State eyes margin trading, takeovers to boost bourse

The government is targeting to increase trading volumes on the Nairobi Securities Exchange (NSE) by allowing margin trading and takeovers, among other licences.

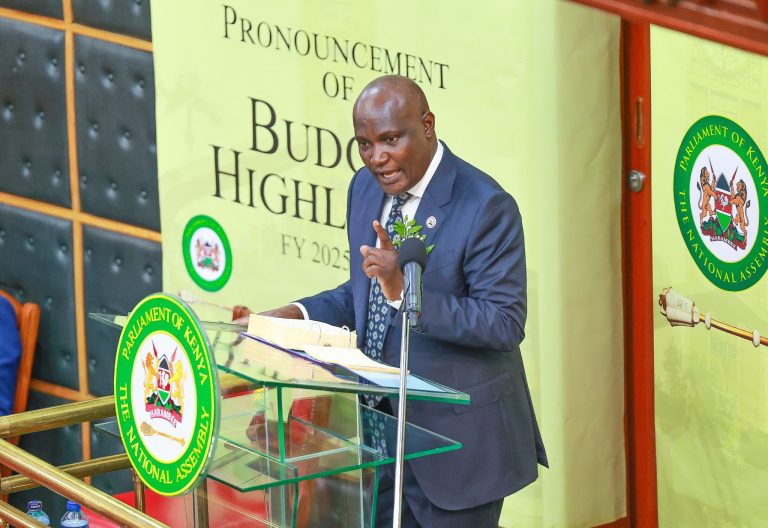

In his 2025/26 Budget Statement, National Treasury Cabinet Secretary John Mbadi announced sweeping reforms aimed at revitalising the stock exchange and making it more attractive to both local and international investors.

“The government is in the process of reviewing the regulatory frameworks for licensing, margin trading, conduct of business for market intermediaries and mergers, acquisitions, and takeovers,” he said.

Capital markets

Mbadi added: “Once in place, these regulations will reinvigorate capital markets activity and make our capital markets more facilitative and efficient.”

The NSE has suffered a prolonged decline in investor activity over the past decade.

Trading volumes and the number of new listings have steadily dwindled, with the exchange losing a significant share of foreign investor participation.

According to data from the Capital Markets Authority (CMA), foreign investor participation fell from over 50 per cent in 2015 to below 30 per cent by 2024, largely due to regulatory uncertainty, currency risk, and a lack of fresh market opportunities.

To counter this, the government is banking on regulatory reforms that will unlock new trading mechanisms and restore investor confidence.

One of the key reforms is the introduction of margin trading, a practice that allows investors to borrow money from their brokers to buy more shares than they can afford with their own capital.

By leveraging their positions, investors can potentially earn higher returns if share prices rise. However, the practice also comes with increased risk, as losses can also be magnified.

Trading volumes

If implemented prudently with the right safeguards, margin trading can lead to: Higher trading volumes, as investors are able to take larger positions, and greater liquidity, allowing for faster and more efficient price discovery and attracting sophisticated investors, including hedge funds and proprietary traders who often rely on leverage.

However, this requires robust risk management frameworks to prevent systemic shocks, particularly during periods of market volatility.

Another area of reform is the regulation of mergers, acquisitions, and takeovers. These corporate actions are essential in keeping the stock market dynamic.

A takeover occurs when one company acquires a controlling stake in another, often with the intention of consolidating resources or entering new markets.

The lack of a clear and modern regulatory framework for such transactions has made it difficult for companies in Kenya to pursue strategic mergers or acquisitions.

Investors are often kept in the dark due to inadequate disclosure rules, while companies face cumbersome approval processes.

With better-defined rules, Kenya could experience: Increased corporate restructuring and consolidation, which is essential in a maturing economy, new listings and revaluations, as companies merge and grow in scale and more investor confidence, due to transparency and protection of minority shareholders.

Market intermediaries

The reforms also touch on licensing and business conduct standards for market intermediaries such as brokers, investment banks, fund managers, and financial advisors.

The intent is to make the entry and operation of these players more efficient and competitive.

Currently, some stakeholders argue that high compliance costs and overlapping regulations have discouraged innovation in the capital markets.

Streamlined licensing and conduct rules could encourage the creation of new financial products, technology-based trading platforms, and alternative asset classes.

Mbadi’s statement marks a turning point for the NSE, which has faced declining investor confidence, limited listings, and falling returns. The success of these reforms will depend on how fast and effectively they are implemented.

“We must ensure that policy rates and regulatory measures translate quickly into market outcomes,” Mbadi emphasised.

If the proposed frameworks are enacted and enforced with consistency, the NSE could once again become a vibrant marketplace, not only for Kenyan investors but for the entire East African region.