Creditors agree to take 70pc off Uchumi supermarket’s debt

Seth Onyango @SethManex

Uchumi supermarket creditors have agreed to take a 70 per cent cut on the broke retailer’s Sh3.6 billion debt in a new Company Voluntary Agreement (CVA) after the first bid flopped.

The new deal means suppliers and bankers will give up an estimated Sh2.5 billion in debts owed to them deemed a “better-than-nothing” deal should the retail chain collapse.

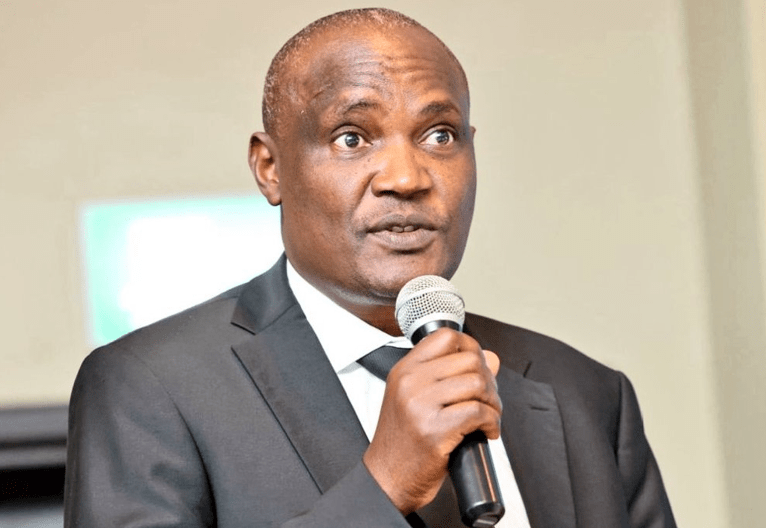

Uchumi chief executive Mohamed Mohamed said that they will, however, be adjustments subject to the performance of the retailer.

At the same time Uchumi has announced it is inching closer to completing the sale of its Sh2.8 billion land in Kasarani to shore up its flagging operations as well as clear some debts.

Timely payment

“The disposal of that asset is not sufficient to clear all the debts; that is why we went into this CVA to agree on how the debt can be restructured,” he said.

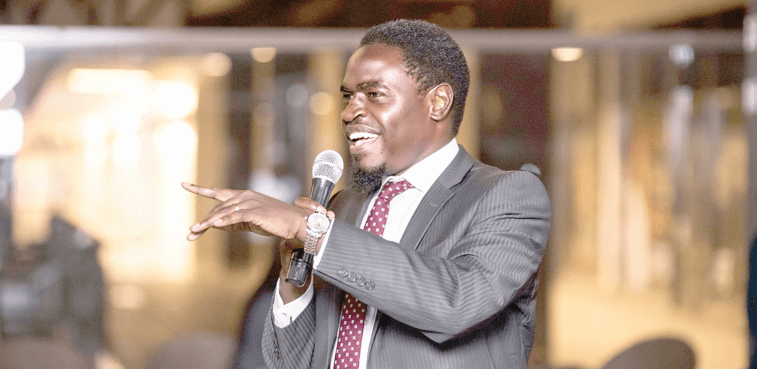

And in a game changer in the market, provisional supervisor Owen Koimburi said a supplies committee will be formed to work on a framework that ensures timely payment of suppliers.

In the new plan, to take effect once the CVA is implemented, all suppliers will be paid six days after delivering goods.

A tamper-proof portal will also be set up to ensure verification of goods supplied and payments made to ensure there is no mischief where cash is made for goods that had not been supplied.

Unlike in the previous CVA, which was given a wide berth, three secured creditors including KCB and UBA banks, yesterday, endorsed the deal.

Their nod is likely to avert another eminent collapse of a local retailer, just months after local retailer, Nakumatt, finally closed shop after creditors voted for its liquidation.

Secured creditors that include banks voted 75 per cent in favour against 25 per cent descending, while unsecured creditors (suppliers) voted 54 per cent to nay’s 46 per cent.

Preferred creditors, that is, shareholders on the other hand gave the deal 100 per cent nod.

In March last year, Uchumi filed a creditors plan at the High Court outlining the measures it intended to take towards reducing its debt as well as restocking its five branches.

Subsequently, it gave suppliers and bankers tough choices ― either to take 30 per cent of what the retailer owes them or be prepared to lose all their money.

But UBA challenged the deal successfully in court thus opening the way for another round of elusive negotiations for a palatable deal.

Although it is suspected the lender refused to budge yesterday, speculations are rife to ensure that this time the deal does not washout.

Court process

Uchumi’s insolvency practitioner will now file the new inked CVA in court to kick off the process of implementation.

And according to the draft plan, the retailer is projected to make a net profit of Sh61.5 million as at June 30, bouncing back from a net loss (provisional) of Sh515.9 million in the year ending June last year.

Uchumi sunk into insolvency on June 1, 2006, though it reopened 45 days later following the government’s injection of Sh675 million and a compromise from the PTA Bank and KCB.