CBK returns to highly liquid bonds market, raises Sh81b

Tax free returns, high liquidity and falling yields on short-term debt saw the government raise Sh81 billion for the 16-year infrastructure bond last week as prospects for external borrowing remain weak.

Number of bids totalled Sh125 billion, representing a performance rate of 251 per cent. The government had only sought Sh50 billion.

This signals a surge in demand for long-tenor securities helped by a poorly performing stock market which is suffering from a dry spell.

“The 16-year Infrastructure Treasury bond auction of January 20 received record market participation, attracting bids totaling Sh125.5 billion against an advertised amount of Sh50 billion,” Central Bank of Kenya said. The interest rate on the bond was 12.26 per cent.

Rejected bids

Analysts at Kingdom Securities said it was partly due to heavy liquidity caused by excess maturities in the month of February.

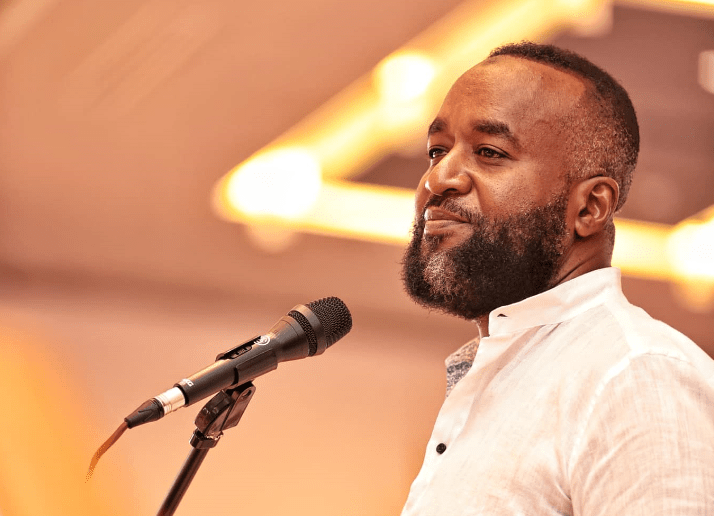

“The timing was unique because there is a lot of liquidity in January due to a lot of payouts this month, remember the bond is also tax free,” said Willis Nalwenge, an analyst at Kingdom Securities.

Nalwenge added that part of the drivers for oversubscription is that infrastructure bonds have two partial redemptions where 50 per cent of the principal is paid after eight-years, making it flexible.

Head of operations at Faida Investment Bank said: “Infrastructure bonds are usually popular due to the tax-free aspect and asset managers such as insurers normally tend to seek assured returns rather than a more risky stock market.”

Analysts at Genghis Capital estimate that the oversubscription will force returns downwards in the coming days.

“We expect the rejected bids worth Sh 44.4 billion from last week’s primary bond auction will spur outsized demand for the IFB1/2021/16.

This cements our view that the paper will trade below auction levels (12.257 per cent),” said Genghis in its investors brief.

The bond proceeds will partly redeem a two-year bond with an outstanding amount of Sh31 billion.

In the T-Bill segment, the subscription dipped to Sh20.3 billion, representing a performance rate of 84.5 percent.

Nalwenge said the IFB was also meant to attract forex reserves held by the central bank since IFBs tend to attract foreign investors more.

The stock market is expected to suffer concerns over prospects of business recovery, sovereign debt levels and likelihood of heightened political activities with a referendum in 2021 and general election in 2022.

Kenya is seeking to rely more on domestic borrowing as it seeks debt moratoriums from foreign lenders over heightened concerns that it could default on sovereign debt.

The country is also among a few African countries offering attractive returns on the continent alongside Uganda, Ghana and others.