Greater small-taxpayer compliance key to economic growth

Micro and small taxpayers, particularly Micro, Small, and Medium Enterprises (MSMEs), form the backbone of economies worldwide. In Kenya, MSMEs constitute the vast majority of business entities and play a crucial role in employment and economic growth across various industries and sectors. However, despite their significant economic presence, their tax contribution remains low.

With over 20 million registered personal identification numbers (PINs) at the Kenya Revenue Authority (KRA), only about 12,000 belong to large, medium, and government entities. This implies that the majority of taxpayers fall within the micro and small taxpayer category. Despite their numbers, this segment contributes only 15 percent of domestic taxes, while large and medium taxpayers and government entities together with the attendant agency taxes collected by these entities with PAYE and withholding taxes included account for 85 percent. For instance, between July 2024 and January 2025, micro and small taxpayers contributed Sh124 billion.

The question arises, how does the most vibrant sector of the economy contribute so minimally to the tax base? KRA has assessed this challenge and taken strategic steps to address it, aiming to unlock the potential of these taxpayers and ensure a fairer tax system. Expanding the tax base through enhanced compliance among micro and small taxpayers is a key priority to ensure equity and fairness in our tax systems.

One major challenge impeding tax compliance among this segment is trust and tax morale. Several factors contribute to low trust and morale, including complex tax systems that are difficult to navigate, limited engagement and support from KRA for this segment, and perceived unfairness in taxation, which discourages voluntary compliance. If these concerns are addressed, there is immense potential to enhance voluntary compliance, increase revenue contributions, and create a more conducive business environment.

KRA has taken proactive measures to address these challenges by reorganising its structure to focus specifically on micro and small taxpayers. A dedicated department has been established to cater to their needs, ensuring that their concerns are heard and incorporated into policy decisions. Key initiatives include decentralising services by establishing offices nationwide to support micro and small taxpayers, ensuring that services are accessible where businesses operate rather than requiring taxpayers to visit KRA offices and to enhance customer experiences while interacting with the tax systems.

To ease compliance, micro and small taxpayers with annual turnovers below Sh25 million are subject to a final tax of 1.5 percent on annual turnover, while those in the rental business with annual rental income below Sh15 million pay final tax of 7.5 percent as Monthly Rental Income tax (MRI). The digitisation of tax processes has also been implemented through systems like eTIMS, which has improved visibility and compliance by enabling taxation at the source and facilitate MSMEs with vital sales and stock records, which are stored and can be retrieved for business efficiency.

While these initiatives mark significant progress, more needs to be done. The new department will focus on reviewing tax regimes to incorporate taxpayer feedback. Areas under review include the revision of the turnover tax regime to better align with business realities and the reassessment of tax rates and regimes for informal businesses to facilitate compliance and fairness.

Additionally, KRA is prioritising the simplification of tax registration, filing, and payment processes. Leveraging technology, the authority aims to integrate payment and filing, ensuring that once a taxpayer makes a payment, their tax compliance process is complete. This will significantly reduce the administrative burden and encourage more businesses to comply.

Enhancing compliance requires a multi-stakeholder approach. KRA will collaborate with county governments and other institutions to integrate tax systems, formalise transactions, and improve efficiency. This partnership will also help develop sector-specific tax solutions tailored to the needs of different industries.

The newly established Micro and Small Taxpayers Department is committed to addressing the unique challenges faced by this segment. By implementing tailored tax solutions, simplifying compliance procedures, leveraging technology, and fostering collaboration, KRA aims to create a fairer and more efficient tax system. Ensuring that tax obligations are structured to minimise complexity will facilitate compliance, expand the tax base, and ultimately contribute to Kenya’s economic growth.

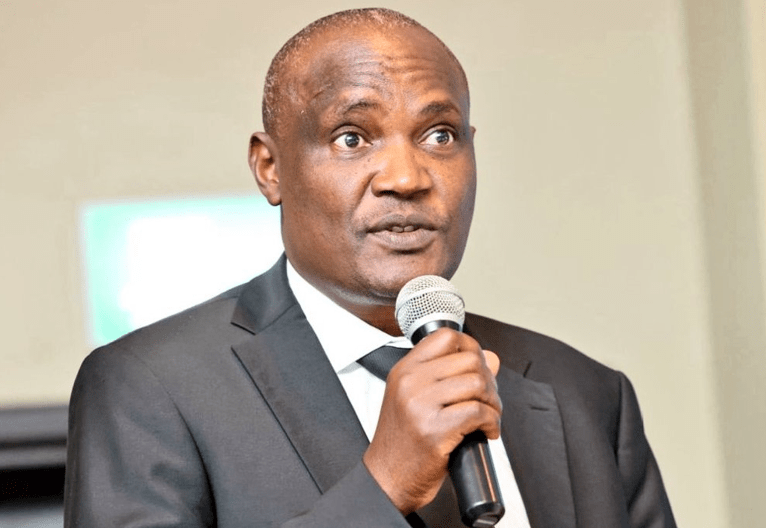

— The writer is the Acting Commissioner for Micro and Small Taxpayers Department at the Kenya Revenue Authority