Treasury unveils country’s most ambitious Sh4tr budget estimates

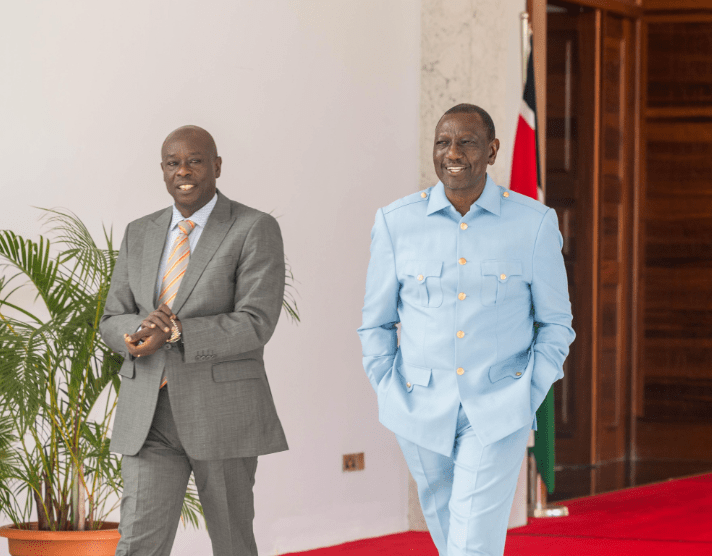

President William Ruto’s administration yesterday unveiled its ambitious Sh3.99 trillion for the 2024/25 budget up from Sh3.75 trillion, which was later adjusted to Sh3.75 trillion.

To finance the budget, the Kenya Kwanza government intends to raise Sh3.34 trillion through the Finance Bill with a fiscal deficit of Sh597 billion.

This will see the nation tap the international debt market for net foreign financing of Sh333.8 billion coupled with a net domestic financing of Sh263.2 billion.

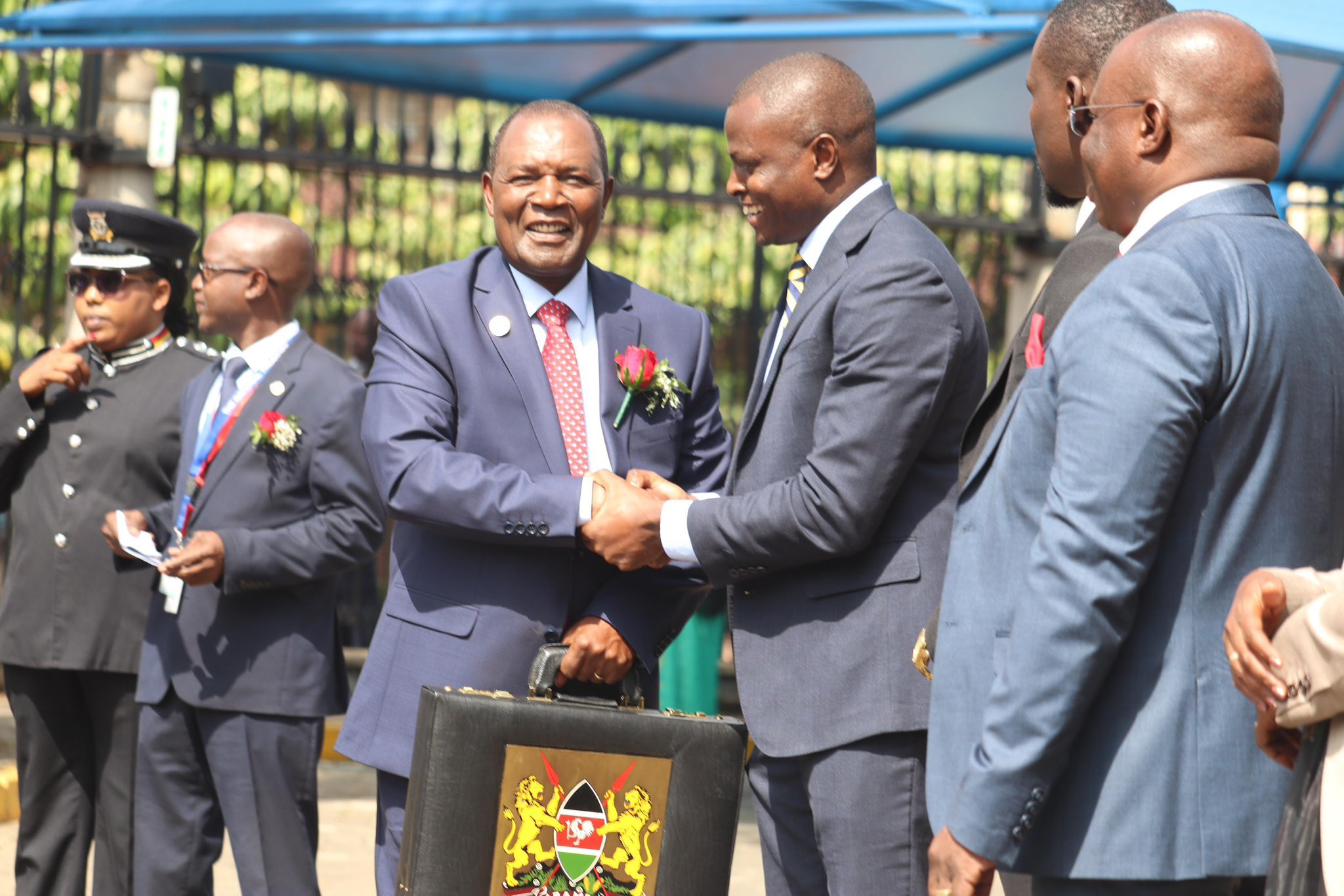

While presenting the budget before MPs yesterday Treasury Cabinet Secretary Njuguna Ndung’u said this year’s budget was developed against a backdrop of improved global economic outlook.

“The tax measures proposed in the Finance Bill, 2024 and the said custom measures are expected to generate an additional Sh346.7 billion or 1.9 per cent of GDP to the exchequer for the FY 2024/25 budget,” Ndung’u said.

To finance the budget, Ndung’u said they have come up with new tax policy measures aimed at raising funds from areas that have not been targeted.

Among the areas that they propose to amend to raise money to finance the budget include the Income Tax Act, followed by Value Added Tax; Excise Duty Act; Tax Procedures Act; and Miscellaneous Fees and Levies Act.

His sentiments come at a time when the Departmental committee on Finance and National Planning chaired by Molo MP Kimani Kuria has retreated to write its report on the bill after meeting with various stakeholders.

About 108 of 120 stakeholders in the Manufacturing, telecommunication, edible oil, banking and digital sector have already opposed a number of proposals contained in the finance bill on grounds that it would not lead to job leases but is also bad for Kenyans.

Parliament is required by law to pass the Finance Bill and have it signed into law by the President by June 30th every year, paving the way for enforcement of all revenue -raising measures including new taxes from July 1 when the financial year starts.

For them to be able to raise the said monies from taxation, he will enlarge the tax base, minimize the tax expenditures that amount to Sh396.9 billion or as of 2022 out of which 63.1 per cent is on VAT refunds on zero rated final consumer goods, create a tax system that is not only predictable to taxpayers but also yields predictable revenues to Government as well as develop a tax system that support markets, production, consumption and investments.

He said: “The FY 2024/25 marks the beginning of these reforms through the proposed amendments in the various tax laws contained in the Finance Bill, 2024. Mr. Speaker, these reforms are part of the wider tax policy reforms contained in the Medium-Term Revenue Strategy and I will shortly be providing highlights of these reforms.”

With regards to the income tax act, he said that they are proposing to amend the said tax to exempt all retirement benefits paid from a registered pension fund, registered provident fund, registered individual retirement fund of National Social Security Fund and the Public Pension Scheme, upon attainment of the retirement age.

For the individuals that take early retirement, he said the exemption will only apply if the individual has contributed to the pension schemes for a period of twenty years from the date of registration as a member. He said: “the annual limit of pension contribution that is exempt from tax is 30 percent of the individual income or Sh240,000 whichever is lower.