Tax plans are unpopular but is Ruto listening?

As budget week unfolds in East Africa, it’s a pivotal time for the region, economically and possibly politically. Finance officials gather in their respective parliaments to present their estimates for the coming fiscal year.

This annual ritual holds significant weight, as it’s the assembly members’ duty to scrutinise the instrument that grants the government the power to spend. This year, the budget process in Kenya has sparked more than passing interest.

The proposed taxes have caught the public’s attention and stirred curiosity. In the past, the budget statement was merely acknowledged as presented in Parliament, with the expectation of the usual increases.

The products that some referred to as sin commodities and attracted taxes year on year without people raising eyebrows have traditionally been spirits and cigarettes. It is easy to understand why. But this year, life will become expensive because of the range of taxes proposed.

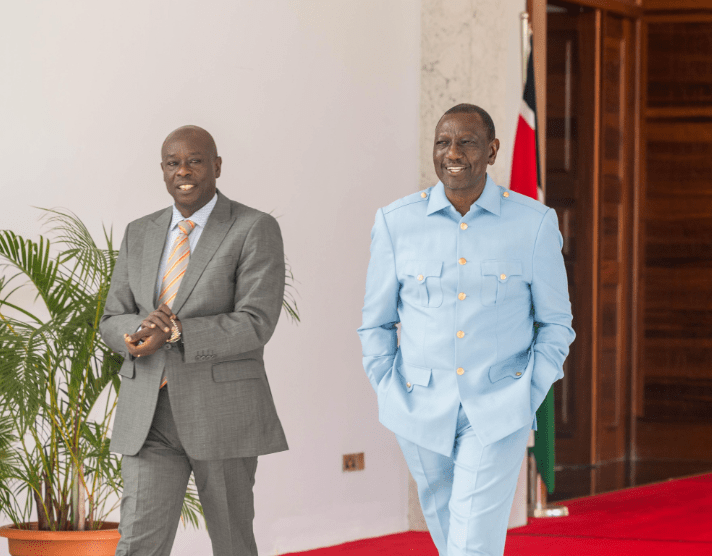

President William Ruto has built a reputation as a leader who adjusts his position on issues as he deals with new situations. For example, just a while back, he seemed to give the green light for changing the city’s skyline, with the potential for high-rise accommodation facilities coming up even within the precincts of the airbase in Eastlands. But last week, he reversed his position.

When he campaigned for President, he championed lower taxes. He castigated the then government, in which he was serving as second-in-command, for increasing taxes.

As a leader who adapts to new situations, Ruto has proposed a significant change in the tax landscape. In an interview, he suggested a gradual increase in taxes from the current 14 percent rate to 22-24 percent in the coming years. If he gets his way, Kenyans could pay taxes on every product they use.

The President compared Kenya’s tax situation with that of other countries and concluded that Kenya could do better. However, the counter-argument is that governments in those countries deliver services. These may include collecting garbage and providing security and health services. In Kenya, such services are essentially privatised. Citizens organise how their garbage is collected, provide their own water through mobile vehicles, and hire private guards to watch their property.

Kenya is a sad case of an uneven distribution of wealth. The rich keep getting richer, while the poor heavily weigh the scales at the end of the poverty line. The situation has been getting worse, and it could deteriorate further.

On top of this, the menace of corruption is unabated. It is no wonder that today, in Nairobi, though the roads are tarmacked, they are poorly done and unmotorable. Except for the Chinese-built Expressway, most roads are poor, bumpy work, if not completely dotted with potholes.

It begs the Opposition’s indulgence. Any smart Opposition figure can make hay of the mess. Whether the stunts managed by the Deputy President will rise to that level depends on his mission and communication strategy. Give him credit, though.

He did well in getting the public talking by simply dragging a suitcase to a Kenya Airways plane after the President considered the airline, the continent’s pride, too expensive.

For Kenya’s stability, the executive and the legislative arms of government need to listen to the public more. If they did, they would appreciate that these tax measures are unpopular; given a different time and role, the President would oppose them.

He would argue for prudent use of the taxes already collected and provide services to the people. It would be the right message, the popular message, and the right thing to do for Kenyans. Now that he is in charge, it would be the right thing for him to do.

— The writer is the Dean of Daystar University’s School of Communication