Adani Energies bids Ksh130b for key energy transmission projects

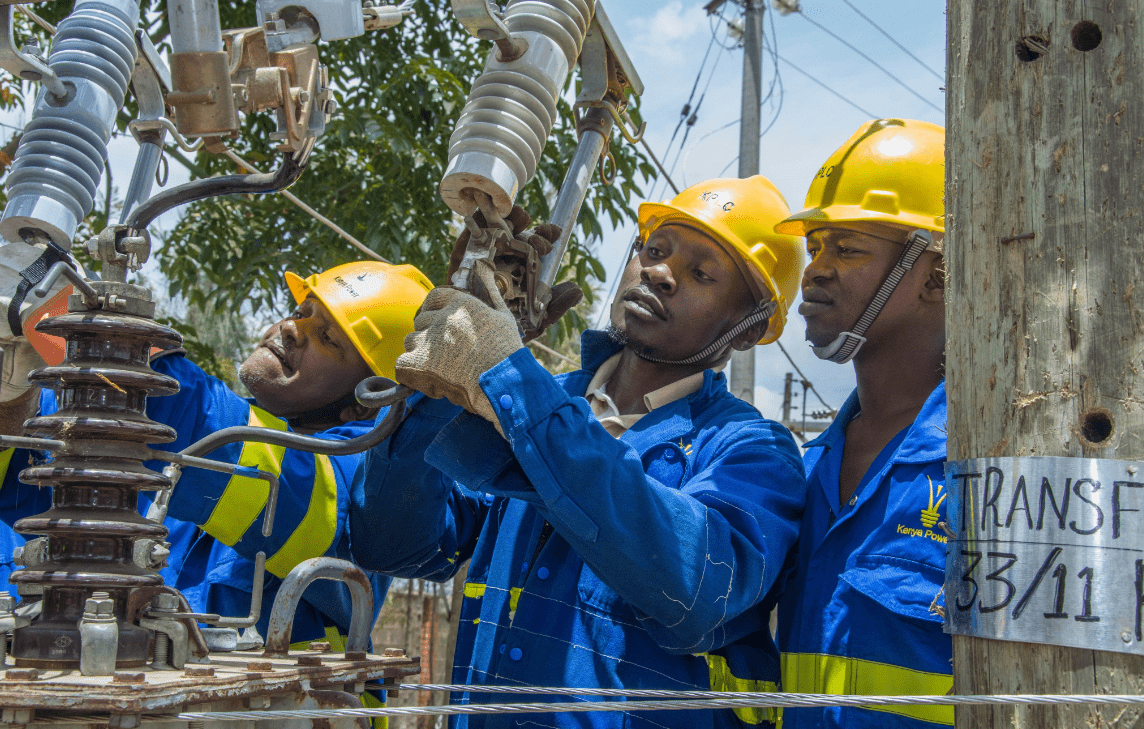

Adani Energy Solutions Limited, a subsidiary of the Adani Group, has submitted a Private Initiative Proposal (PIP) valued at about Sh130 billion to enhance Kenya’s power transmission infrastructure and reduce the frequent blackouts that have been witnessed lately.

This ambitious proposal aims to construct three key energy projects, a 206 km 400kV Gilgil-Thika-Malaa transmission line, a 400kV/220/132kV substation at Rongai, and a 95kV Tongai-Keringet-Chemosit line.

John Mativo, Managing Director of the Kenya Electricity Transmission Company Limited (Ketraco), confirmed that the proposal is currently in the draft project agreement phase. “This includes among other things approval of the projects and risk assessment report prepared by the negotiating team,” he said.

Mativo said that Ketraco has also completed four stages of due diligence for another consortium involving Africa50 and PowerGrid from India for constructing two transmission lines between Samburu and Western Kenya.

Despite the potential benefits of these projects, Adani’s involvement comes amid controversy surrounding a separate $1.85 billion (Sh238 billion) deal to operate Jomo Kenyatta International Airport (JKIA) for the next 30 years.

The deal has faced public backlash, particularly after President William Ruto initially claimed ignorance about it.

The Kenya Airports Authority (KAA) later confirmed the agreement through local newspaper advertisements, raising concerns about transparency and governance.

Mativo noted that Ketraco has successfully renegotiated the contract sum from $1.014 million (Sh130 billion) to $736 million (Sh95 billion) and aims to reduce it further to below $600 million (Sh77 billion), with an ultimate goal of reaching $320 million (Sh41 billion). If Adani Energies bags the contract, the firm will manage the facilities for the next three decades.

Mativo said Adani Energies is charging 11.5 per cent interest as the cost of the debt, but Ketraco is working to lower it to single digits. They are also aiming for a return on equity of 14 per cent.

Successfully lowering these rates would decrease the overall financial burden on KETRACO, making the project more cost-effective and sustainable in the long run. “The law gives us six months, so we have until December to finish the negotiations,” he said.