Capital markets defy effects of Corona to register growth

Steve Umidha @UmidhaSteve

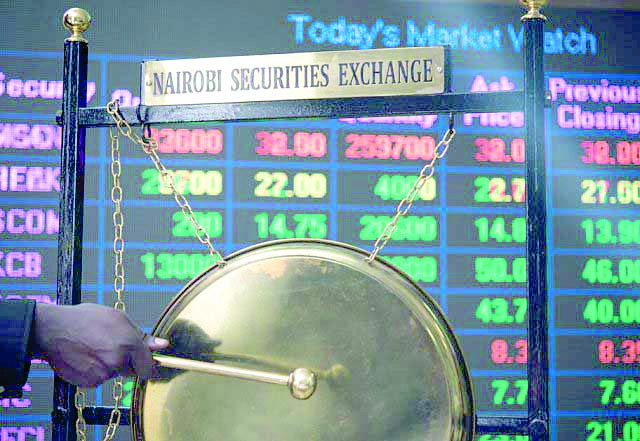

Kenya’s capital markets registered an impressive performance recording a 392.16 per cent jump in deals during the financial year ended June 30, despite the debilitating effects of the Coronavirus.

Capital Markets Authority (CMA) said the market recorded increased activities with 1,506 deals being concluded in the period under review compared to 306 deals in the previous quarter.

The latest industry figures show that equity turnover, for instance, rose by 19.69 per cent to register Sh37.99 billion, while market capitalisation grew by10.88 per cent to register Sh2.7 trillion.

During the quarter under review, an estimated 1.1 billion shares traded up from 997.75 traded in the previous quarter, a 4.39 per cent increase, while Nairobi Securities Exchange (NSE) 20 Share Index closed the quarter at 1,927.53 points, a 9.40 per cent increase. NSE All Share Index registered 173.53 points while 36.04 per cent increase was realised in bond turnover to Sh 271.23 billion.

Similarly, the industry regulator fingered recent policy changes such as the amendment of the Central Depository Act to allow for opening of omnibus investment accounts by persons investing on behalf of others in the securities as well as the amendment of the Capital Markets Act which improved sector operations.

The latter for example, CMA noted, is further expected to see the Capital Markets Tribunal hear and determine any appeal within 90 days while the amendment of the VAT Act is also hoped to exempt the transfer of assets into REITs and Asset Backed Securities from taxation.

“These incentives will come in handy in facilitating the Authority in the achievement of its twin mandate of regulating and developing the Kenyan Capital Markets Industry,” noted the in its quarterly statistical report released last week.

In recent months, a certain calm has returned to financial markets, presumably driven by optimism around an economic recovery – as lockdowns and movement restrictions ended across major parts of the country.

Economic projections

While there have been improvements in the sector amid the pandemic, many experts such as the Stanbic Bank Kenya Purchasing Managers Index (PMI) are surprised by these improvements in market sentiment, considering economic projections and expectations which continue to be dismal despite substantial efforts by the government to support its citizens.

“The pace of the recovery slowed in June following the strong improvement witnessed in May when some of the stringent public health restrictions were lifted,” said Kuria Kamau, Fixed Income and Currency Strategist at Stanbic Bank while commenting on the PMI Survey which posted 51 points last month compared to 52.5 registered in May.

While fiscal, monetary, and regulatory policy-makers have moved quickly since March to preserve financial-market functioning and support households and businesses, CMA warns that greater policy action and partnerships will be needed to ensure that financial risks do not lead to greater economic dislocation.

According to Wyckliffe Shamiah, CMA’s Chief executive the capital markets regulator remain grateful to all stakeholders who in the past year have shown resilience despite the challenging operating environment.

“I would also urge all market players to continue embracing a collaborative approach towards making the Kenyan capital markets an investment destination of choice,” he said.