County releases new land rates for Nairobi residents

Landowners in Nairobi will begin paying revised land rates from January 1, 2025.

The new rates, based on land size and value, range between Sh2,560 to Sh4,800 annually, with residential, commercial, and agricultural plots taxed at 0.115 per cent of their value.

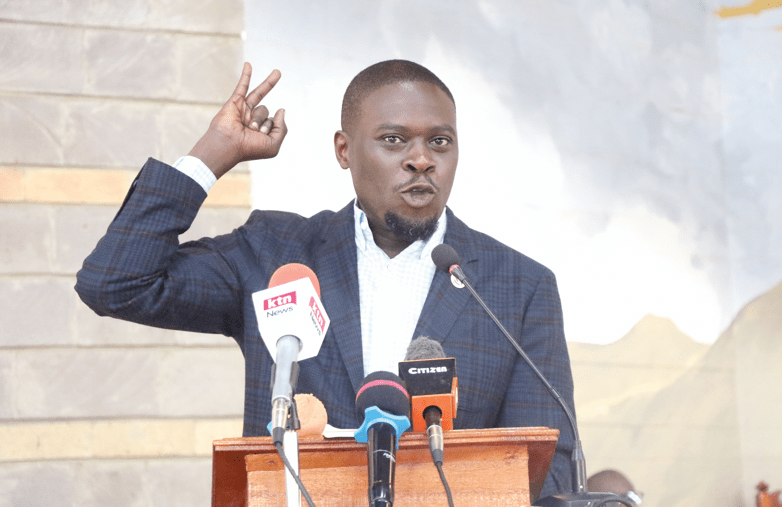

“In exercise of the power conferred by section 15 (1) of the Rating Act (Cap. 267) and Section 18 of the Valuation for Rating Act (Cap. 266), notice is given to the general public that land rates levied by the Nairobi City County Government for the year 2025 shall become due on the 1st January 2025,” reads the notice dated November 29, 2024 and outlined by the county’s Executive for Built Environment and Urban Planning Patrick Mbogo.

For landowners with plots under 0.1 hectares, the annual rate is set at Sh2,560, while plots between 0.1 and 0.2 hectares will attract Sh3,200. Those with land between 0.2 and 0.4 hectares will pay Sh4,000, and plots exceeding 0.4 hectares will incur Sh4,800.

However, specific provisions have been made to address discrepancies and disputes. If the new rates are lower than the 2022 rates, property owners will pay the 2022 rates.

If the new rates exceed double the 2022 rates, landlords will pay double the previous rates as per the 2019 draft valuation roll.

For those with objections or whose properties are missing from the roll, the county directed that they continue paying the old rates until their cases are resolved by the Valuation Court.

Additionally, sectional title holders must now open individual rates accounts, while landowners with unvalued or omitted land have been advised to contact the Chief Valuer at City Hall.

The changes aim to align the rates with current property values and improve transparency in revenue collection. Land rates are the top own-source revenue earner in Nairobi accounting for about 25 per cent of revenue collected by the county government.

Nairobi’s six key own-source revenue streams include parking fees, rates, single business permits, house rents, building permits, and billboards and adverts, accounting for close to 80 per cent of the county’s annual own-source revenue.

Earlier this year, Governor Sakaja had announced a one-month extension to the penalty waiver on land rates.