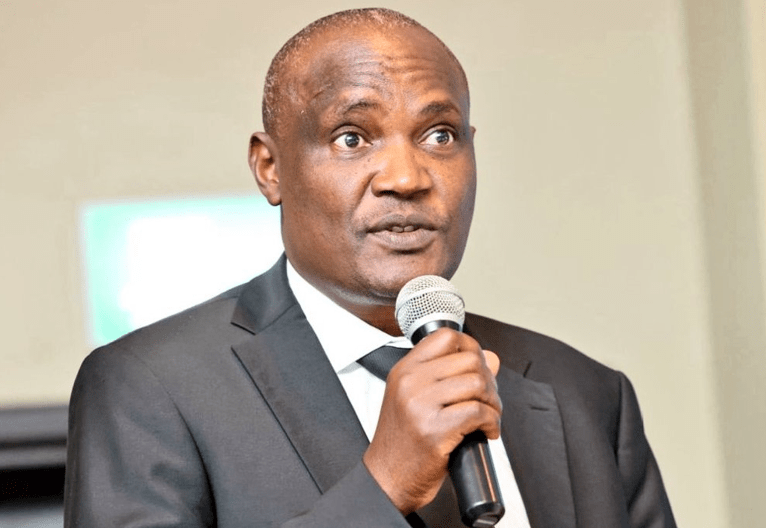

Mbadi warns Gen Zs against rushing to say Finance Bill 2025 has tax hikes

Treasury Cabinet Secretary John Mbadi has come out strongly to clarify misconceptions surrounding the Finance Bill 2025, urging Kenyans, particularly the youth, not to rush to conclusions that the bill introduces significant tax hikes.

Speaking during a town hall meeting on Friday, May 16, 2025, Mbadi emphasised that the Finance Bill 2025 contains no major tax adjustment rates. He further elaborated that the bill is not aimed at raising additional revenue through taxation.

“This Finance Bill has no major adjustments in tax rates; we are not really using this Finance Bill to raise more revenue in terms of additional tax systems or tax rates. So that is the bottom line,” Mbadi firmly stated.

He urged citizens to take the time to understand the contents of the bill thoroughly before reacting or comparing it to the controversies that surrounded the Finance Bill 2024.

On that note, he reflected on the uproar that followed the announcement of last year’s Finance Bill and urged the youth not to respond so harshly to this year’s bill as they did previously.

“So before muanguke na hii ya 2025 vile mlianguka na ile ya 2024, I want you to take time and understand what is in it,” Mbadi explained, stressing the importance of informed discussions rather than immediate backlash.

Mbadi went on to detail that the purpose of the Finance Bill 2025 is primarily to enhance efficiency within the tax system rather than to expand the tax burden on individuals and businesses.

He insisted that this is precisely what the government is now focused on, being far more considerate of taxes that may feel excessively burdensome to citizens, striving instead to create a fairer and more balanced tax system that supports both revenue collection and public welfare.

“What we have done with this Finance Bill is simply to make the tax system more efficient and to streamline it,” he added.

Mbadi also added that a key focus of the bill is on tax administration, addressing long-standing ambiguities and contradictions in the existing tax laws.

He highlighted that these challenges have hindered effective tax collection and compliance, making reform necessary.

“Tax administration, that is what it is dealing with. There have been a lot of ambiguities and contradictions in our tax laws,” he noted.

Public debt

At the same time, Mbadi also warned that Kenya faces a significant fiscal challenge as a substantial portion of its public debt is set to mature by 2032, potentially placing the economy under severe strain.

He provided a detailed assessment of the country’s debt trajectory and fiscal outlook and observed that the coming decade will mark a critical period when Kenya must meet sizeable debt repayments.

“From now until 2032, we are approaching a juncture where many of our debts are maturing and will require settlement. This situation is concerning; however, it does not unduly alarm me as the government has formulated a clear strategy to manage this responsibly,” Mbadi stated.

However, he pointed out that he is not overly concerned that the country might soon face pressure or teeter on the edge of serious consequences for failing to meet its debt obligations because the government has put in place robust strategies they trust will ensure debt sustainability.

A core pillar of this strategy, he said, involves systematically reducing the national budget deficit, a fundamental step towards securing debt sustainability.

Mbadi noted the progress achieved since 2020, highlighting that the budget deficit has declined from 8.3 per cent of GDP to an estimated 5.2 per cent, despite acknowledging that further improvements were possible had all proposed revenue measures been fully realised.

“One key approach is reducing our budget deficits, which is one of the most effective ways to maintain debt sustainability. We began this process back in the 2020-2021 financial year when our budget deficit was 8.3 per cent of GDP. The following year, it decreased, and now it stands at around 5.2 per cent, although I recognise that we could have done better if all tax revenue measures had been fully implemented,” Mbadi stated.