Capital Markets Authority put on the spot over investors loses

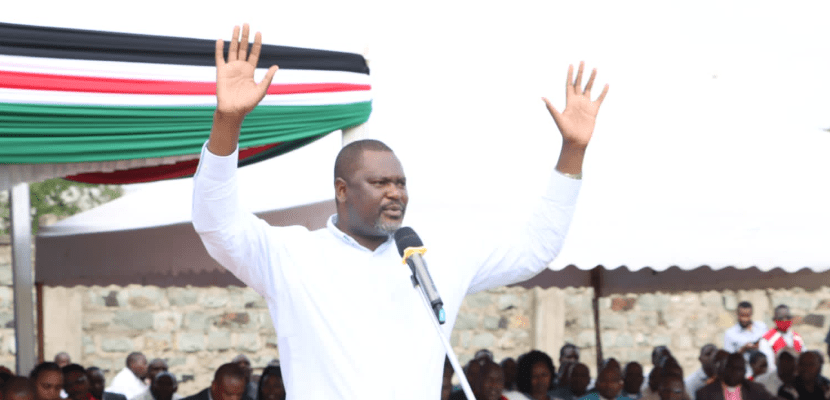

Garissa Town Member of Parliament, Aden Duale has accused the Capital Markets Authority (CMA) of failure to regulate and oversight the capital market hurting investors.

Duale’s criticism comes barely a week after investors accused investment management firm, Cytonn, of fleecing them billions of shillings through the Cytonn High Yield fund.

Speaking in Parliament on Tuesday, Duale requested a statement from the departmental committee on finance seeking to know the total number of unregulated capital markets products in the country and CMA’s role in the proliferation of illegal investment funds in the country’s capital markets.

He also demanded to know the effectiveness and efficiency of the CMA in regulating the capital markets including firms penalised in the last five years.

Customer deposits

“Estimated total losses by innocent Kenyan investments due to the negligence of CMA in terms of regulation is approximately Sh36.8 billion.

To put this into perspective, the total estimated loss of Sh36.8 billion in the capital markets industry in the incidences highlighted herein is an equivalent of one-half of the total Sh72.59 billion customers deposits held at Family Bank Limited as at 31st March 2021,” Duale said.

“It is on account of these grave concerns relating to the efficiency by CMA in regulating the capital market industry and the continued loss of investments of innocent Kenyans that I seek for a Statement from the chairperson of the Departmental Committee on Finance and National Planning,” he added.

Duale blamed CMA for the investor losses that occurred at Imperial Bank, Chase Bank, and Nakumatt between 2005 and 2018.