KRA misses tax target by Sh212b as pandemic bites

Lewis Njoka @LewisNjoka

Slow economic growth saw the Treasury miss revenue targets by Sh212 billion in the nine months between July 2019 to March this year.

According to a supplementary budget tabled in Parliament on Wednesday, the government collected Sh1.3 trillion against a target of Sh1.5 trillion.

The exchequer attributed the shortfall to underperformance of projected revenues as well as an economic slowdown brought about by the Covid-19 pandemic.

Government agencies and devolved units failed to meet projected expenditure for the nine month period leaving Sh216.1 billion underutilised, having spent Sh1.8 trillion out of the Sh2.01 trillion projected to have been spent for the period.

Consolidated funds

“The total cumulative expenditure and net lending, inclusive of transfer to county governments, for the period ending March 29 amounted to Sh1.8 trillion against a target of Sh2 trillion,” reads the budget statement in part adding, “the shortfall of Sh216.1 billion was attributed to under-absorption in both recurrent and development expenditures by the national and county governments.”

Churchill Ogutu, an analyst at Genghis Capital, says the government seeks to reduce spending and increase the consolidated fund amounts.

“In its 2019/20 Financial Year Supplementary Budget II Estimates, Treasury seeks to further reduce spending to the national government by Sh73.4 billion.

On the other hand, Consolidated Fund Service is expected to increase by Sh64.7 billion.

By adjusting the Supplementary Budget II Estimates, the overall budget will reduce by Sh9.7 billion from Sh3.13 trillion (post- Supplementary Budget I) to Sh3.12 trillion.

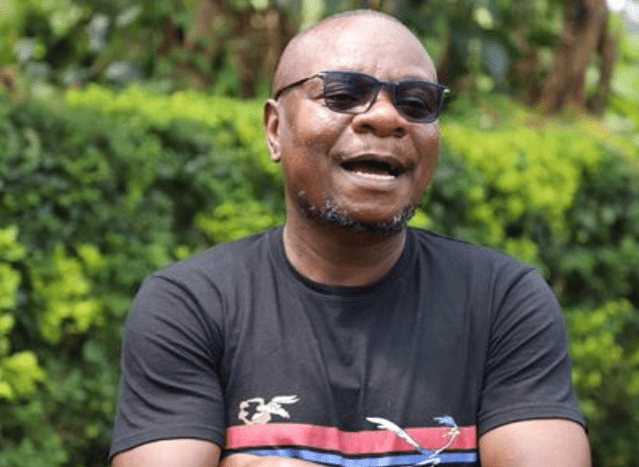

According to former Central Bank of Kenya governor Njuguna Ndung’u, there are several challenges which weakened the economy even before the Covid-19 pandemic struck.

Constrained liquidity

“Recession which set in 2016, was triggered by national and county governments failure to pay suppliers and contractors.

This had three effects; constrained liquidity in the economy, collapse of the retail trade and the collapse of the SME sub-sector,” said Njuguna in a recent interview.

“At times we need to take cognisance of the initial conditions. The pandemic found Kenya already speeding downhill from factors that should have been contained. In that case, the pandemic acelerates the declining economic performance downwards,” he added.

The International Monetary Fund (IMF) this week revised Kenya’s economic growth prospects to one per cent down from six per cent due to the Covid-19 pandemic.

A recent report by McKinsey shows that country’s economy will dip by between Sh317 billion and Sh1 trillion this year due to the pandemic.

This is corroborated by another report by NCBA Bank, which projects that the country’s economic growth will reduce to 2.3 per cent in 2020, should the Covid-19 pandemic persist through the second quarter of this year.

Asset management firm, Cytonn, says it expects the country’s GDP growth to range from 4.3 per cent to 5.2 per cent in 2020 depending on the severity of the Cocid-19 outbreak.

Kenya Revenue Authority (KRA) has on several occasions missed its revenue targets forcing the government to borrow from both internal and external sources to fill the ensuing gap.