shield the company from mounting financial costs.

Strengthening Kenya shilling

The strengthening of the Kenyan shilling against major global currencies has significantly reduced KPLC’s finance costs, trimming forex-related expenses by Sh24.84 billion.

Additionally, electricity sales rose to Sh231 billion, a 21per cent increase from the previous financial year, driven by the addition of 447,251 new customers and heightened consumption within the industrial and manufacturing sectors.

KPLC CEO Joseph Siror emphasized the company’s focus on high-impact projects and operational excellence.

“We would have recorded an operating profit of Sk19 billion, but all of it was wiped out, nearly pushing us to a negative position of Sh4.4 billion.

This was mainly due to the IFRS rules, which I know the CFO can elaborate on. These rules require valuing loans based on the exchange rate,” noted Korir Singoei, the Managing Director of KPLC.

“At the time we closed in June 2023, the dollar was about Sh140. This meant that a 1 billion dollar obligation appeared as Sh140 billion. However, in the following year, the dollar dropped to about 128 shillings. The same 1 billion dollar obligation then appeared as 128 billion shillings, reducing our financial costs significantly.”

For the first time in over seven years, KPLC also declared a dividend of Sh0.70 per share, demonstrating confidence in its future.

Siror added that they aim to maintain stable margins through cost management.