Stakeholders call on State to drop plans to hike rates and attract investors

The Government has been urged to consider dropping its plan to hike land rates to woo more investors in the country.

Investors and stakeholders in the land sector maintain that hiking land rates would lock out many Kenyans from owning properties.

The Ministry of Lands, Housing and Urban Development has been scheming to increase service fees levied on lands as it seeks to cast its revenue net wider.

Among the fees that the government has been eying to hike include land registration fees, the cost of official land search, and fees on registration of documents including deeds of indemnity, agreements, contracts and trust deeds.

The government is set to collect billions of shillings from the essential services thereby adding more tax burdens to Kenyans.

Players in the real estate sector however say that this move will not only impoverish Kenyans seeking to buy land and homes but will scare potential investors who are key in turning around the country’s economy.

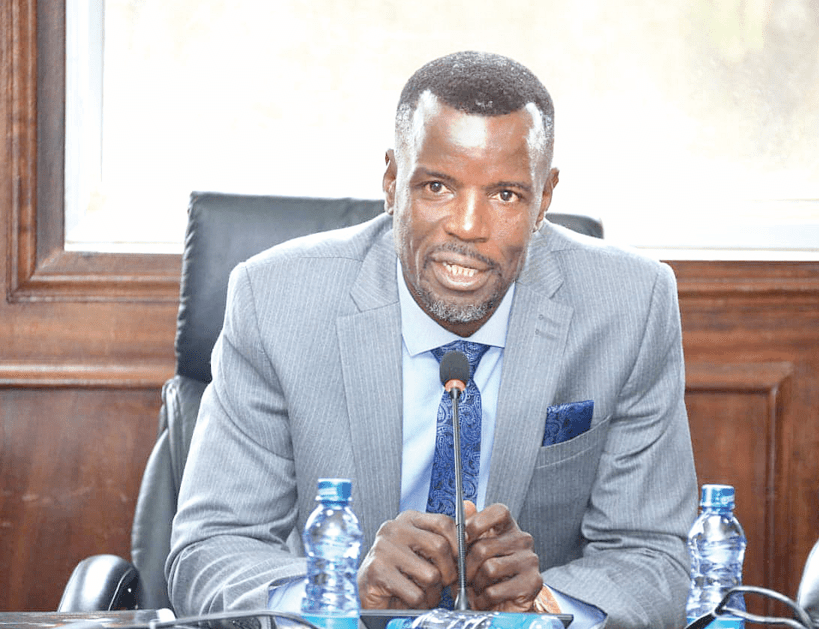

Led by Dhahabu Lands Limited managing director Peter Kamau, the sector stakeholders urged the government to be considerate of the current economic situation in the country before it revises the land taxes upwards.

Speaking while issuing over 700 title deeds to the firm’s investors in Ruiru, Kamau said that while taxes are imperative for the country’s economic growth, the government should go consider gradual increment of the land fees so as to allow Kenyans who are grappling with the high cost of living access the crucial services.

He however hailed the President William Ruto-administration for shelving plans to increase rates and introduce more punitive laws singling out the withdrawal of the Land Amendment Act 2023 that had been sponsored by Kikuyu MP and the National Assembly Majority Leader Kimani Ichung’wa.

Meanwhile, Kamau called on Kenyans planning to invest in land or homes to do proper due diligence before investing their hard-earned money to avoid falling prey to criminals purporting to sell land.

He noted with concern that Kenyans have lost billions of shillings to unscrupulous individuals and land-buying firms in fake land deals.

“Please don’t be in a hurry but take your time to conduct searches, companies’ profiles and track records before investing your resources,” he advised.

“We are also urging Kenyans to take advantage of the current economic hardships to buy land as this is the most opportune time to invest in land since most individuals or firms are disposing of their properties,” he added.

Investors led by Naomi Ngoiri and Elizabeth Murugi echoed Kamau’s.