Corporate tax drops as banks slow lending to private sector

An economic slowdown in the first two years after the country capped interest rates in August 2016 saw a dip in corporate tax as banks tightened lending leading to reduced activity in the private sector.

Total corporate tax paid in Kenya slid from Sh185 billion in 2017 to Sh162.4 billion last year, a Kenya Bankers Association (KBA) and PwC on tax contribution report released yesterday says.

However, the period, which was marred by electioneering violence, saw banking industry’s corporate tax hit Sh91 billion to emerge the largest contributors in the country despite the ensuing credit crunch.

Private sector credit growth remained below the government’s annual target of 18.3 per cent, and by August 2017 growth had fallen to 1.6 per cent, having a knock-on effect on the economy.

“The country witnessed marginal growth with corporate profitability reducing from double to single digits,” said Reginald Kadzutu project lead at financial services firm Zamara Investments.

“We saw banks in lots of distress especially tier three institutions,” he added.

Private sector credit growth slowed down further amid economic downturn as businesses postponed expansion plans and some closed shop.

Pricing constraints

During that period, banks also became more reluctant to lend on account of “deteriorating asset quality and risk pricing constraints” following the interest rate caps law.

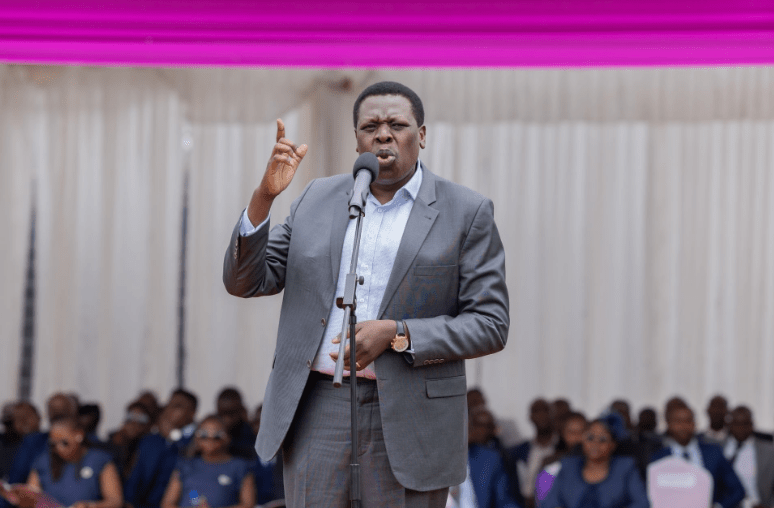

Speaking yesterday during the launch of the report, Titus Mukora, PwC director in charge of tax services said despite these challenges 26 per cent (Sh91 billion) of the corporate taxes collected by KRA came from banks.

“The reduction in 2017 profits corresponds with the first full year of the interest rate cap coupled with a prolonged electioneering,” he said.

This was reflected in the decline in growth of net assets in the sector in 2017 of 6.8 per cent down from an 11 per cent growth in the previous year.

Compared to other sectors, though, and bearing in mind the banking sector is not a significant driver of economic growth, the high corporate tax contributions point to high levels of regulation and compliance in the industry.

Produced in conjunction with by PwC and Kenya Bankers Association (KBA),the report says financial service providers should put their houses in order having been on the radar of Central Bank of Kenya over compliance for a while, even as they do not enjoy tax incentives like those to the manufacturing sector.

“There are hardly any corporate tax incentives for banks. On the contrary, one of the industry’s core expenses, (bad debt expense) has very strict requirements for deductibility which invariably leads to the high corporate taxes paid by the sector,” said Mukora.

In 2017 and 2018, banks contributed a total of Sh207 billion in taxes, with Sh91 billion being corporation tax.

Rising prominence

The report also notes rising prominence of excisable non-funded income among banks which led to a 42 per cent increase in excise taxes collection by banks last year, compared to the previous year.

Interestingly, despite a dip in the number of employees in the sector from

29,058 in 2017 to 28,352 in 2018, as financial institutions migrated from the traditional “brick and mortar” channels, the amount of Pay-As-You-Earn collected grew from Sh18.7 billion to Sh19.2 billion.

This is informed by wage increments paid to higher cadre employees in the industry and the continued replacement of lower cadre jobs as institutions adopt technology.