Capital markets hit hard by Corona, study shows

Lewis Njoka @LewisNjoka

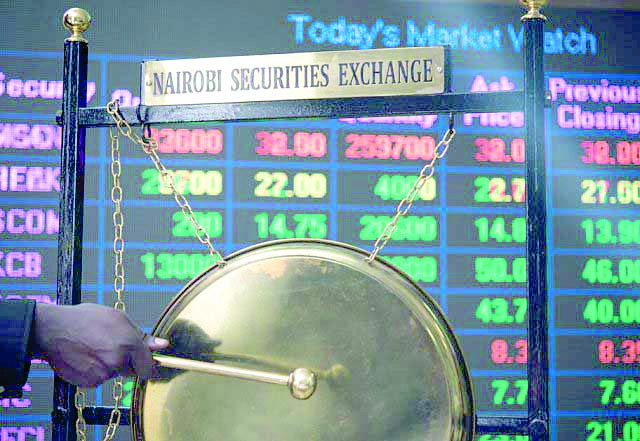

Coronavirus (Covid-19) shocks worsened already vulnerable capital markets as equities and corporate bonds posted reduced performance in 2020, a new report shows.

The Financial Stability Report 2020 says the pandemic worsened the performance of Kenya’s fragile equities market by striking at a time when liquidity ratios had declined to 6.1 per cent in 2019 down from 8.4 per cent in 2018.

“The capital markets industry remains vulnerable as indicated by the leading equities market indicators that were already declining in 2019, but have worsened in the first half of 2020 due to the Covid-19 pandemic,” reads a joint report released by local fnancial sector regulators.

The report attributes the vulnerability of the equities market to tough business conditions facing listed companies and businesses in general.

Equities market

Additionally, rate capping which was repealed in November 2019, affected the performance of banks, a major segment of the equities market.

The equities market was severely affected by reduced participation by foreign investors at the Nairobi Securities Exchange.

Average foreign investor participation to total equity turnover declined to 60.6 per cent by end July 2020 down from 73.7 per cent in December 2018.

“Most of the foreign investors sold more shares than they purchased, resulting to net outflow from the local bourse,” says the report.

Worse still, some loss-making companies were de-listed and others placed under receivership contributing further to the poor performance of the equities market.

In addition, the Covid-19 pandemic further weakened the firms, leading to overall net outflows by foreign investors to cut losses.

According to the report, the top five companies by market capitalisation accounted for over 90 per cent of the equity turnover during the period, meaning risk was concentrated in a few entities and that other companies shares are highly illiquid.

As at December 2019, the five companies accounted for 70.9 percent of trade compared to 65.8 percent in 2018.

Foreign investors accounted for 68.6 per cent of total equity turnover in 2019 compared to 63.3 percent in 2018.

Luckily, the establishment of the derivative market at the NSE has reduced volatility in equity prices, with volatility of the Nairobi All Share Index (NASI) averaging 0.48 in 2019 compared to 0.55 in 2018.

Other risks facing the equities segment include low product uptake, political and economic risks.

On the brighter side, the exit of foreigners provided opportunity for local investors to buy undervalued blue-chip stocks, according to the report.

Like equities, the corporate bonds segment of the capital market has performed poorly with the October 2019 Acorn green bond being the only issuance since 2015.

The value of outstanding bonds on the secondary market declined from Sh86.8 billion for 17 issues in 2016 to Sh23.2 billion for 6 issues in June 2020.

Balance sheets

“Governance issues that led to the collapse of Chase Bank and Imperial Bank as well as weak balance sheets, have made it unattractive to issue or invest in corporate bonds,” says the report.

Despite the tough times facing the capital market in the country, the industry licensees’ assets increased to Sh28 billion in 2019 from Sh23.70 billion in 2018.