Public debt nears Sh6tn as borrowing continues

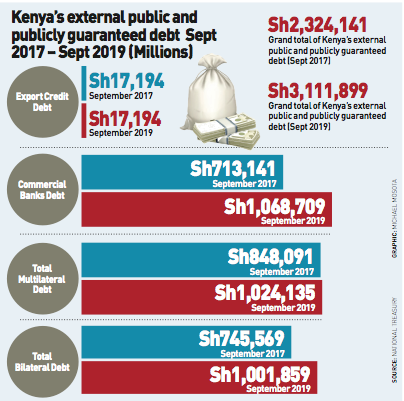

Kenya’s public debt stood at Sh5.97 trillion in September, pushed mainly by a 12.4 per cent rise in domestic debt as government’s borrowing continues to be a matter of concern.

The domestic debt grew to Sh2.86 trillion from Sh2.54 trillion in a similar period in 2018, a quarterly economic and budgetary review for 2019/20 indicates.

According to the review, Kenya Revenue Authority (KRA) fell short of realising its target by Sh73.9 billion mainly due to shortfall in all major tax heads and Appropriation-in-Aid (A-i-A) – the money generated by governmental departments from internal activities.

By the end of September, the total revenue collected including A-i-A amounted to Sh421 billion against the target of Sh495 billion while ordinary revenue collection was Sh384.4 billion against a target of Sh444.5 billion, which was Sh60.2 billion below the target.

Increment in deficit

Analysis of the quarterly economic budgetary review indicates that there was an increment in deficit occasioned mainly by a decline in the financial accounts that more than offset the improvement realised in the current account.

Nearly all metrics slid beginning with the balance of payments recording a deficit of $1,254.6 million (Sh127.2 billion) in September compared to $771 million (Sh78.19 billion) in the previous period.

However, the country received $7252.5 million (Sh735.1 billion) in total which were mainly accrued from investment, direct investment and portfolio investment which stood at $1517.5 million (Sh15.4 billion) and $1159.7 million (Sh117.55 billion ) respectively.

The total expenditure and net lending for the period under the review amounted to Sh544.6 billion against a target of Sh565 billion. “The shortfall of Sh21 billion is attributed mainly to lower absorption recorded in the development expenditures by the national government,” the review indicates.

In terms of sectors, services remained the main source of growth though it expanded at a slower rate of 6.6 per cent in the second quarter of 2019 as compared to a growth of 6.8 per cent in 2018.

Key sectors, which registered improvement, were information and communication (11.6 per cent) accommodation and restaurants (10.6 per cent) and transport storage (7.2 per cent). Financial and insurance sectors also grew by 6.7 per cent while wholesale and retail trade went up 5.8 per cent.

Second quarter

The performance of the industry slowed down to a growth of 5.3 per cent in the second quarter of 2019 compared to 5.5 per cent in 2018.

National Treasury and Planning Acting Cabinet Secretary, Ukur Yatani, said the decline noted in the review process happened at a time when the global economy is weakening amid rising trade tensions, tighter global financial conditions and higher policy uncertainty across many economies.

He said the economic growth momentum observed in 2018 continued in the first half of 2019, by an average of 5.6 per cent and indicators in the third quarter of this year point to continued economic recovery to 5.9 per cent in the financial year 2019/20. The CS said the fiscal performance of the financial year 2018/19 budget was below target on account of revenue shortfalls and rising expenditure pressures.

However, in order to contain the resultant fiscal gap and public debt, National Treasury has initiated several revenue and expenditure measures in line with our fiscal consolidation plan.

The government has launched budget cuts on non-core expenditures including foreign and domestic travel, hospitality, training, communication supplies, printing and advertising, purchase of furniture, office and general supplies and use of government vehicles.