Dealing with financial conflicts in marriage

One of the challenges that many marriages face is finances – how to acquire and manage it in the right way. In fact, money arguments are the second leading cause of divorce, behind infidelity, according to study.

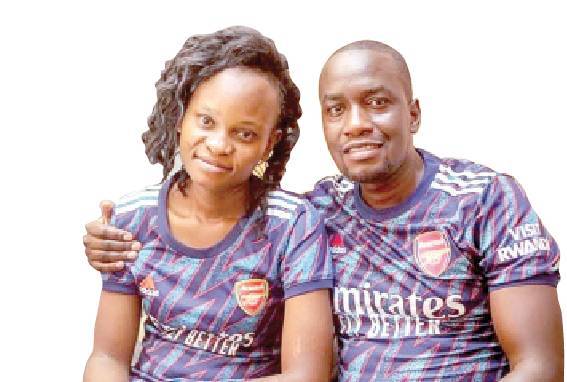

Jacktone Asimeto and Melvin Kizito have been married for four years. One thing they decided to do to avoid financial disagreements is to come up with a budget that would help them plan their resources wisely to avoid straining or putting pressure on each other when it comes to meeting their family financial obligations.

“My wife and I both work. Right from the start of our marriage, we made a decision to share the household budget. Once we draw our monthly budget, we get to decide how we would share the cost,” says Jacktone.

The couple has two children aged seven and five years say this strategy has worked out for them and created mutual understanding between them. “By doing this, we minimise any financial conflicts that may arise,” says Melvin.

When it comes to supporting relatives financially, Jacktone says it all depends with the circumstances. “We decided that one should make their own decision and help with what they have. You don’t need to force your partner or make demands about helping a relative or friend,” he says.

For Jacktone and Melvin, they believe that marriage is all about helping each other and to navigate through this journey well, there is need for couples to plan their finances and draw out a plan that will be favourable for both of them.

Sheila Mmboga, a financial literacy expert says many families experience financial problems because they do not have good money management skills and make unwise decisions about how to use income and credit.

“Couples get into all sorts of arguments and family disagreements over money. In my time as a financial consultant, I have run into families arguing about who will pay for their elderly parents’ care, divorcees disagreeing over who will pay for their child’s school-related expenses or other major events such as weddings, family members fighting about bad debts borrowed from one another, and, of course, families arguing over inherited estates, with issues such as how an inherited business will be run or sold and proceeds shared,” says Sheila.

Money arguments

“Unfortunately, when money is at stake, people get lost in their pain and anger. They feel attacked on a deep level; they feel enraged and driven to retaliation and war. This fight-or-flight reaction seemingly supersedes any memory of their relationship, and they simply cannot talk themselves back to a rational space,” she adds.

According to the expert, some sources of financial conflicts in a family may include disagreements on spending money, handling debt whereby debt accumulated by one spouse can directly affect the other, financial inequality where you find that one spouse may make substantially more money than the other, assisting relatives when they are in financial need and leisure activities and living standards.

Sheila offers: “It is not uncommon for people to have different financial personalities within a family, but the differences can still co-exist well with the right communication and understanding. One major cause of conflicts is hiding spending from one another.

Whether it’s hiding receipts to hide evidence of dining out, hidden spending can harm a marriage. On the other hand, debt matters in marriage should be ideally addressed before tying the knot.

On the issue of financial inequality, some men are not comfortable with making less than their spouse and some women don’t prefer to be the breadwinner.

This can in time lead to some resentment amongst the couple. Sometimes, one spouse being at home could cause stress on the other spouse who has full financial responsibility if their income is insufficient.

Managing money conflicts

“Marriage involves collectively discussing finances with your spouse, and sometimes people may give help without thinking twice.

If helping a relative in their time of need is not reasonable for your household’s finances, then it may not be wise to do so.

A decision must be made between both people if helping family is within their needs,” explains the expert.

Dealing with family conflict usually depend very much on the particular circumstances.

Some of the strategies couples can apply may include having a meeting as a family to explain the financial issue(s) and make a plan to solve it, develop an effective budget that would cater for spending, savings, investing and debt elimination.

“If you and your spouse have different activities or hobbies, discuss a monthly budget for each. This shows your partner that you can compromise to make both of you happy, which can prevent financial conflicts from spending habits,” says Sheila.

The expert says having a joint account can be the most transparent way of knowing where the money goes from both sides. Joint bank accounts or credit card accounts establish trust in marriages.

Some apps such as Zeta or HoneyFi can help couples/families determine the set budgets that need to be created, more precisely categorise transactions and discuss them right on the apps.

Financial therapy should be considered if money has been an issue in the family previously. “Making finances issue a priority just like emotional health or day-to-day functions is necessary.

This cannot be achieved without couples being good at communicating with each other. Proper actions prevent matters from becoming worse.

It’s best to be transparent about what your household needs financially, and what it will take from both partners to make it happen,” advises Sheila.